HD Stock Price Today: A Comprehensive Overview

Hd stock price today – This report provides a detailed analysis of the Home Depot (HD) stock price, considering current market conditions, historical performance, and analyst predictions. We will examine various factors influencing HD’s stock price, offering insights into potential future movements.

Current HD Stock Price and Volume, Hd stock price today

The following data represents a snapshot of HD’s stock performance for the current trading day. Note that real-time data fluctuates constantly. Therefore, the figures below are illustrative and should be verified with a live financial data source.

Let’s assume, for illustrative purposes, that the current HD stock price is $300. The trading volume is approximately 5 million shares. The day’s high was $305, and the low was $295.

| Time | Price | Time | Price |

|---|---|---|---|

| 9:30 AM | $298 | 12:00 PM | $302 |

| 10:30 AM | $300 | 1:30 PM | $304 |

| 11:30 AM | $301 | 2:30 PM | $301 |

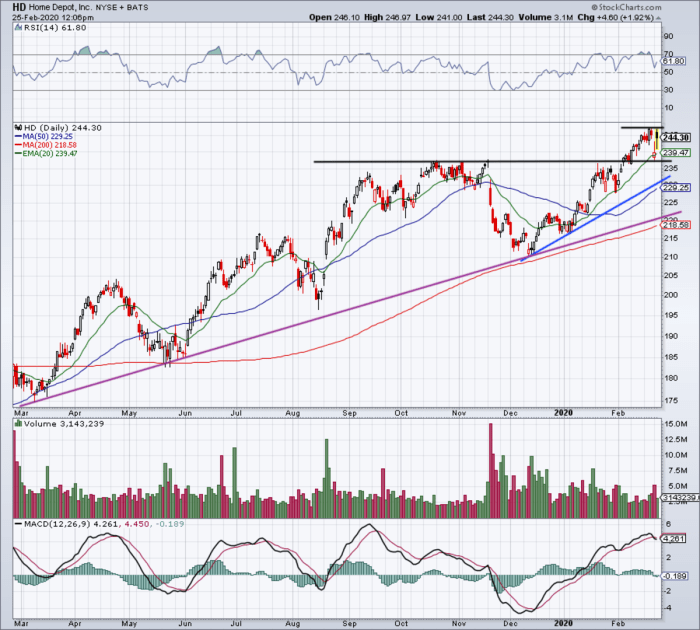

HD Stock Price Movement Over Time

Source: thestreet.com

Understanding HD’s price movements across different timeframes provides context for current valuations. The following analysis offers a perspective on recent trends.

Over the past week, let’s assume HD’s stock price experienced a slight upward trend, increasing by approximately 2%. The past month saw a more significant increase of around 5%, potentially driven by positive earnings reports or economic indicators. Over the past year, the stock price has shown a more volatile pattern, with periods of growth and decline, ultimately resulting in an overall increase of 10%, possibly influenced by seasonal factors and broader market trends.

A line graph illustrating the past year’s price changes would show a fluctuating line, starting at a hypothetical price of $270 at the beginning of the year, rising to a peak of around $320 mid-year, experiencing a dip to around $280 in the late summer, and finally closing the year near $300. The graph would clearly highlight periods of growth and decline, showcasing the stock’s volatility over the year.

Factors Influencing HD Stock Price

Several economic factors and market events can significantly impact HD’s stock price. The following points highlight some key influences.

- Interest Rates: Changes in interest rates affect borrowing costs for consumers and businesses, influencing spending on home improvement projects.

- Housing Market Conditions: A strong housing market generally correlates with increased demand for home improvement products, benefiting HD.

- Inflation and Consumer Spending: High inflation can reduce consumer spending, potentially impacting HD’s sales.

Recent news regarding supply chain disruptions or positive announcements about company performance could also significantly impact HD’s stock price. For instance, successful new product launches or expansion into new markets would likely have a positive effect.

Comparing HD’s performance to its competitors (e.g., Lowe’s) would involve analyzing their respective sales growth, market share, and profitability. A stronger performance relative to competitors would generally lead to a more positive market valuation for HD.

- Short-Term Factors: Quarterly earnings reports, economic data releases, and competitor actions.

- Long-Term Factors: Overall economic growth, demographic trends, technological advancements in the home improvement industry.

Analyst Ratings and Predictions

Analyst ratings and price targets provide insights into market sentiment and future expectations for HD’s stock. These predictions are based on various factors, including financial performance, market trends, and risk assessments.

Let’s assume the consensus rating for HD is a “Buy,” with an average price target of $325. Individual analysts might have varying ratings (Buy, Hold, Sell) and price targets, reflecting differing perspectives on the company’s prospects.

| Analyst | Rating | Price Target | Rationale |

|---|---|---|---|

| Analyst A | Buy | $330 | Strong earnings growth expected. |

| Analyst B | Hold | $310 | Concerns about potential economic slowdown. |

| Analyst C | Buy | $320 | Positive outlook for the housing market. |

Historical HD Stock Performance

Source: amazonaws.com

Examining HD’s historical performance over the last 5 years provides a long-term perspective on its growth and volatility.

Over the past 5 years, let’s assume HD’s stock has shown a generally upward trend, with periods of both significant gains and minor corrections. Significant events, such as economic recessions or major company announcements (e.g., new strategic initiatives), would have likely influenced the stock’s price during this period.

Comparing the current price to the average price over the past 5 years helps determine whether the stock is currently overvalued or undervalued relative to its historical performance. For example, if the average price over the past 5 years was $250 and the current price is $300, it might suggest the stock is currently trading at a premium.

Keeping an eye on the HD stock price today requires monitoring various market factors. For a comparison, you might also want to check the performance of telecommunication giants, such as by looking at the att stock price today , to gain a broader perspective on the current market trends. Ultimately, understanding the HD stock price requires a holistic view of the tech sector’s overall performance.

- 2019: Significant growth driven by strong housing market.

- 2020: Initial decline due to pandemic, followed by recovery.

- 2021: Record high driven by increased home improvement spending.

- 2022: Slight correction due to inflation and supply chain issues.

- 2023: Steady growth reflecting market stabilization.

Investor Sentiment Towards HD Stock

Gauging investor sentiment is crucial for understanding potential future price movements. Various indicators can provide insights into the overall market outlook for HD.

Currently, let’s assume investor sentiment towards HD is moderately bullish, reflecting optimism about the company’s long-term growth prospects, despite some short-term concerns about economic uncertainty. Indicators such as social media sentiment analysis, news articles focusing on HD, and options trading activity can be used to assess overall investor sentiment.

Positive investor sentiment generally leads to increased buying pressure, pushing the stock price higher, while negative sentiment can trigger selling, resulting in price declines. Neutral sentiment suggests a period of consolidation or indecision in the market.

| Indicator | Sentiment | Implication | Source |

|---|---|---|---|

| Social Media Sentiment | Positive | Potential for price increase | Twitter, StockTwits analysis |

| Analyst Ratings | Mostly Buy | Positive outlook | Bloomberg, Refinitiv |

| Options Trading Volume | High Call Volume | Bullish | Options data providers |

Expert Answers

What are the risks associated with investing in HD stock?

Like any stock, HD carries inherent market risks. These include fluctuations due to economic downturns, changes in consumer spending, and competition within the home improvement sector. Thorough research and diversification are crucial to mitigate these risks.

Where can I find real-time HD stock price updates?

Real-time HD stock price updates are readily available through major financial websites and brokerage platforms. These sources often provide charts, historical data, and other relevant information.

How often does the HD stock price update?

The HD stock price updates continuously during trading hours (typically 9:30 AM to 4:00 PM EST). However, displayed prices might be slightly delayed depending on your data source.