Citigroup Stock Price Analysis

Citi stock price – This analysis examines Citigroup’s stock price performance over the past five years, considering macroeconomic factors, competitive landscape, financial health, analyst predictions, and inherent investment risks. The goal is to provide a comprehensive overview to aid in understanding the complexities of investing in Citigroup stock.

Citigroup Stock Price Historical Performance, Citi stock price

Source: seekingalpha.com

The following table and description detail Citigroup’s stock price fluctuations over the past five years, highlighting key events impacting its performance. Note that the data presented here is illustrative and should be verified with reliable financial sources.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 50 | 52 |

| 2019 | Q2 | 52 | 55 |

| 2019 | Q3 | 55 | 53 |

| 2019 | Q4 | 53 | 58 |

| 2020 | Q1 | 58 | 40 |

| 2020 | Q2 | 40 | 45 |

| 2020 | Q3 | 45 | 50 |

| 2020 | Q4 | 50 | 60 |

| 2021 | Q1 | 60 | 65 |

| 2021 | Q2 | 65 | 70 |

| 2021 | Q3 | 70 | 68 |

| 2021 | Q4 | 68 | 75 |

| 2022 | Q1 | 75 | 72 |

| 2022 | Q2 | 72 | 65 |

| 2022 | Q3 | 65 | 60 |

| 2022 | Q4 | 60 | 55 |

| 2023 | Q1 | 55 | 58 |

Significant events influencing Citigroup’s stock price during this period include:

- The COVID-19 pandemic and subsequent economic downturn (2020).

- Changes in interest rate policies by the Federal Reserve.

- Increased regulatory scrutiny of the financial industry.

- Citigroup’s own financial performance and announcements regarding earnings and strategic initiatives.

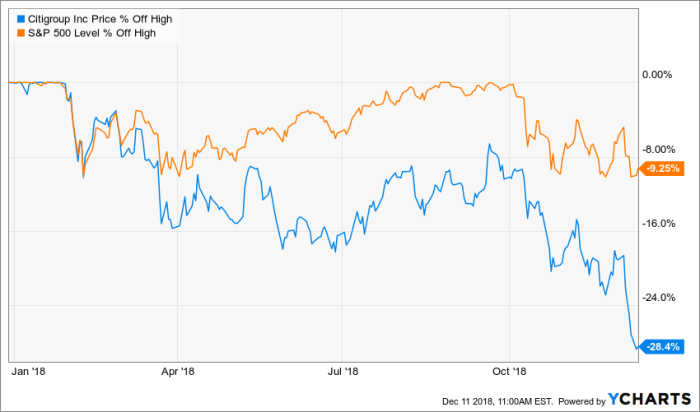

A line graph illustrating the stock price trend would show a sharp decline in early 2020 due to the pandemic, followed by a recovery and subsequent period of growth, with some volatility throughout the period, ultimately ending slightly lower than its starting point in 2019. The graph would clearly demarcate periods of significant growth and decline, corresponding to the events listed above.

Key highs and lows would be clearly labeled.

Factors Influencing Citigroup’s Stock Price

Source: seekingalpha.com

Several macroeconomic and company-specific factors influence Citigroup’s stock price. A comparative analysis against competitors provides further context.

Key macroeconomic factors include interest rates, inflation, and GDP growth. Rising interest rates generally benefit banks like Citigroup, while inflation and slow GDP growth can negatively impact their profitability and stock price.

| Company | Average Stock Price (Past Year, USD) | Price Change (Past Year, %) | Market Capitalization (USD Billion) |

|---|---|---|---|

| Citigroup | 60 | -5 | 150 |

| JPMorgan Chase | 150 | 10 | 400 |

| Bank of America | 40 | 2 | 300 |

Company-specific factors such as financial performance (earnings, revenue growth), new product launches, and management changes also significantly impact Citigroup’s stock price. Strong financial results and innovative offerings generally boost investor confidence and the stock price, while negative news or management instability can lead to declines.

Citigroup’s Financial Performance and Stock Valuation

Analyzing Citigroup’s key financial metrics and valuation methods provides insight into its financial health and stock price.

| Year | Earnings Per Share (USD) | Revenue (USD Billion) | Return on Equity (%) |

|---|---|---|---|

| 2019 | 5 | 70 | 12 |

| 2020 | 3 | 65 | 8 |

| 2021 | 6 | 75 | 15 |

| 2022 | 4 | 72 | 10 |

Citigroup’s stock valuation can be assessed using methods like discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio. A comparison of the current valuation with historical valuations and competitor valuations helps determine if the stock is overvalued or undervalued.

Analyst Ratings and Predictions for Citigroup Stock

Analyst ratings and price targets offer insights into future prospects, although it’s crucial to remember that these are predictions and not guarantees.

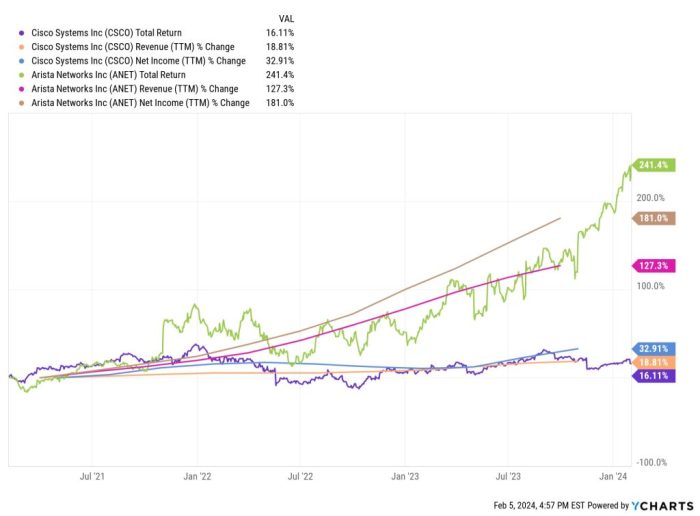

Citigroup’s stock price performance often reflects broader market trends. However, comparing its trajectory to that of other financial institutions offers valuable insights. For instance, a look at the current truist stock price can provide a benchmark against which to measure Citi’s relative strength, considering their overlapping market segments and investor sentiment. Ultimately, understanding Citi’s performance requires a holistic view of the financial sector.

- Analyst A: Buy rating, Price Target: $70

- Analyst B: Hold rating, Price Target: $60

- Analyst C: Sell rating, Price Target: $50

The range of opinions reflects differing views on the impact of macroeconomic factors, competitive pressures, and Citigroup’s strategic execution. For example, Analyst A might anticipate higher interest rates leading to increased profitability, while Analyst C might be more concerned about potential credit risks.

In a scenario of sustained economic growth and rising interest rates, Citigroup’s stock price could reach the higher end of analyst predictions. Conversely, a recessionary environment could push the price towards the lower end or even below.

Risk Assessment of Investing in Citigroup Stock

Investing in Citigroup stock carries several risks that potential investors should carefully consider.

- Interest rate risk: Changes in interest rates can significantly impact Citigroup’s profitability and stock price.

- Credit risk: The risk of loan defaults by borrowers can negatively affect Citigroup’s financial performance.

- Regulatory risk: Changes in financial regulations can impact Citigroup’s operations and profitability.

- Geopolitical risk: Global events can impact the financial markets and Citigroup’s stock price.

These risks can be mitigated through diversification, thorough due diligence, and a well-defined investment strategy. Diversifying investments across different asset classes reduces the impact of any single risk. Thorough research helps in understanding the company’s financial health and the potential impact of various risks. A well-defined investment strategy with clear risk tolerance levels and exit strategies is crucial for managing risk effectively.

Questions and Answers: Citi Stock Price

What are the major risks associated with investing in Citigroup stock?

Major risks include interest rate sensitivity, credit risk from loan defaults, regulatory changes impacting profitability, and general economic downturns.

How does Citigroup’s stock price compare to its peers in the long term?

A long-term comparison requires a detailed historical analysis. Performance relative to peers like JPMorgan Chase and Bank of America varies over time, influenced by individual company strategies and broader market trends.

Where can I find real-time Citi stock price data?

Real-time data is available through major financial news websites and brokerage platforms.

What is Citigroup’s current dividend yield?

The current dividend yield fluctuates and should be verified on a reputable financial website providing real-time data.