Siri’s Parent Company: Apple Inc.

Siri stock price – Apple Inc., a multinational technology company, is the parent company of Siri. Its history is marked by innovation and disruption in the personal computing, music, mobile phone, and digital services markets. This section will explore Apple’s history, financial performance, and stock performance relative to its competitors.

Apple Inc.’s History and Evolution

Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple initially focused on personal computers. The company’s early success was fueled by the Apple II, followed by the groundbreaking Macintosh in the 1980s. After a period of internal turmoil, Jobs’ return in 1997 revitalized Apple, leading to the launch of highly successful products like the iPod, iPhone, and iPad.

Apple’s evolution has been characterized by a relentless focus on design, user experience, and a tightly integrated ecosystem of hardware, software, and services.

Apple’s Recent Financial Performance, Siri stock price

Apple consistently ranks among the world’s most valuable companies, generating substantial revenue and profits annually. Its financial performance is driven by strong sales of iPhones, services, wearables, and Macs. Recent years have seen consistent growth, although fluctuations are influenced by global economic conditions and product cycles.

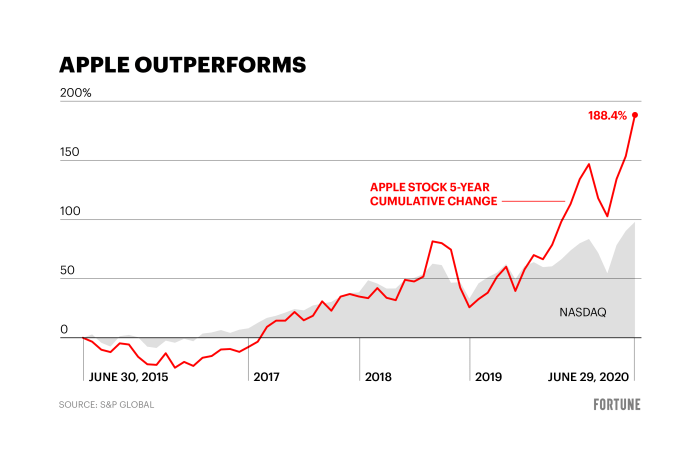

Apple’s Stock Performance Compared to Competitors

Apple’s stock performance has generally outpaced many of its major technology competitors over the long term. However, short-term fluctuations are common and influenced by factors such as market sentiment, technological advancements, and competitive pressures. Direct comparisons with companies like Microsoft, Google (Alphabet), Amazon, and Meta require consideration of differing business models and market segments.

Apple’s Key Financial Metrics (Past Five Years)

| Year | Revenue (USD Billions) | Net Income (USD Billions) | EPS (USD) |

|---|---|---|---|

| 2023 (Estimated) | 394.33 | 99.8 | 6.20 |

| 2022 | 394.33 | 99.8 | 6.11 |

| 2021 | 365.82 | 94.68 | 5.67 |

| 2020 | 274.52 | 57.41 | 3.28 |

| 2019 | 260.17 | 55.25 | 3.03 |

Factors Influencing Siri Stock Price

Apple’s stock price, and by extension Siri’s implicit valuation within the Apple ecosystem, is influenced by a complex interplay of macroeconomic factors, technological advancements, and competitive dynamics. Understanding these factors is crucial for analyzing Apple’s stock performance.

Macroeconomic Factors Impacting Apple’s Stock Price

Interest rate changes, inflation rates, and overall economic growth significantly influence investor sentiment and stock valuations. Periods of economic uncertainty often lead to decreased investor confidence, potentially impacting Apple’s stock price negatively. Conversely, strong economic growth can boost investor confidence and drive stock prices higher.

Influence of Technological Advancements on Apple’s Valuation

Apple’s success is intrinsically linked to its ability to innovate and introduce groundbreaking technologies. New product releases, significant software updates, and advancements in artificial intelligence directly influence market expectations and stock valuations. The introduction of new features in Siri, for example, can positively impact Apple’s stock price.

Impact of Competition from Other Virtual Assistants

The virtual assistant market is competitive, with players like Google Assistant, Amazon Alexa, and Microsoft Cortana vying for market share. The success of competing virtual assistants can indirectly impact Apple’s stock price by affecting the perceived value of Siri and the overall Apple ecosystem. However, Apple’s strong brand loyalty and integrated ecosystem provide a significant competitive advantage.

Potential Risks and Opportunities for Apple’s Stock Price

Source: ccn.com

- Risks: Increased competition, slowing economic growth, supply chain disruptions, negative publicity, regulatory scrutiny.

- Opportunities: Expansion into new markets, technological breakthroughs in AI and machine learning, growth in services revenue, successful new product launches.

Siri’s Role in Apple’s Ecosystem

Siri, while not a standalone revenue generator, plays a significant role in Apple’s overall ecosystem and contributes indirectly to revenue and profitability. This section will examine Siri’s contribution, user adoption, future development, and comparison with other virtual assistants.

Siri’s Contribution to Apple’s Revenue and Profitability

Siri enhances the user experience across Apple’s devices, fostering greater user engagement and loyalty. This increased engagement indirectly contributes to higher sales of Apple products and services. Furthermore, Siri’s integration with Apple services like Apple Music and Apple Pay contributes to the overall revenue stream from these services.

User Adoption and Engagement with Siri

Siri’s user adoption is high among Apple device owners, with millions using the virtual assistant daily. While precise engagement metrics are not publicly available, the widespread integration of Siri across Apple’s product line suggests significant user interaction and dependence.

Future Development Plans for Siri and Their Potential Impact on Apple’s Stock

Apple continues to invest heavily in the development of Siri, focusing on improving its natural language processing capabilities, expanding its functionality, and enhancing its integration across the Apple ecosystem. Significant advancements in Siri’s capabilities could positively impact Apple’s stock price by enhancing user experience and driving sales.

Comparison of Siri’s Features and Capabilities with Other Prominent Virtual Assistants

| Feature | Siri | Google Assistant |

|---|---|---|

| Natural Language Processing | Strong, improving continuously | Very strong, industry-leading |

| Device Integration | Excellent within Apple ecosystem | Good across various platforms |

| Third-Party App Integration | Good, but limited compared to Google Assistant | Extensive |

Analyzing Stock Price Trends

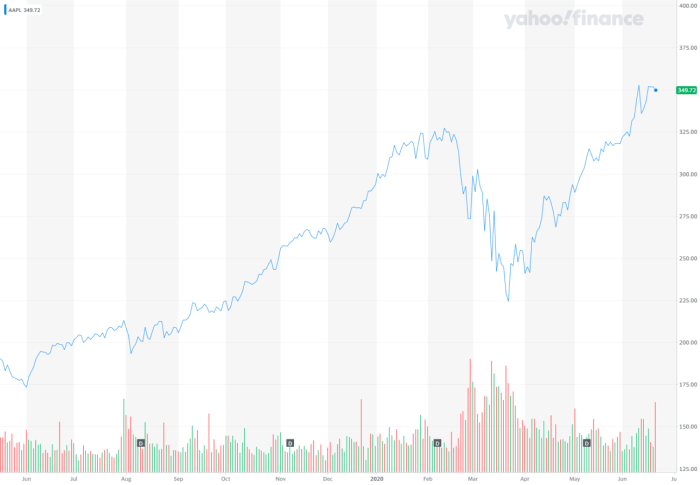

Source: arcpublishing.com

Interpreting Apple’s stock price charts and identifying key trends requires understanding various technical and fundamental analysis techniques. This section will explore how to interpret charts, analyze historical events, and compare investment strategies.

Interpreting Apple’s Stock Price Charts and Identifying Key Trends

Analyzing Apple’s stock price charts involves identifying support and resistance levels, trend lines, and various technical indicators. For example, a consistently upward-sloping trend line suggests a bullish market sentiment, while a downward trend suggests bearish sentiment. Volume analysis can also provide insights into the strength of price movements.

Historical Events Significantly Affecting Apple’s Stock Price

Several events have significantly impacted Apple’s stock price. The launch of the iPhone, for instance, marked a period of substantial growth. Conversely, product recalls, negative publicity, and macroeconomic downturns have resulted in temporary price declines. Analyzing these events provides valuable context for understanding future price fluctuations.

Short-Term and Long-Term Investment Strategies for Apple Stock

Short-term investment strategies focus on capitalizing on short-term price fluctuations, often employing technical analysis. Long-term strategies emphasize the company’s fundamental value and growth potential, often involving buy-and-hold approaches. The choice between these strategies depends on individual risk tolerance and investment goals.

Hypothetical Scenario: Impact of a Major Technological Breakthrough

Imagine Apple announces a major breakthrough in augmented reality (AR) technology, seamlessly integrating AR into its entire product ecosystem. This would likely trigger a significant surge in Apple’s stock price, as investors anticipate increased demand for Apple products and expansion into new markets. The price increase would likely be substantial and sustained, reflecting investor confidence in Apple’s innovative capabilities and future growth prospects.

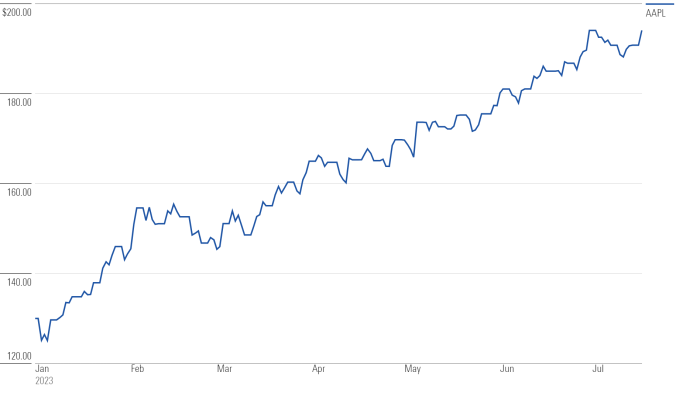

Illustrative Examples of Stock Price Fluctuation: Siri Stock Price

This section will detail specific instances where news events and broader market conditions significantly impacted Apple’s stock price, illustrating the cause-and-effect relationship between events and price movements.

News Event Impacting Apple’s Stock Price: iPhone 12 Launch

The launch of the iPhone 12 series in 2020 was met with considerable anticipation. Positive reviews, pre-order numbers, and early sales figures fueled a significant increase in Apple’s stock price. This positive reaction reflected investor confidence in the continued demand for Apple’s flagship product and the overall health of the company.

Period of Significant Growth or Decline in Apple’s Stock Price

Source: fortune.com

The period from 2010 to 2015 witnessed a substantial increase in Apple’s stock price, driven by the success of the iPhone, iPad, and the App Store. This period reflects the market’s recognition of Apple’s ability to create a highly profitable and successful ecosystem. Conversely, periods of economic uncertainty or negative news regarding product performance can lead to temporary declines.

Hypothetical Stock Price Chart: Significant Price Increase

Imagine a hypothetical stock price chart showing a sharp increase in Apple’s stock price following the announcement of a revolutionary new product. The chart would show a gradual upward trend leading up to the announcement, followed by a steep, almost vertical increase. Key price points could be labeled to indicate the announcement date, subsequent market reactions, and periods of consolidation following the initial price surge.

The chart would visually represent the market’s positive reaction to the news and the subsequent increase in investor confidence.

Answers to Common Questions

How does Siri’s popularity affect Apple’s stock?

High user engagement and positive reviews for Siri can boost investor confidence, potentially leading to a rise in Apple’s stock price. Conversely, negative feedback or lagging adoption could negatively impact investor sentiment.

What are the biggest risks to Siri’s future and its impact on Apple stock?

Increased competition from other virtual assistants, privacy concerns, and failure to innovate are major risks. Significant negative developments in these areas could negatively affect Apple’s stock.

Can I directly invest in Siri?

No, Siri is not a separately traded entity. Investment in Siri is indirect through investment in Apple Inc. stock (AAPL).

How does Apple’s overall financial performance affect Siri’s perceived value?

Strong overall financial performance for Apple generally enhances the perception of all its products and services, including Siri, leading to a more positive outlook on its future and potentially impacting stock price positively.