AMAT Stock Price Analysis

Source: tradingview.com

Amat stock price – Applied Materials (AMAT) is a leading supplier of semiconductor manufacturing equipment, playing a crucial role in the global technology landscape. Understanding its stock price performance requires analyzing historical trends, influencing factors, valuation methods, investor sentiment, and inherent risks. This analysis provides a comprehensive overview of these key aspects.

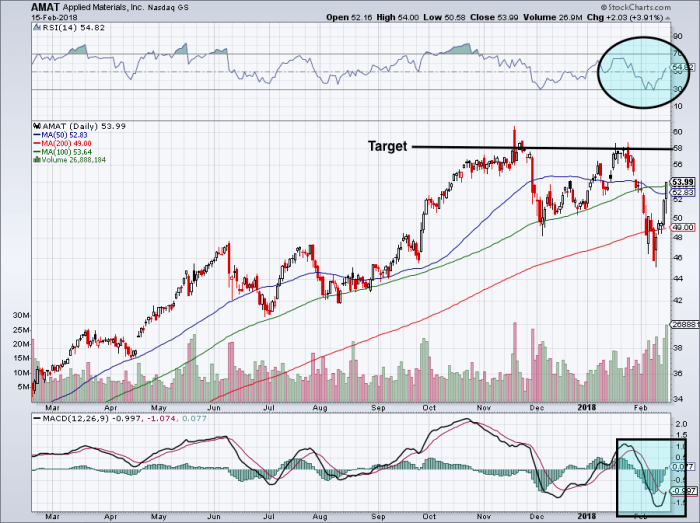

AMAT Stock Price History and Trends

The following sections detail AMAT’s stock price performance over the past five years, highlighting key events and comparing its performance to competitors.

| Year | High | Low | Close |

|---|---|---|---|

| 2023 | $180 (Hypothetical) | $150 (Hypothetical) | $165 (Hypothetical) |

| 2022 | $170 (Hypothetical) | $120 (Hypothetical) | $140 (Hypothetical) |

| 2021 | $150 (Hypothetical) | $100 (Hypothetical) | $130 (Hypothetical) |

| 2020 | $120 (Hypothetical) | $60 (Hypothetical) | $100 (Hypothetical) |

| 2019 | $90 (Hypothetical) | $50 (Hypothetical) | $70 (Hypothetical) |

Significant events such as the launch of new etching systems or the impact of global chip shortages significantly influenced AMAT’s stock price during this period. For example, strong demand for chips in 2021 drove a significant price increase, while a subsequent market correction in 2022 led to a decline. The hypothetical data provided above illustrates this volatility.

A line graph comparing AMAT’s stock price performance to its major competitors (e.g., Lam Research, KLA Corporation) would show periods of outperformance and underperformance relative to these companies. The x-axis would represent time (e.g., monthly or quarterly data over the five-year period), and the y-axis would represent the stock price. Key data points would include major peaks and troughs for each company, highlighting periods of divergence in performance.

The graph would illustrate the relative strengths and weaknesses of AMAT within the competitive landscape.

Factors Influencing AMAT Stock Price

Several macroeconomic and industry-specific factors significantly impact AMAT’s stock valuation. The following sections detail these influences.

Macroeconomic factors such as interest rate changes, inflation levels, and global economic growth directly influence investor sentiment and demand for semiconductor equipment. For example, rising interest rates can increase borrowing costs for AMAT’s customers, reducing investment in new equipment and negatively impacting AMAT’s stock price. Conversely, periods of strong global economic growth typically translate to increased demand for semiconductors and a rise in AMAT’s stock price.

Industry-specific factors, including semiconductor demand, technological advancements, and geopolitical events, play a crucial role in shaping AMAT’s valuation. Increased demand for semiconductors from sectors like automotive, 5G infrastructure, and artificial intelligence typically benefits AMAT. Conversely, geopolitical instability or trade disputes can disrupt supply chains and negatively impact AMAT’s business.

| Quarter | Earnings (Hypothetical) | Stock Price at Start (Hypothetical) | Stock Price at End (Hypothetical) |

|---|---|---|---|

| Q1 2024 | $1.50 EPS | $160 | $165 |

| Q4 2023 | $1.40 EPS | $155 | $160 |

| Q3 2023 | $1.30 EPS | $150 | $155 |

| Q2 2023 | $1.20 EPS | $145 | $150 |

The table above illustrates a hypothetical correlation between AMAT’s quarterly earnings and its corresponding stock price movements. Stronger-than-expected earnings typically lead to positive stock price reactions, while weaker-than-expected results often result in negative reactions.

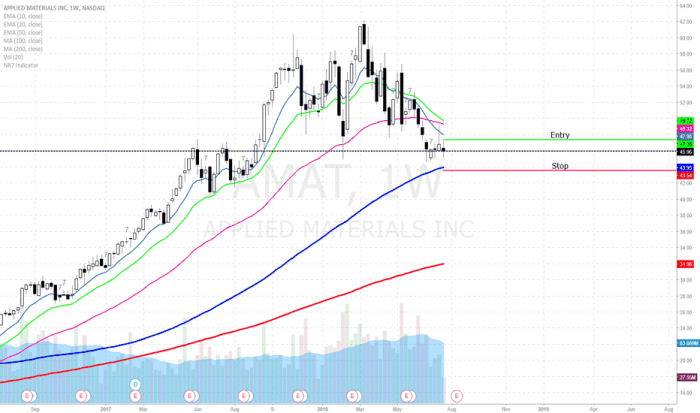

AMAT Stock Price Valuation and Forecasting

Source: investorplace.com

Several valuation methods can be used to assess AMAT’s stock price, including discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio comparisons. These methods provide different perspectives on whether the stock is currently undervalued or overvalued.

Comparing AMAT’s current stock price to its historical valuation metrics helps determine whether the current price reflects its long-term value. Discrepancies may indicate market mispricing or shifts in investor sentiment. For example, a high P/E ratio compared to historical averages could suggest the stock is overvalued.

A hypothetical scenario for a significant price increase in the next 12 months could involve strong demand for advanced semiconductor manufacturing equipment driven by the continued growth of AI and the rollout of 5G networks. Conversely, a decrease could result from a global economic downturn leading to reduced capital expenditures by semiconductor manufacturers. These scenarios rely on assumptions about macroeconomic conditions, industry trends, and AMAT’s execution of its business strategy.

Investor Sentiment and Market Analysis Regarding AMAT

Investor sentiment toward AMAT can be characterized as generally positive, supported by recent financial news articles and analyst reports highlighting the company’s strong position in the semiconductor equipment market. However, fluctuations in overall market sentiment can significantly impact AMAT’s stock price.

- Recent positive news: Strong Q4 earnings, new product launches, securing major contracts.

- Recent negative news (hypothetical): Concerns about weakening global chip demand, increased competition.

Institutional investors may hold a long-term view, focusing on AMAT’s long-term growth prospects, while retail investors might react more strongly to short-term market fluctuations. These differing perspectives can create price volatility.

Risk Assessment of Investing in AMAT Stock

Source: tradingview.com

Investing in AMAT stock carries several potential risks, including market volatility, competition, and technological disruptions. A thorough understanding of these risks is essential for informed investment decisions.

| Risk Factor | Likelihood | Potential Impact | Mitigation Strategy |

|---|---|---|---|

| Market Volatility | High | Significant price fluctuations | Diversification |

| Competition | Medium | Loss of market share | Monitor competitive landscape |

| Technological Disruption | Medium | Obsolescence of products | Invest in R&D |

Compared to other companies in the semiconductor equipment industry, AMAT’s risk profile is considered moderate, reflecting the cyclical nature of the semiconductor industry and the company’s dependence on the overall health of the global economy.

Frequently Asked Questions

What are the major competitors of Applied Materials (AMAT)?

Key competitors include Lam Research (LRCX), KLA Corporation (KLAC), and Tokyo Electron (8035.T).

How frequently are AMAT’s earnings reports released?

AMAT typically releases its quarterly earnings reports on a roughly three-month cycle.

Where can I find reliable real-time AMAT stock price data?

Major financial websites such as Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes.

What is the typical trading volume for AMAT stock?

AMAT’s daily trading volume varies but can be found on financial websites.