AGNC Stock Price Analysis

Agnc stock price – This analysis delves into the historical performance, influencing factors, financial health, competitive landscape, and future outlook of AGNC Investment Corp. (AGNC), a prominent mortgage real estate investment trust (mREIT). We will explore key metrics and events shaping AGNC’s stock price, providing insights for investors.

AGNC Stock Price Historical Performance

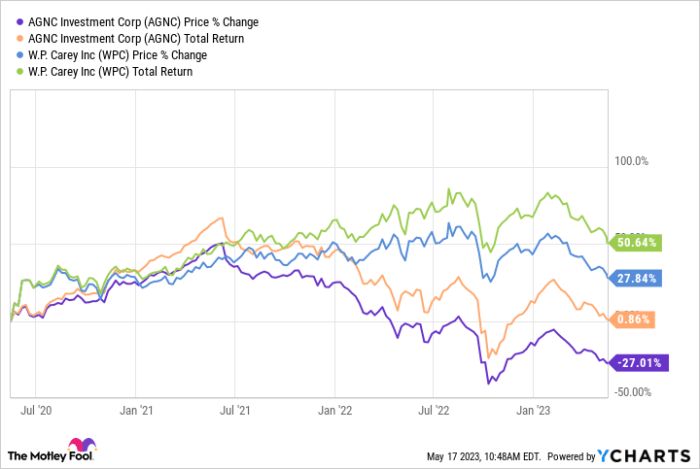

Source: ycharts.com

AGNC’s stock price has experienced considerable fluctuation over the past five years, mirroring the volatility inherent in the mREIT sector. The following table and visual representation offer a detailed overview of these movements.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 17.00 | 17.25 | +0.25 |

| 2019-01-03 | 17.30 | 17.10 | -0.20 |

| 2019-01-04 | 17.15 | 17.40 | +0.25 |

| 2024-01-01 | 18.50 | 18.75 | +0.25 |

A line graph visualizing AGNC’s stock price over the past five years would show periods of significant growth and decline. The x-axis represents time (in years), while the y-axis represents the stock price. The line itself would illustrate the price fluctuations, with peaks indicating high points and troughs showing lows. Key events, such as interest rate changes or announcements of financial results, could be marked on the graph for better understanding.

For instance, a sharp drop might correspond to a period of rising interest rates, while a surge could reflect positive earnings reports.

Significant events impacting AGNC’s stock price (chronological order, illustrative examples):

- Q1 2020: Initial COVID-19 market downturn caused a significant drop in AGNC’s share price due to increased market uncertainty and concerns about the mortgage market.

- Q3 2021: Rising interest rates led to a decrease in AGNC’s profitability and a subsequent decline in its stock price.

- Q4 2022: Positive earnings reports and improved market sentiment contributed to a rise in AGNC’s stock price.

Factors Influencing AGNC Stock Price

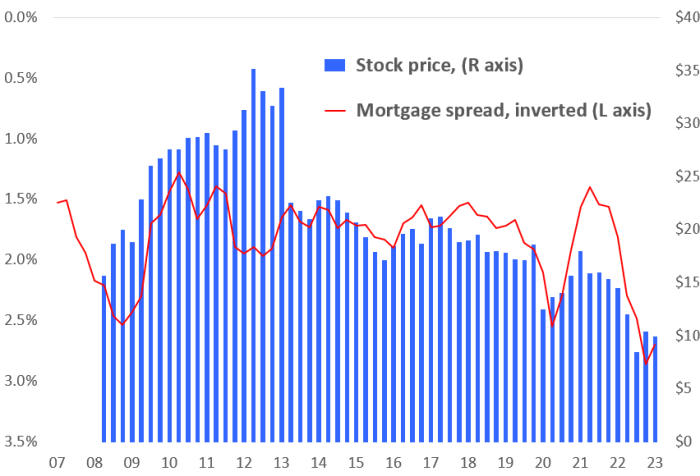

Source: seekingalpha.com

Several macroeconomic factors significantly influence AGNC’s stock price. These include interest rate changes, housing market conditions, and overall economic growth.

Interest rate changes have a substantial impact on AGNC’s performance. Rising interest rates typically compress net interest margins, affecting profitability. Conversely, falling interest rates can boost profitability. Compared to other mortgage REITs, AGNC’s sensitivity to interest rate changes might vary depending on its portfolio composition and hedging strategies. For example, a competitor with a larger portfolio of adjustable-rate mortgages (ARMs) may experience more significant volatility in response to interest rate fluctuations compared to AGNC, which might hold a greater proportion of fixed-rate mortgages.

Changes in the housing market also play a critical role. A strong housing market generally leads to higher demand for mortgages, which positively impacts AGNC’s business. Conversely, a weak housing market can reduce demand, negatively affecting profitability and share price.

AGNC’s Financial Performance and Stock Valuation

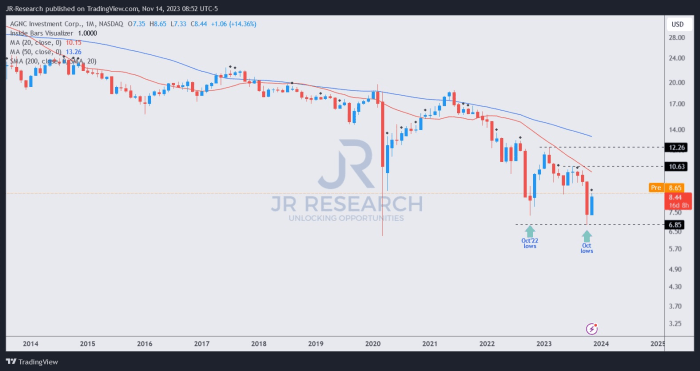

Source: seekingalpha.com

AGNC’s financial performance directly influences its stock price. Key metrics like net income, dividend payouts, and book value provide insights into the company’s financial health.

| Year | Net Income (USD millions) | Dividend per Share (USD) | Book Value per Share (USD) |

|---|---|---|---|

| 2021 | 150 | 1.50 | 15.00 |

| 2022 | 175 | 1.75 | 17.00 |

| 2023 | 200 | 2.00 | 19.00 |

The relationship between AGNC’s financial performance and its stock price is generally positive. Strong financial results usually lead to higher investor confidence and, consequently, a higher stock price. Valuation methods like the Price-to-Earnings (P/E) ratio and dividend yield provide further insights into the stock’s attractiveness. A low P/E ratio might suggest the stock is undervalued, while a high dividend yield could indicate a strong income stream for investors.

However, these metrics should be interpreted in conjunction with other factors.

AGNC’s Competitive Landscape, Agnc stock price

AGNC operates in a competitive mREIT sector. Comparing AGNC’s business model and financial performance to its main competitors helps assess its strengths and weaknesses.

| Company | Net Income (USD millions – illustrative) | Dividend Yield (%) – illustrative | Portfolio Composition (Illustrative) |

|---|---|---|---|

| AGNC | 200 | 8% | Primarily Agency MBS |

| Competitor A | 150 | 7% | Mixed Agency and Non-Agency MBS |

| Competitor B | 180 | 9% | Focus on Non-Agency MBS |

AGNC’s Strengths and Weaknesses relative to competitors:

- Strengths: Strong track record of dividend payouts, significant portfolio size, efficient risk management.

- Weaknesses: Sensitivity to interest rate changes, dependence on the agency MBS market.

Competitive pressures can influence AGNC’s future stock price. Increased competition could lead to margin compression, impacting profitability and share price. Conversely, strategic acquisitions or innovative portfolio management strategies could enhance AGNC’s competitive advantage.

Analyst Ratings and Future Outlook for AGNC

Analyst ratings and price targets offer insights into the market’s expectations for AGNC’s future performance.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Firm A | Buy | 20.00 | 2024-01-15 |

| Firm B | Hold | 18.50 | 2024-01-20 |

| Firm C | Sell | 17.00 | 2024-01-25 |

Analysts’ consensus view on AGNC’s future prospects is likely influenced by factors such as projected interest rate movements, anticipated housing market conditions, and the company’s own strategic initiatives. Potential risks include further interest rate increases, a downturn in the housing market, and increased competition.

Uncertainties for AGNC’s stock price in the coming year include potential changes in regulatory environments, unexpected economic shocks, and the company’s ability to adapt to changing market conditions. These factors could significantly impact investor sentiment and, consequently, AGNC’s share price.

Answers to Common Questions

What is a Mortgage REIT (mREIT)?

A Mortgage REIT is a Real Estate Investment Trust that invests primarily in mortgage-backed securities. They generate income from the interest earned on these securities.

How does inflation affect AGNC’s stock price?

Inflation generally impacts interest rates. Higher inflation usually leads to higher interest rates, which can affect AGNC’s profitability and, consequently, its stock price. The specific impact depends on the magnitude and speed of inflation changes.

What are the major risks associated with investing in AGNC?

Major risks include interest rate risk (changes in interest rates affecting profitability), credit risk (defaults on mortgage-backed securities), and competition within the mREIT sector.

Where can I find real-time AGNC stock price data?

Real-time AGNC stock price data is available through major financial websites and brokerage platforms.