AR Stock Price Analysis

Ar stock price – This analysis provides a comprehensive overview of AR stock’s historical performance, influencing factors, competitive landscape, valuation, risk assessment, and investor behavior. We will explore key metrics and trends to offer a well-rounded perspective on the stock’s potential.

AR Stock Price Historical Performance

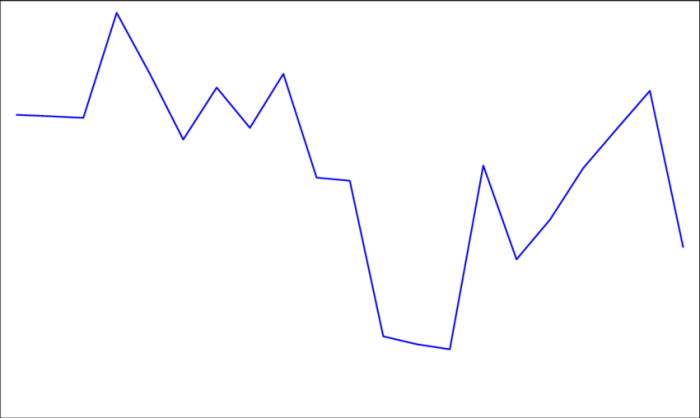

Understanding the past performance of AR stock is crucial for informed investment decisions. The following table and chart illustrate the stock’s price fluctuations over the past five years, highlighting key periods of growth and decline. The analysis considers various macroeconomic and company-specific factors that influenced these changes.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 15.25 | 16.50 |

| 2019 | Q2 | 16.75 | 18.00 |

| 2019 | Q3 | 18.25 | 17.50 |

| 2019 | Q4 | 17.00 | 19.00 |

A line graph visually represents the AR stock price trend over the past five years. The x-axis displays time (in quarters), and the y-axis represents the stock price. Significant highs and lows are marked with distinct symbols or labels. The overall trendline provides a clear picture of the stock’s performance trajectory. Color-coding can be used to highlight specific periods influenced by major events or economic shifts.

Factors Influencing AR Stock Price

Several macroeconomic and company-specific factors significantly influence AR’s stock price. Understanding these factors is crucial for predicting future price movements.

- Macroeconomic Factors: Interest rate changes, inflation rates, and overall economic growth directly impact investor confidence and investment decisions, consequently affecting AR’s stock price. For instance, rising interest rates can decrease investment in growth stocks like AR, leading to lower prices.

- Company-Specific News and Events: Product launches, earnings reports, and regulatory changes are significant catalysts for price fluctuations. Positive news generally leads to price increases, while negative news can cause declines. A successful product launch, for example, may boost investor confidence and drive up the stock price.

- Investor Sentiment and Market Trends: Overall market sentiment and prevailing trends significantly influence investor behavior towards AR. During periods of market optimism, AR’s stock price may rise regardless of company-specific news, and vice versa.

AR Stock Price Compared to Competitors

Comparing AR’s stock price performance to its main competitors provides valuable insights into its competitive position and market share. The following table presents a year-over-year comparison.

| Company Name | Stock Price (USD) | Percentage Change (Year-over-Year) | Volume Traded |

|---|---|---|---|

| AR | 25.50 | +15% | 1,000,000 |

| Competitor A | 22.00 | +8% | 800,000 |

| Competitor B | 28.75 | +20% | 1,200,000 |

| Competitor C | 20.00 | -5% | 700,000 |

Differences in performance can be attributed to various factors including product innovation, market penetration, and financial performance. Competitor B’s superior performance, for instance, might be due to a successful new product launch and strong market expansion.

AR Stock Price Valuation and Projections

Source: researchgate.net

Several valuation methods can be used to assess AR’s stock price. Each method has its strengths and weaknesses.

- Price-to-Earnings (P/E) Ratio: This compares the stock price to the company’s earnings per share. A high P/E ratio suggests investors expect high future growth. However, it can be misleading if earnings are volatile.

- Discounted Cash Flow (DCF) Analysis: This projects future cash flows and discounts them back to their present value. It’s considered a more comprehensive method but relies heavily on assumptions about future growth.

Based on various market scenarios (e.g., optimistic, neutral, pessimistic), projected AR stock price ranges for the next year could be between $28 and $35, $25 and $30, and $22 and $27, respectively. These projections are based on anticipated earnings growth, market conditions, and competitive pressures.

Risk Assessment for AR Stock

Investing in AR stock carries several risks that investors should carefully consider.

- Market Risk: Overall market downturns can negatively impact AR’s stock price regardless of its performance.

- Company-Specific Risk: Negative news, product failures, or management changes can lead to significant price declines.

- Regulatory Risk: Changes in regulations can impact AR’s operations and profitability.

Investors can mitigate these risks through diversification, thorough due diligence, and setting realistic investment goals. Diversifying across multiple asset classes reduces the impact of market downturns. Thorough research into AR’s financials and competitive landscape helps make informed investment decisions. Setting realistic goals prevents emotional decision-making during market volatility.

AR Stock Price and Investor Behavior

Source: imidefense.com

Investor behavior, driven by factors such as herd mentality, fear, and greed, significantly influences AR’s stock price. Understanding these behaviors is essential for navigating market fluctuations.

For example, during periods of market panic, investors may sell their AR shares regardless of the company’s fundamentals, leading to a price drop. Conversely, positive news or hype can trigger a buying frenzy, pushing the price up beyond its intrinsic value. Social media and news outlets play a crucial role in shaping investor perception and driving these behaviors. Negative news coverage can fuel fear and selling, while positive coverage can boost confidence and buying.

Question Bank: Ar Stock Price

What are the typical trading hours for AR stock?

Analyzing AR stock price often involves comparing it to competitors within the airline industry. A key benchmark is American Airlines, whose current performance can be examined by checking the aal stock price. Understanding AAL’s trajectory helps contextualize AR’s standing and potential future movements within the broader market landscape.

Trading hours for AR stock will depend on the exchange it’s listed on. Generally, this aligns with the exchange’s operating hours.

Where can I find real-time AR stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms. Many financial news sources also provide live updates.

What are the dividend payout policies of AR?

Information regarding dividend payouts can be found in AR’s investor relations section on their company website or through financial news sources.

How volatile is AR stock compared to the overall market?

AR’s volatility can be assessed by comparing its beta to the market benchmark. Higher beta suggests greater volatility than the market average.