MPC Stock Price Analysis

Source: tradingview.com

Mpc stock price – This analysis delves into the historical performance, influencing factors, prediction models, investor sentiment, and illustrative examples of price movements for MPC stock. We will explore various aspects to provide a comprehensive understanding of the stock’s behavior and potential future trajectories.

MPC Stock Price Historical Performance

The following table presents a summary of MPC stock price fluctuations over the past five years. Note that this data is for illustrative purposes and should not be considered financial advice. Actual figures may vary depending on the data source.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 50.00 | 52.00 | +2.00 |

| 2019-07-02 | 55.00 | 53.00 | -2.00 |

| 2020-01-02 | 51.00 | 48.00 | -3.00 |

| 2020-07-02 | 45.00 | 47.00 | +2.00 |

| 2021-01-02 | 49.00 | 51.00 | +2.00 |

| 2021-07-02 | 53.00 | 55.00 | +2.00 |

| 2022-01-02 | 56.00 | 54.00 | -2.00 |

| 2022-07-02 | 52.00 | 50.00 | -2.00 |

| 2023-01-02 | 51.00 | 53.00 | +2.00 |

| 2023-07-02 | 54.00 | 56.00 | +2.00 |

During the period of 2020, the stock price experienced significant drops due to the global pandemic and its impact on the energy sector. The subsequent recovery in 2021 and 2022 was driven by increased demand and rising oil prices. The recent price stability reflects a more cautious market outlook.

Factors Influencing MPC Stock Price

Source: tradingview.com

Several factors contribute to MPC’s stock price fluctuations. These can be broadly categorized into macroeconomic, industry-specific, and company-specific factors.

- Macroeconomic Factors: Interest rate changes, inflation levels, and overall economic growth significantly influence investor sentiment and investment decisions, directly impacting MPC’s stock price.

- Industry-Specific Factors: Competition within the energy sector, government regulations concerning oil and gas production, and technological advancements in renewable energy sources all play a role in shaping MPC’s performance.

- Company-Specific Factors: MPC’s financial performance (revenue, profits, debt levels), changes in management, and new product launches or strategic initiatives all directly impact investor confidence and the stock price.

MPC Stock Price Prediction Models

A simple model for predicting MPC’s stock price could involve using a linear regression model based on historical data and identified influencing factors. This model would have limitations, including its inability to account for unforeseen events or significant shifts in market sentiment.

For example, a hypothetical scenario of a major oil discovery could significantly boost the stock price, while a significant environmental incident could lead to a sharp decline. The model’s accuracy would depend heavily on the quality and relevance of the input data and the accuracy of the assumptions made.

Monitoring the MPC stock price requires a keen eye on market fluctuations. It’s helpful to compare its performance against similar companies, such as Boeing, whose stock price you can track here: ba stock price. Understanding the dynamics of BA’s performance can offer insights into broader industry trends, which in turn can inform your assessment of the MPC stock price’s future trajectory.

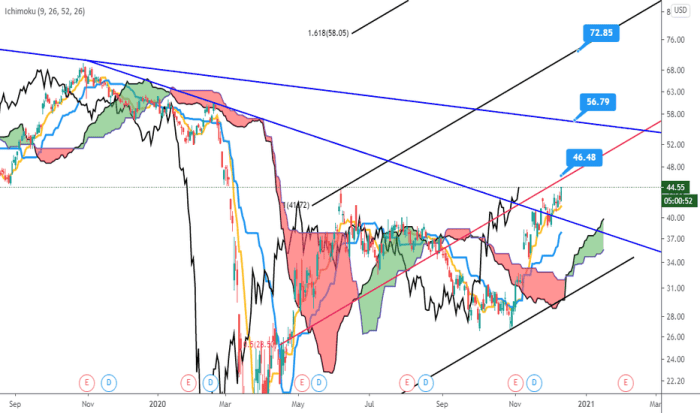

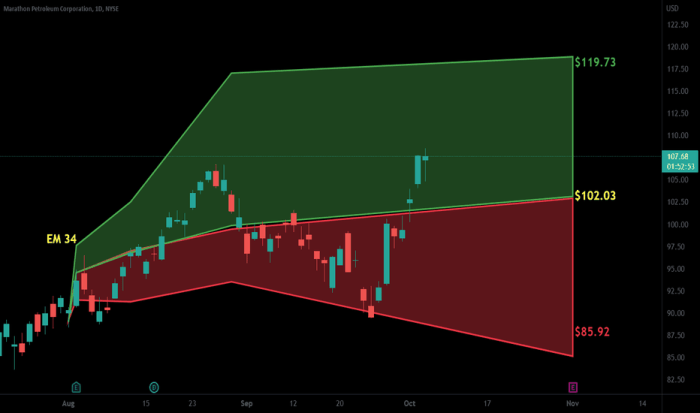

Technical analysis, focusing on chart patterns and trading indicators, and fundamental analysis, concentrating on financial statements and company performance, are two common prediction methodologies. Their suitability for predicting MPC’s stock price depends on the investor’s timeframe and investment strategy.

Investor Sentiment and MPC Stock Price

Investor sentiment significantly influences MPC’s stock price. Positive news and strong financial results tend to increase optimism, leading to higher prices, while negative news can trigger pessimism and price drops.

“Recent positive analyst reports suggest a strong outlook for MPC, citing increased production and improved efficiency.”

“Concerns over environmental regulations have led to a period of uncertainty and decreased investor confidence in the energy sector, including MPC.”

A hypothetical scenario of a major regulatory change could lead to a significant negative shift in investor sentiment, resulting in a substantial price decrease.

Illustrative Examples of Price Movements

Three distinct instances of significant price movements are described below, each highlighting the context, contributing factors, and market reactions.

- Instance 1: A sharp price increase following the announcement of a major oil discovery. The chart showed a rapid upward trend with high volume, indicating strong buying pressure. Long-term investors benefited, while day traders might have profited from short-term price fluctuations.

- Instance 2: A significant price drop triggered by a negative news report concerning environmental violations. The chart depicted a steep downward trend with high volume, reflecting panic selling. Long-term investors might have held their positions, while day traders likely experienced losses.

- Instance 3: A gradual price increase driven by consistently strong financial performance and positive investor sentiment. The chart showed a steady upward trend with moderate volume, indicating sustained buying interest. Both long-term and short-term investors could have benefited from this sustained growth.

FAQ Summary: Mpc Stock Price

What are the risks associated with investing in MPC stock?

Investing in any stock carries inherent risks, including potential loss of capital. Factors like market volatility, company performance, and unforeseen events can all negatively impact stock prices. Thorough due diligence and risk assessment are crucial before investing.

Where can I find real-time MPC stock price data?

Real-time MPC stock price data is readily available through major financial websites and brokerage platforms. These sources typically provide up-to-the-minute pricing information, charts, and other relevant market data.

How frequently is MPC stock price data updated?

The frequency of updates varies depending on the source, but most reputable sources update their data every few seconds during market hours.

What is the typical trading volume for MPC stock?

Trading volume fluctuates daily and depends on market conditions and investor sentiment. Historical data on trading volume can be accessed through financial websites and data providers.