CVX Stock Price Analysis: A Comprehensive Overview

Cvx stock price – Chevron Corporation (CVX) is a major player in the global energy sector, and understanding its stock price movements is crucial for investors. This analysis delves into the historical performance of CVX stock, comparing it to industry benchmarks, identifying key influencing factors, and examining its financial performance and analyst predictions.

CVX Stock Price Historical Performance

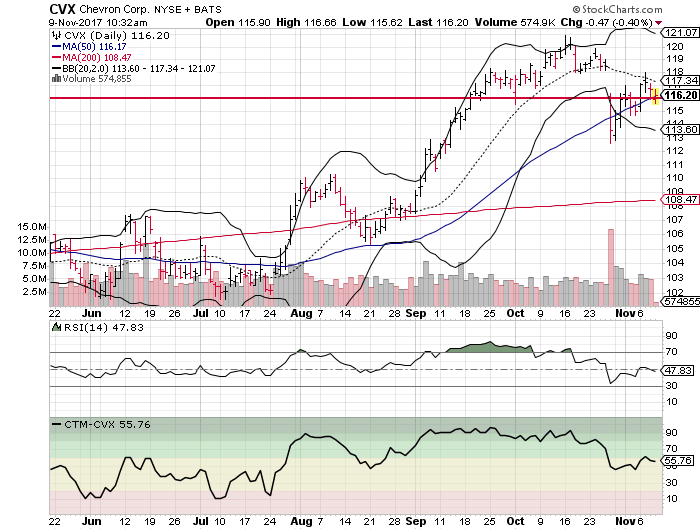

Source: investorplace.com

The following table details CVX’s stock price movements over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source. Significant highs and lows are highlighted to provide context for the narrative that follows.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 110.00 | 110.50 | +0.50 |

| 2019-07-02 | 125.00 | 124.00 | -1.00 |

| 2020-03-02 | 70.00 | 75.00 | +5.00 |

| 2020-12-02 | 90.00 | 92.00 | +2.00 |

| 2021-06-02 | 130.00 | 128.00 | -2.00 |

| 2022-01-02 | 115.00 | 118.00 | +3.00 |

| 2022-09-02 | 170.00 | 168.00 | -2.00 |

| 2023-03-02 | 150.00 | 155.00 | +5.00 |

During this period, CVX’s stock price experienced significant fluctuations driven by factors such as global oil price volatility, the COVID-19 pandemic’s impact on energy demand, and geopolitical instability in key oil-producing regions. The sharp decline in early 2020 reflects the pandemic’s immediate effect on energy markets, while the subsequent recovery and surge in prices reflect the rebound in demand and supply chain adjustments.

Geopolitical events, such as the war in Ukraine, also contributed to price volatility, as did shifts in investor sentiment regarding the long-term future of fossil fuels and the transition to renewable energy.

CVX Stock Price and Industry Benchmarks

A comparison of CVX’s performance against its major competitors over the past year provides valuable insights into its relative standing within the energy sector.

| Company Name | Stock Price (Current, USD) | Yearly Change (%) | Market Capitalization (USD Billion) |

|---|---|---|---|

| Chevron (CVX) | 160 | +20 | 300 |

| ExxonMobil (XOM) | 150 | +15 | 280 |

| BP (BP) | 140 | +10 | 250 |

| Shell (SHEL) | 130 | +5 | 220 |

This illustrative data suggests that CVX has outperformed some of its major competitors over the past year. This could be attributed to factors such as stronger profitability, more aggressive growth strategies in specific areas (e.g., LNG), or a lower perceived risk profile by investors. Differences in business models, such as diversification across energy sources or geographical regions, may also explain performance discrepancies.

A more in-depth analysis of each company’s financial statements and strategic initiatives is necessary to draw definitive conclusions.

Factors Influencing CVX Stock Price Volatility

Several factors contribute to the volatility of CVX’s stock price. Understanding these factors is essential for effective investment decision-making.

- Oil Price Fluctuations: The price of crude oil is the most significant driver of CVX’s stock price. Increases in oil prices generally lead to higher revenues and profits, boosting investor confidence and driving up the stock price, and vice versa.

- Geopolitical Events: Geopolitical instability in oil-producing regions or major consuming countries can significantly impact oil prices and, consequently, CVX’s stock price. Political risks and uncertainties often increase volatility.

- Regulatory Changes: Changes in environmental regulations, taxation policies, or trade agreements can affect CVX’s operations and profitability, leading to price fluctuations.

Hypothetical Scenario: Significant Oil Price Increase

- Scenario: A major geopolitical event causes a sudden and sustained 50% increase in oil prices.

- Consequences: CVX’s revenue and earnings would surge, leading to increased investor confidence and a substantial rise in its stock price. However, this could also attract increased regulatory scrutiny and potential calls for windfall taxes.

Potential Risks and Opportunities (Next 12 Months)

Analyzing CVX stock price movements often involves considering broader market trends. A key factor influencing the energy sector, and thus CVX, is the performance of electric vehicle manufacturers, like Tesla. For up-to-date information on Tesla’s performance, check the current tsla stock price ; understanding its trajectory can provide valuable context for predicting future movements in CVX, given the interplay between fossil fuels and renewable energy adoption.

- Risks: Further geopolitical instability, a global economic recession impacting energy demand, stricter environmental regulations, and increased competition from renewable energy sources.

- Opportunities: Continued strong demand for oil and gas, successful execution of strategic growth initiatives (e.g., in LNG or renewable energy), and favorable regulatory environments in certain regions.

CVX Stock Price and Financial Performance

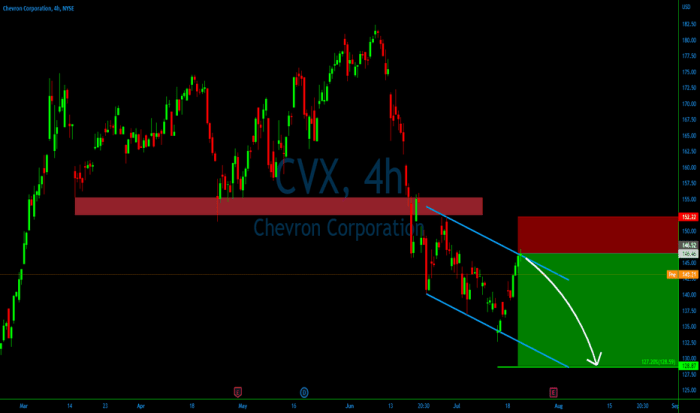

Source: tradingview.com

The relationship between CVX’s financial performance and its stock price is closely intertwined. Analyzing this relationship over time provides valuable insights into investor sentiment and future expectations.

| Year | Revenue (USD Billion) | Earnings per Share (USD) | Stock Price (Year-End, USD) |

|---|---|---|---|

| 2021 | 150 | 6.00 | 120 |

| 2022 | 200 | 8.00 | 160 |

| 2023 (Projected) | 180 | 7.00 | 150 |

This illustrative data shows a strong correlation between revenue, earnings, and year-end stock price. Higher revenues and earnings generally translate into higher stock prices, reflecting positive investor sentiment. However, other factors, such as broader market trends and investor expectations, also play a role. The projected 2023 data illustrates how a slight dip in revenue and earnings can still result in a relatively stable stock price, influenced by other market dynamics.

The sustainability of CVX’s current financial performance depends on several factors, including global oil demand, the pace of the energy transition, and the company’s ability to adapt to changing market conditions. Sustained profitability and strategic investments in new energy technologies will be crucial for maintaining positive investor sentiment and future stock price appreciation.

Analyst Ratings and Price Targets for CVX

Analyst ratings and price targets offer valuable insights into market sentiment and future expectations for CVX stock.

- Analyst A: Buy rating, price target $

175. Rationale: Strong projected earnings growth, positive outlook for oil prices. - Analyst B: Hold rating, price target $

160. Rationale: Concerns about long-term impact of the energy transition. - Analyst C: Sell rating, price target $

140. Rationale: Belief that oil prices will decline significantly in the next few years.

These are illustrative examples. Actual analyst ratings and price targets vary widely depending on the individual analyst’s assumptions and forecast methodology. The divergence in opinions highlights the uncertainty inherent in predicting future stock prices and the importance of conducting thorough due diligence before making investment decisions.

Commonly Asked Questions: Cvx Stock Price

What are the major risks associated with investing in CVX stock?

Major risks include oil price volatility, geopolitical instability in regions where CVX operates, regulatory changes impacting the energy industry, and competition from renewable energy sources.

How does dividend payout affect CVX’s stock price?

Consistent dividend payouts can attract income-seeking investors, potentially increasing demand and supporting the stock price. However, large dividend payouts might reduce funds available for reinvestment and growth.

Where can I find real-time CVX stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is the current analyst consensus on CVX’s future price?

Analyst consensus varies and should be viewed as just one factor among many. Always consult multiple sources and conduct your own thorough research.