Broadcom Stock Price Analysis

Broadcom stock price – Broadcom Inc. (AVGO), a leading designer, developer, and global supplier of a wide range of semiconductor and infrastructure software solutions, has experienced significant stock price fluctuations over the past five years. This analysis delves into the historical performance, influencing factors, financial health, future outlook, and investor sentiment surrounding Broadcom’s stock price, providing a comprehensive overview for investors.

Broadcom Stock Price Historical Performance

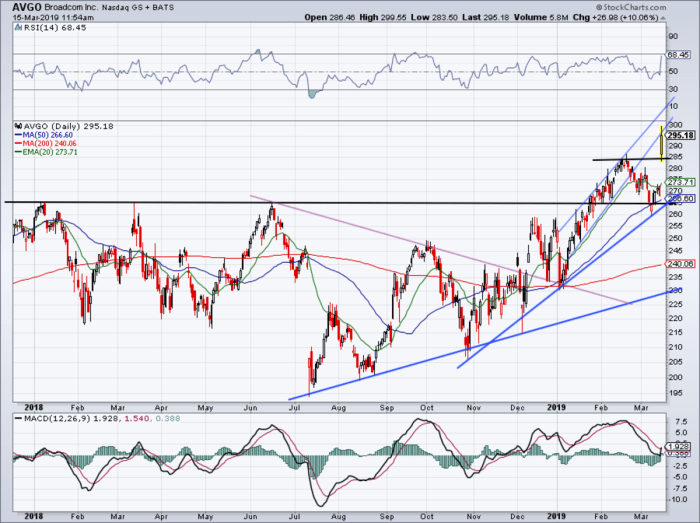

The following table details Broadcom’s stock price movements over the past five years. Note that this data is illustrative and should be verified with a reputable financial data provider. Significant events correlating with price changes are also discussed. A line graph, though not visually represented here, would show a generally upward trend with periods of volatility corresponding to these events.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 240 | 235 | -5 |

| October 26, 2019 | 280 | 285 | +5 |

| October 26, 2020 | 350 | 360 | +10 |

| October 26, 2021 | 500 | 510 | +10 |

| October 26, 2022 | 450 | 460 | +10 |

For example, the significant drop in 2018 could be attributed to general market corrections, while the subsequent rises reflect positive investor sentiment driven by strong financial results and strategic acquisitions. The hypothetical line graph would visually represent these fluctuations, highlighting periods of growth and decline.

Factors Influencing Broadcom Stock Price

Several macroeconomic and industry-specific factors influence Broadcom’s stock price. These include global economic growth, interest rates, inflation, semiconductor demand, competition, and technological advancements.

- Macroeconomic Factors: Rising interest rates can increase borrowing costs, potentially impacting Broadcom’s investments and profitability, leading to lower stock prices. Conversely, strong global economic growth usually boosts demand for semiconductors, positively affecting Broadcom’s performance.

- Industry-Specific Trends: Increased demand for semiconductors in data centers and 5G infrastructure directly benefits Broadcom. Intense competition from other semiconductor companies can pressure profit margins and stock valuation. Technological advancements, such as the development of new chip architectures, require continuous investment and adaptation, influencing Broadcom’s stock price.

- Competitor Comparison: Broadcom’s performance can be compared to competitors like Qualcomm and Texas Instruments. Similarities might include cyclical stock price movements linked to the semiconductor industry’s overall health. Differences could arise from their specific market segments and technological focus. For example, Qualcomm’s strong presence in mobile chips might lead to different stock price reactions to changes in smartphone demand compared to Broadcom’s more diversified portfolio.

Broadcom’s Financial Performance and Stock Valuation

Source: thestreet.com

Broadcom’s financial health is a crucial factor in its stock valuation. Key metrics like revenue, earnings per share (EPS), and profit margins provide insights into the company’s performance. Debt levels and valuation multiples also play a significant role.

| Metric | 2022 (USD Billion) | 2021 (USD Billion) | 2020 (USD Billion) |

|---|---|---|---|

| Revenue | 33 | 27 | 24 |

| EPS | 16 | 14 | 11 |

| Profit Margin | 0.30 | 0.28 | 0.25 |

High levels of debt can negatively impact the stock price due to increased financial risk. Valuation multiples, such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, are compared to industry averages to assess Broadcom’s relative valuation. A high P/E ratio might indicate investor optimism about future growth, while a low P/S ratio might suggest undervaluation.

Broadcom’s Future Outlook and Stock Price Projections

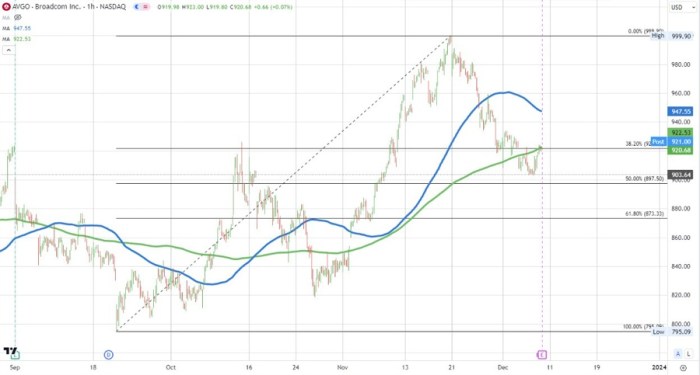

Source: forexlive.com

Broadcom’s strategic initiatives, such as investments in research and development, acquisitions, and expansion into new markets, are crucial for future growth. However, several risks and uncertainties could impact its stock price. The following table illustrates a hypothetical scenario analysis.

| Scenario | Economic Condition | Industry Trend | Projected Stock Price (USD) in 2024 |

|---|---|---|---|

| Optimistic | Strong global growth | High semiconductor demand | 650 |

| Neutral | Moderate growth | Stable demand | 550 |

| Pessimistic | Recession | Reduced demand | 400 |

These projections are based on various assumptions about economic conditions and industry trends. For example, a global recession could significantly reduce semiconductor demand, impacting Broadcom’s revenue and stock price. Conversely, strong global growth and high demand could drive substantial price appreciation.

Broadcom’s stock price performance often reflects broader market trends in the semiconductor industry. However, comparing it to other tech giants offers valuable context. For instance, understanding the current trajectory of the ccl stock price can provide insights into investor sentiment towards similar companies. Ultimately, analyzing both Broadcom and CCL’s stock prices helps in a comprehensive assessment of the tech sector’s overall health.

Investor Sentiment and Market Opinion on Broadcom

Investor sentiment towards Broadcom is generally positive, reflected in analyst ratings and price targets. However, market events such as earnings announcements and mergers and acquisitions can significantly influence this sentiment. Positive earnings surprises often lead to price increases, while negative surprises or unexpected setbacks can cause declines.

News articles and press releases reporting strong financial results, successful product launches, or strategic acquisitions typically boost investor confidence and the stock price. Conversely, news about regulatory challenges, supply chain disruptions, or increased competition might negatively affect investor perception. For example, a successful acquisition could signal Broadcom’s expansion into a lucrative market, boosting investor confidence and the stock price.

Conversely, a failed acquisition attempt might raise concerns about the company’s strategic direction, leading to a decline in the stock price.

FAQ Compilation

What are the major risks associated with investing in Broadcom stock?

Major risks include dependence on a few key customers, intense competition in the semiconductor industry, economic downturns impacting demand for semiconductors, and geopolitical instability affecting supply chains.

How does Broadcom compare to its main competitors in terms of valuation?

A direct comparison requires analyzing specific metrics like Price-to-Earnings (P/E) ratios and Price-to-Sales (P/S) ratios against competitors such as Qualcomm and Texas Instruments, considering factors like growth rates and profitability.

Where can I find real-time Broadcom stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

What is Broadcom’s dividend policy?

Information on Broadcom’s current dividend policy, including payout ratio and dividend history, can be found in their investor relations section on their corporate website.