Riot Games: A Deep Dive into its Stock Price

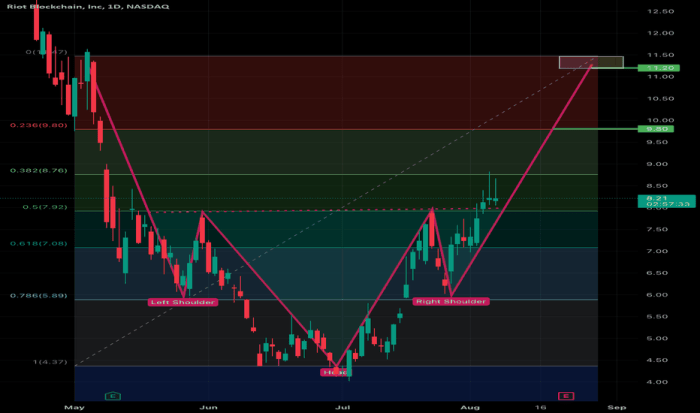

Source: tradingview.com

Riot stock price – Riot Games, the renowned developer and publisher behind the massively popular League of Legends, has experienced significant growth and market fluctuations since its inception. This analysis explores the key factors influencing Riot Games’ stock price, examining its financial performance, investor sentiment, and future outlook. We will delve into the company’s history, business model, and market position to provide a comprehensive understanding of its stock performance.

Riot Games Company Overview, Riot stock price

Understanding Riot Games’ trajectory requires examining its history, business model, and key game titles. This provides context for analyzing its stock performance.

| Event | Year | Description | Impact on Stock Price |

|---|---|---|---|

| Founded | 2006 | Riot Games was founded by Brandon Beck and Marc Merrill. | N/A (Pre-IPO) |

| League of Legends Release | 2009 | Release of League of Legends, a massively multiplayer online battle arena (MOBA) game. | N/A (Pre-IPO), but laid the foundation for future success. |

| Acquisition by Tencent | 2011 | Tencent acquired a majority stake in Riot Games. | N/A (Pre-IPO), but provided significant financial backing and market access. |

| Initial Public Offering (IPO) | 2020 | Riot Games went public, listing its shares on the stock market. | Initial surge in stock price followed by market-driven fluctuations. |

| Valorant Release | 2020 | Launch of Valorant, a tactical first-person shooter. | Positive impact, contributing to overall revenue growth and potentially influencing stock price. |

| League of Legends: Wild Rift Release | 2020 | Release of League of Legends: Wild Rift, a mobile version of League of Legends. | Positive impact, expanding the player base and revenue streams. |

Factors Influencing Riot Stock Price

Several factors significantly impact Riot Games’ stock price. These range from game releases and esports performance to broader macroeconomic conditions and industry competition.

New game releases, particularly successful ones like Valorant and Wild Rift, directly influence revenue and consequently the stock price. Esports, a major revenue stream for Riot, also significantly impacts investor sentiment and market valuation. Furthermore, macroeconomic factors like overall market trends and economic growth play a role, affecting investor risk appetite and impacting the valuation of all publicly traded companies, including Riot Games.

Finally, the performance of competitors in the gaming industry affects Riot’s relative market position and investor confidence.

Riot’s stock price has seen considerable volatility recently, mirroring the broader trends in the cryptocurrency market. However, it’s interesting to compare its performance to that of other tech companies involved in similar supply chains; for instance, a look at the current micron stock price provides a useful benchmark given Micron’s involvement in semiconductor manufacturing, a sector also impacting Riot’s operations.

Ultimately, understanding Riot’s future trajectory requires careful consideration of these related market forces.

Financial Performance and Stock Valuation

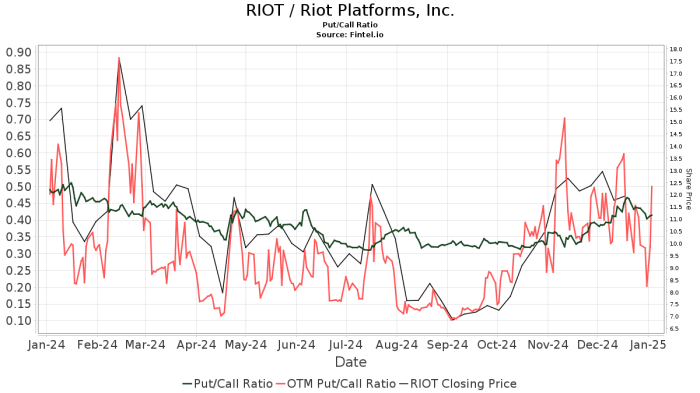

Source: fintel.io

Analyzing Riot Games’ financial metrics, expense structure, and debt-to-equity ratio provides insight into its financial health and stock valuation. A chart visualizing the stock price trend over the past year, highlighting significant fluctuations, would offer a clear visual representation of its market performance.

For example, a hypothetical chart might show a steady increase in stock price throughout the year, punctuated by a temporary dip following a period of negative news or market correction. Conversely, a period of strong revenue growth following a successful game launch might be reflected in a sharp upward trend in the stock price. The company’s financial statements would reveal details on revenue, earnings, expenses, and profitability, allowing for a deeper understanding of the factors driving stock price movements.

The debt-to-equity ratio indicates the company’s financial leverage and risk profile, further influencing investor perception and stock valuation.

Investor Sentiment and Market Analysis

Understanding investor sentiment and market analysis is crucial for interpreting Riot Games’ stock price movements. Analyst ratings and price targets provide valuable insights into the market’s expectations for the company’s future performance.

- Current investor sentiment may be cautiously optimistic, given the success of existing titles and the potential for future growth.

- Major news events, such as new game releases or significant partnerships, can significantly impact the stock price.

- Analyst ratings and price targets offer a range of perspectives on the company’s potential.

Potential risks include increased competition, changes in player preferences, and macroeconomic headwinds. Opportunities include expansion into new markets, the development of new game titles, and the continued growth of the esports market.

Future Outlook and Growth Projections

Source: usethebitcoin.com

Riot Games’ future plans, growth strategies, and potential challenges will shape its stock price in the coming years. Continued success in esports, expansion into new gaming genres, and the development of new intellectual property will be key drivers of growth.

For instance, successful launches of new games or expansion into new geographic markets could lead to significant revenue growth and a positive impact on the stock price. Conversely, challenges such as increased competition or negative publicity could negatively impact investor sentiment and lead to a decline in the stock price. The company’s ability to innovate and adapt to changing market conditions will be crucial for its long-term success and the continued growth of its stock price.

FAQ Corner: Riot Stock Price

What are the major risks associated with investing in Riot Games stock?

Major risks include competition from other gaming companies, dependence on a limited number of successful titles, changes in player preferences, and macroeconomic factors affecting consumer spending.

How does esports impact Riot Games’ stock price?

Esports’ growth significantly impacts Riot’s stock price, as it generates substantial revenue through viewership, sponsorships, and merchandise sales related to League of Legends competitive play.

Where can I find real-time Riot Games stock price data?

Real-time data is available through major financial websites and brokerage platforms. Look for the stock ticker symbol (typically found on their investor relations page).

What is Riot Games’ current market capitalization?

This fluctuates constantly. Check reputable financial news sources for the most up-to-date market capitalization figure.