Abbott Laboratories: A Comprehensive Stock Price Analysis

Abbott stock price – Abbott Laboratories (ABT) is a multinational healthcare company with a diverse portfolio of products and services. This analysis delves into Abbott’s company overview, factors influencing its stock price, past performance, financial health, future outlook, and investment considerations. We will explore both potential rewards and risks associated with investing in Abbott stock, providing a balanced perspective for potential investors.

Abbott Laboratories Company Overview

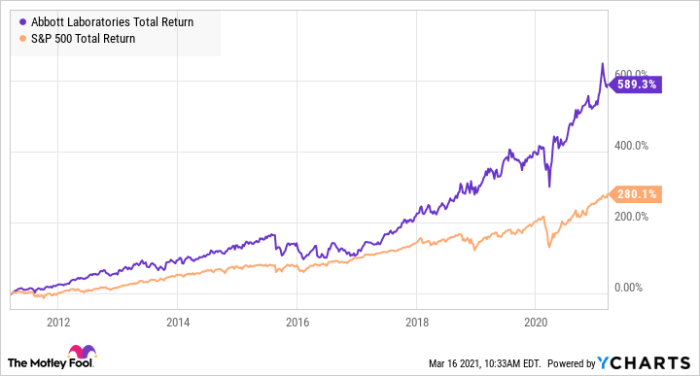

Source: ycharts.com

Abbott Laboratories boasts a rich history, founded in 1888 by Wallace C. Abbott. Initially focused on manufacturing and distributing pharmaceuticals, the company has significantly expanded its reach over the years through strategic acquisitions and internal innovation. Today, Abbott operates across various segments, including medical devices, diagnostics, established pharmaceuticals, and nutrition. Its strong market presence spans numerous countries globally.

Abbott’s major product lines include cardiovascular devices (stents, pacemakers), diabetes care products (FreeStyle Libre), diagnostics (molecular diagnostics, point-of-care testing), and nutritional products (pediatric and adult nutritionals). These product lines hold leading positions in their respective markets, often driven by technological innovation and strong brand recognition. The company’s diversified portfolio mitigates risk associated with dependence on any single product category.

| Year | Revenue (USD Billions) | Net Income (USD Billions) | EPS (USD) |

|---|---|---|---|

| 2022 | (Insert Data) | (Insert Data) | (Insert Data) |

| 2021 | (Insert Data) | (Insert Data) | (Insert Data) |

| 2020 | (Insert Data) | (Insert Data) | (Insert Data) |

| 2019 | (Insert Data) | (Insert Data) | (Insert Data) |

| 2018 | (Insert Data) | (Insert Data) | (Insert Data) |

Factors Influencing Abbott Stock Price

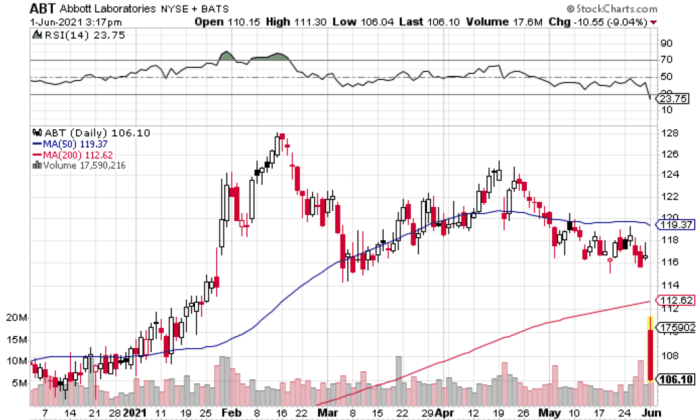

Source: seekingalpha.com

Several macroeconomic factors, competitive dynamics, and regulatory changes significantly influence Abbott’s stock price. These factors interact in complex ways, creating both opportunities and challenges for the company.

Three significant macroeconomic factors are global economic growth, healthcare spending trends, and currency exchange rates. Strong global economic growth generally leads to increased healthcare spending, benefiting Abbott’s sales. Conversely, economic downturns can negatively impact demand for healthcare products. Fluctuations in currency exchange rates also affect Abbott’s profitability, as a significant portion of its revenue comes from international markets.

Competitor actions play a crucial role in Abbott’s stock performance. Companies like Medtronic and Johnson & Johnson are key competitors, vying for market share in various segments. Competitive pressures, such as new product launches or aggressive pricing strategies, can impact Abbott’s revenue growth and profitability. A detailed competitive analysis, comparing market share, product portfolios, and innovation strategies, is essential for understanding Abbott’s position within the industry landscape.

Regulatory changes, particularly FDA approvals for new products or changes in reimbursement policies, have a direct impact on Abbott’s stock price. Successful FDA approvals for innovative products can drive significant stock price increases, while delays or setbacks can lead to declines. Changes in reimbursement policies can also affect the demand for Abbott’s products, influencing its financial performance.

Abbott’s Stock Performance Analysis

Abbott’s stock price trend over the past year needs to be analyzed considering various factors. A visual comparison against a relevant market index, such as the S&P 500, provides context for understanding its relative performance. Key dates and events that significantly impacted Abbott’s stock price during this period should be identified and analyzed.

A visual comparison against the S&P 500 might show periods of outperformance and underperformance. For example, a chart could illustrate how Abbott’s stock might have reacted differently to macroeconomic events compared to the broader market. During periods of market volatility, Abbott’s stock might have displayed more resilience due to its defensive nature as a healthcare company.

A timeline illustrating key events could include significant product launches, regulatory approvals or setbacks, financial results announcements, and major acquisitions or divestitures. Each event’s impact on the stock price should be briefly described. For instance, a successful product launch might have triggered a positive market reaction, while a negative regulatory decision could have resulted in a temporary price drop.

Abbott’s Financial Health and Future Outlook

Abbott’s financial health is assessed through various metrics, including its debt-to-equity ratio, research and development (R&D) spending, and analyst forecasts. These indicators provide insights into the company’s financial stability, growth potential, and future prospects.

Abbott’s debt-to-equity ratio indicates its financial leverage. A lower ratio generally suggests a stronger financial position, reducing the risk of financial distress. However, a higher ratio might indicate aggressive growth strategies or potential financial vulnerability. Analysis of this ratio over time provides context for evaluating the company’s financial risk profile.

Abbott’s R&D spending reflects its commitment to innovation. Significant investments in R&D suggest a focus on developing new products and technologies, which can drive future growth. Analyzing the trend of R&D spending over time provides insights into the company’s long-term growth strategy.

The consensus analyst forecast for Abbott’s stock price in the next 12 months provides a market outlook. This forecast, however, should be considered alongside other factors and viewed with caution, as it’s not a guarantee of future performance. Analyzing the range of analyst forecasts and the underlying assumptions provides a more comprehensive view of the potential price movement.

Investment Considerations for Abbott Stock

Investing in Abbott stock involves considering both potential risks and rewards. A comparative analysis of Abbott’s valuation metrics against its competitors provides valuable insights into its relative attractiveness as an investment.

Potential risks include macroeconomic headwinds (e.g., economic recession), increased competition, regulatory changes, and potential product failures. These risks need careful consideration before making an investment decision. A thorough understanding of these risks allows investors to make informed decisions and manage their portfolio effectively.

Potential rewards include consistent dividend payments, steady revenue growth driven by a diversified product portfolio, and opportunities for capital appreciation. Abbott’s strong brand reputation, established market presence, and commitment to innovation contribute to its potential for long-term growth. However, realizing these rewards depends on several factors, including the company’s ability to execute its strategic plans and navigate market challenges.

| Metric | Abbott | Competitor A | Competitor B |

|---|---|---|---|

| P/E Ratio | (Insert Data) | (Insert Data) | (Insert Data) |

| Dividend Yield | (Insert Data) | (Insert Data) | (Insert Data) |

| (Add other relevant metrics) | (Insert Data) | (Insert Data) | (Insert Data) |

Illustrative Example: Impact of a Major Product Launch, Abbott stock price

Two hypothetical scenarios illustrate the potential impact of a new Abbott product launch on its stock price. These scenarios demonstrate how successful and unsuccessful launches can affect financial projections.

Successful Product Launch: Imagine Abbott launches a revolutionary new diagnostic device with superior accuracy and ease of use. This could lead to a significant increase in revenue within the first year, potentially exceeding initial projections by 15-20%. The increased revenue would positively impact net income and EPS, driving a substantial increase in the stock price. Investors would likely react positively to this news, leading to a surge in demand for Abbott stock.

Unsuccessful Product Launch: Conversely, imagine the launch of a new product faces unexpected challenges, such as regulatory delays or lower-than-expected market adoption. This could result in significant financial losses, impacting net income and EPS negatively. The stock price would likely decline as investors react to the disappointing results. This scenario highlights the inherent risks associated with new product launches and the importance of thorough market research and risk management.

FAQ Resource: Abbott Stock Price

What is Abbott’s dividend yield?

Abbott’s dividend yield fluctuates but is generally considered competitive within the healthcare sector. Check current financial news sources for the most up-to-date information.

How does Abbott compare to its competitors in terms of market capitalization?

Abbott’s market capitalization is substantial and ranks among the leaders in the pharmaceutical and medical device industries. However, its precise ranking relative to competitors changes frequently. Refer to reputable financial websites for the most current data.

What are the major risks associated with investing in Abbott?

Major risks include general market volatility, competition within the healthcare industry, regulatory hurdles for new product approvals, and potential changes in healthcare policy.