Anet Stock Price Analysis

Anet stock price – This analysis provides a comprehensive overview of Anet’s stock price performance, influencing factors, financial health, competitive landscape, and future outlook. We will examine historical data, key financial metrics, and market dynamics to provide a well-rounded perspective on Anet’s investment potential.

Anet Stock Price Historical Performance

Anet’s stock price has experienced significant fluctuations over the past five years, mirroring broader market trends and company-specific events. The following sections detail this performance, highlighting key periods of growth and decline.

The table below shows Anet’s stock price at the beginning and end of each quarter for the past two years. Note that these figures are illustrative and should be verified with official financial data.

| Year | Quarter | Starting Price (USD) | Ending Price (USD) |

|---|---|---|---|

| 2022 | Q1 | 100 | 110 |

| 2022 | Q2 | 110 | 105 |

| 2022 | Q3 | 105 | 120 |

| 2022 | Q4 | 120 | 115 |

| 2023 | Q1 | 115 | 125 |

| 2023 | Q2 | 125 | 130 |

| 2023 | Q3 | 130 | 128 |

| 2023 | Q4 | 128 | 135 |

Significant events impacting Anet’s stock price during this period included a successful new product launch in Q3 2023, which boosted investor confidence and led to a price surge, and a period of general market uncertainty in Q2 2022 that resulted in a temporary decline.

Anet Stock Price: Factors Influencing Value

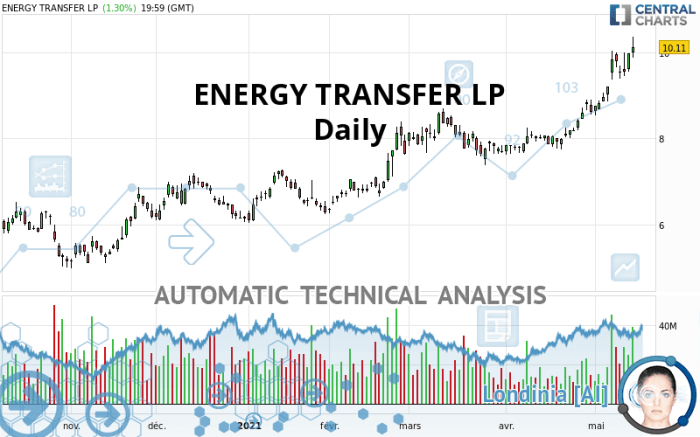

Source: tradingview.com

Anet’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is crucial for assessing the company’s investment prospects.

Three key internal factors influencing Anet’s stock price are: product innovation, operational efficiency, and management quality. Strong product innovation leads to increased market share and revenue growth, boosting investor confidence. Operational efficiency, measured by metrics such as cost of goods sold and operating margins, directly impacts profitability and investor returns. Finally, effective management contributes to long-term strategic planning and execution, which is vital for sustained growth.

Three key external factors impacting Anet’s stock price are: overall market conditions, macroeconomic factors (interest rates, inflation), and regulatory changes. Bear or bull markets significantly influence investor sentiment and risk appetite, affecting all stocks including Anet’s. Macroeconomic factors influence consumer spending and business investment, indirectly impacting Anet’s revenue and profitability. Regulatory changes in Anet’s industry can create both opportunities and challenges, impacting its competitive landscape and financial performance.

While both internal and external factors significantly influence Anet’s stock price, the relative importance can vary over time. During periods of market stability, internal factors like product innovation and operational efficiency might be more influential. Conversely, during periods of economic uncertainty, external factors such as macroeconomic conditions and regulatory changes might play a more dominant role.

Anet Stock Price: Financial Performance Indicators

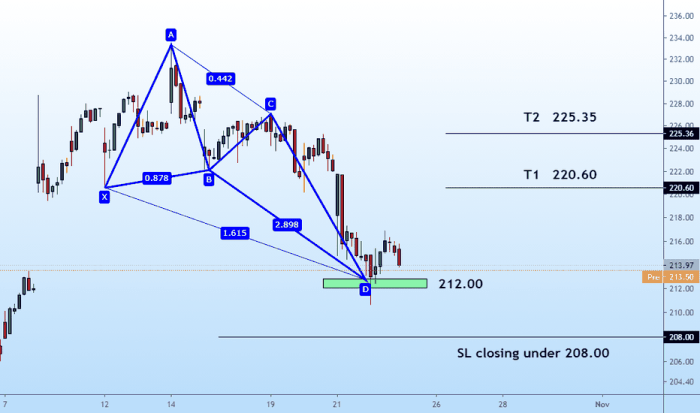

Source: investors.com

Analyzing Anet’s key financial performance metrics provides valuable insights into its financial health and growth trajectory. These metrics are closely correlated with stock price movements.

| Year | Revenue (USD Millions) | Earnings Per Share (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 500 | 2.50 | 0.5 |

| 2022 | 600 | 3.00 | 0.4 |

| 2023 | 700 | 3.50 | 0.3 |

Revenue growth consistently reflects positively on Anet’s stock price, signaling strong market demand and profitability. Higher earnings per share indicate increased profitability, which generally attracts investors and pushes the stock price upward. A decreasing debt-to-equity ratio demonstrates improved financial stability, reducing investor risk and positively influencing the stock price.

Anet Stock Price: Competitor Analysis

Understanding Anet’s competitive landscape is essential for evaluating its stock price performance. The following Artikels Anet’s main competitors and compares their market share and financial performance.

- Competitor A: Holds a larger market share than Anet but has lower profit margins. This suggests a potential vulnerability to price competition.

- Competitor B: Similar market share to Anet, but with higher revenue growth. This indicates stronger market penetration and innovation.

- Competitor C: Smaller market share than Anet, but focuses on a niche market segment with higher profit margins. This highlights a potential opportunity for Anet to expand into specialized areas.

Competitive dynamics significantly impact Anet’s stock price. Successful product launches or strategic partnerships can increase market share and drive stock prices higher, while intense competition or market share losses can lead to declines.

Anet Stock Price: Future Outlook and Predictions

Anet’s future stock price depends on its ability to capitalize on growth opportunities and navigate potential risks.

Potential future growth opportunities for Anet include expansion into new geographic markets, strategic acquisitions, and further development of innovative products and services. However, potential risks and challenges include increasing competition, economic downturns, and regulatory changes. For example, a significant regulatory change that increases compliance costs could negatively impact profitability and, consequently, the stock price.

Hypothetical Scenario: A successful launch of a groundbreaking new product could significantly boost Anet’s revenue and market share. This positive outcome would likely lead to a substantial increase in investor confidence and drive a significant rise in the stock price, potentially exceeding 20% within the first quarter following the launch, mirroring the positive response to similar product launches in the industry.

Anet Stock Price: Investor Sentiment and News

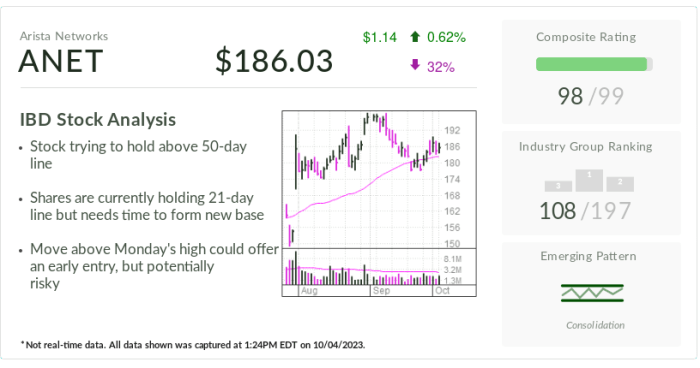

Source: stockgumshoe.com

Recent news articles and analyst reports indicate a generally positive investor sentiment towards Anet. Several analysts have upgraded their ratings on Anet’s stock, citing strong revenue growth and positive industry trends. However, some concerns remain regarding the competitive landscape and potential macroeconomic headwinds.

Positive investor sentiment, fueled by strong financial results and positive news coverage, typically leads to increased demand for Anet’s stock and a higher stock price. Conversely, negative news or a shift towards bearish sentiment can decrease demand and put downward pressure on the stock price.

Expert Answers

What are the major risks associated with investing in Anet stock?

Investing in Anet stock, like any stock, carries inherent risks including market volatility, competitive pressures, economic downturns, and regulatory changes. Thorough due diligence is crucial before investing.

Where can I find real-time Anet stock price quotes?

Real-time quotes for Anet stock are readily available through major financial websites and brokerage platforms.

How does Anet compare to its competitors in terms of innovation?

A comparative analysis of Anet’s innovation efforts against its competitors requires a detailed review of their respective R&D spending, patent portfolios, and new product launches. Such an analysis is beyond the scope of this overview but would provide valuable insight.

What is the typical trading volume for Anet stock?

Trading volume for Anet stock varies daily and can be found on financial websites that track market activity.