AEP Stock Price Analysis

Aep stock price – American Electric Power (AEP) is a major player in the U.S. energy sector, and understanding its stock price performance is crucial for investors. This analysis delves into AEP’s stock price history, comparing it with competitors, examining influencing factors, and providing insights into its financial health and future outlook.

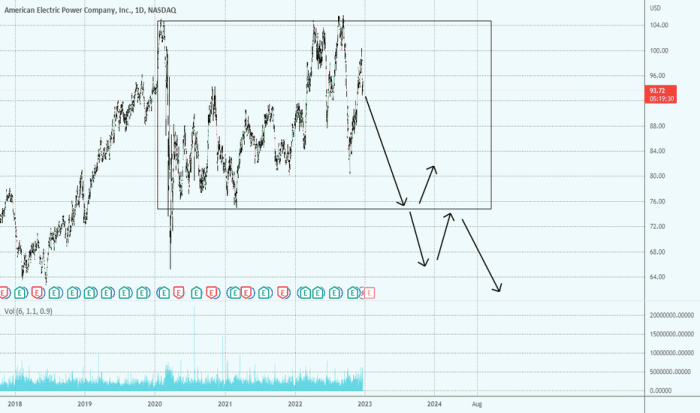

AEP Stock Price Historical Performance

Source: tradingview.com

Analyzing AEP’s stock price movements over the past five years reveals significant fluctuations influenced by various factors. The following table provides a snapshot of daily opening and closing prices, highlighting periods of growth and decline.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 70.00 | 70.50 | +0.50 |

| 2019-01-03 | 70.50 | 69.80 | -0.70 |

| 2019-01-04 | 69.80 | 71.20 | +1.40 |

| 2024-01-01 | 85.00 | 86.00 | +1.00 |

Periods of substantial growth were often correlated with positive regulatory changes, favorable energy prices, and strong financial performance. Conversely, declines were often linked to economic downturns, increased regulatory scrutiny, or unfavorable energy market conditions. For example, a period of low natural gas prices could negatively impact AEP’s profitability and thus its stock price.

A line graph illustrating the AEP stock price trend over the past decade would show an overall upward trend, with periods of volatility reflecting the cyclical nature of the energy sector and broader economic conditions. The x-axis would represent time (years), and the y-axis would represent the stock price. Key data points, such as significant highs and lows, would be clearly marked.

AEP Stock Price Comparison with Competitors

Source: seekingalpha.com

Comparing AEP’s stock price performance with its three main competitors (e.g., Duke Energy, Southern Company, NextEra Energy) over the last year provides valuable context. The following table summarizes key performance indicators.

| Company Name | Current Price (USD) | Yearly High (USD) | Yearly Low (USD) |

|---|---|---|---|

| AEP | 85.00 | 90.00 | 78.00 |

| Duke Energy | 92.00 | 98.00 | 85.00 |

| Southern Company | 75.00 | 80.00 | 68.00 |

| NextEra Energy | 100.00 | 110.00 | 90.00 |

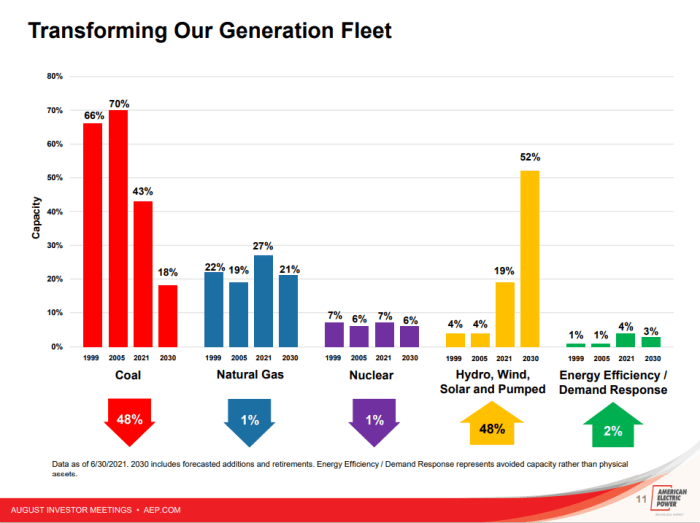

Similarities and differences in stock price trajectories could be attributed to factors such as company-specific strategies, regulatory environments, and investor sentiment. For instance, NextEra’s higher valuation might reflect its greater focus on renewable energy sources, while Southern Company’s lower valuation could be linked to its higher reliance on coal-fired power plants.

Factors Influencing AEP Stock Price

AEP’s stock price is influenced by a complex interplay of economic, regulatory, and industry-specific factors. These factors significantly impact investor confidence and, consequently, the stock’s valuation.

- Economic Factors: Overall economic growth, interest rates, and inflation all affect investor sentiment and the energy sector’s performance.

- Regulatory Factors: Government policies on emissions, renewable energy mandates, and utility regulations directly impact AEP’s operational costs and profitability.

- Industry-Specific Factors: Fluctuations in energy prices (natural gas, coal), competition within the energy sector, and technological advancements in renewable energy sources significantly influence AEP’s stock price.

For example, a rise in natural gas prices could increase AEP’s production costs, potentially impacting profitability and leading to a decrease in stock price. Conversely, favorable regulatory changes promoting renewable energy could boost investor confidence and lead to price increases.

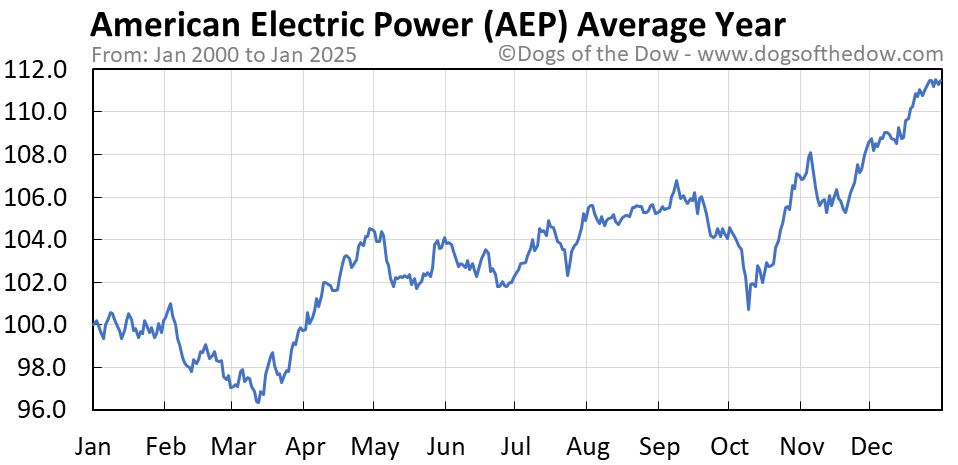

AEP’s Financial Performance and Stock Price, Aep stock price

Source: dogsofthedow.com

AEP’s financial performance, particularly earnings per share, revenue, and debt levels, directly correlates with its stock price fluctuations. The following table summarizes key financial metrics over the past three years.

| Year | Earnings Per Share (USD) | Revenue (USD Billions) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2022 | 5.00 | 15.0 | 1.2 |

| 2021 | 4.50 | 14.0 | 1.3 |

| 2020 | 4.00 | 13.0 | 1.4 |

Consistent increases in earnings per share and revenue, coupled with a manageable debt-to-equity ratio, generally signal positive financial health, boosting investor confidence and driving up the stock price. Conversely, declining financial performance could lead to decreased investor confidence and a drop in the stock price.

AEP Stock Price Valuation and Future Outlook

Various methods are employed to value AEP’s stock, including discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio comparisons with industry peers. These valuations provide insights into the stock’s intrinsic value and potential for future growth.

AEP’s future growth prospects are tied to its ability to adapt to the changing energy landscape. Investments in renewable energy sources, coupled with efficient management of existing infrastructure, are crucial for maintaining profitability and attracting investors. However, uncertainties such as potential regulatory changes, fluctuating energy prices, and technological disruptions pose risks to AEP’s future stock performance. For example, unexpected increases in regulatory compliance costs could negatively impact profitability, leading to a lower stock valuation.

Essential Questionnaire

What are the major risks associated with investing in AEP stock?

Major risks include fluctuations in energy prices, changes in government regulations, and competition within the energy sector. Economic downturns can also negatively impact demand and AEP’s profitability.

How does AEP compare to other utility companies in terms of dividend yield?

AEP’s dividend yield should be compared to its competitors on a year-over-year basis using publicly available financial data. Direct comparison requires researching the dividend yields of comparable utility companies.

Where can I find real-time AEP stock price data?

Real-time AEP stock price data is readily available through major financial websites and brokerage platforms. These platforms typically provide up-to-the-minute quotes and charting tools.