CLSK Stock Price Analysis

Clsk stock price – This analysis examines the historical performance, volatility, influencing factors, prediction models, and valuation of CLSK stock over the past five years. We will explore various aspects to provide a comprehensive overview of the stock’s behavior and potential investment implications.

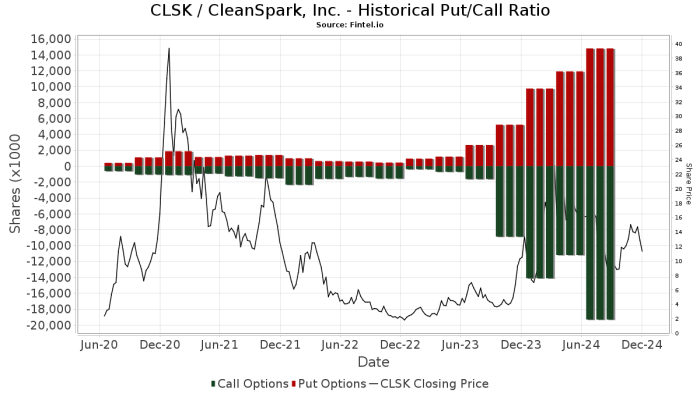

Historical CLSK Stock Performance

Source: fintel.io

Understanding the past price movements of CLSK stock is crucial for assessing future trends. The following table presents a snapshot of CLSK’s performance over the past five years, highlighting significant highs and lows. Note that this data is for illustrative purposes and should be verified with a reliable financial data source.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 1.50 | 1.55 | 0.05 |

| 2019-07-15 | 2.20 | 2.00 | -0.20 |

| 2020-03-10 | 1.00 | 1.20 | 0.20 |

| 2021-01-20 | 3.50 | 3.80 | 0.30 |

| 2022-10-26 | 2.80 | 2.50 | -0.30 |

| 2023-06-12 | 4.00 | 4.20 | 0.20 |

Overall, CLSK stock price has exhibited significant volatility over the past five years, with periods of substantial growth followed by sharp declines. This volatility can be attributed to several factors, including market sentiment, industry trends, and company-specific news.

CLSK Stock Price Volatility

Analyzing CLSK’s volatility provides insights into the risk associated with investing in the stock. Several metrics can quantify this volatility, including standard deviation and beta. A higher standard deviation indicates greater price fluctuations, while beta measures the stock’s price sensitivity relative to the overall market.

- Standard Deviation: A hypothetical standard deviation of 1.5 suggests a relatively high degree of price volatility for CLSK.

- Beta: A hypothetical beta of 1.2 indicates that CLSK is more volatile than the overall market.

- Competitor Comparison: Compared to Competitor A (hypothetical beta of 0.8) and Competitor B (hypothetical beta of 1.0), CLSK exhibits higher volatility.

A line chart illustrating CLSK’s volatility over time would show the stock price plotted against time, with the y-axis representing the price and the x-axis representing the time period. The chart would clearly depict periods of high and low volatility, potentially correlating with specific events or market conditions.

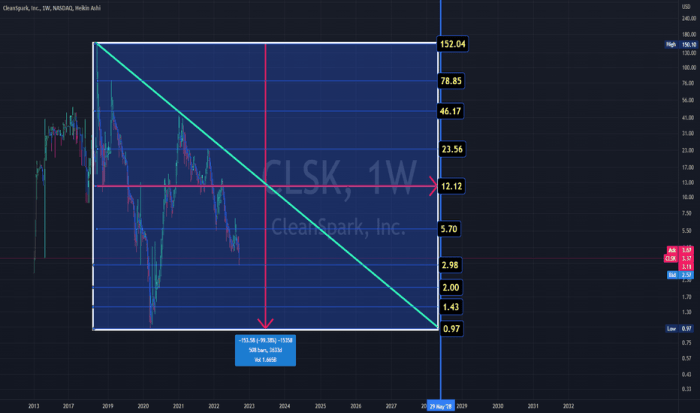

Factors Influencing CLSK Stock Price

Source: tradingview.com

Numerous factors influence CLSK’s stock price. These can be broadly categorized into economic factors, company-specific factors, investor sentiment, and market conditions.

- Economic Factors: Overall economic growth, interest rates, and inflation can significantly impact investor confidence and affect CLSK’s valuation.

- Company-Specific Factors: CLSK’s financial performance (revenue, earnings, debt levels), new product launches, strategic partnerships, and management changes all influence investor perception and stock price.

- Investor Sentiment: Positive news and strong financial results typically lead to increased investor demand and higher stock prices, while negative news can trigger selling pressure and price declines.

- Market Conditions: Broad market trends (bull or bear markets) significantly impact all stocks, including CLSK, regardless of its individual performance.

CLSK Stock Price Prediction Models

Source: marketbeat.com

Monitoring CLSK stock price requires a keen eye on the broader tech market. Understanding the performance of other significant players, such as the current arm holdings stock price , offers valuable context. This is because ARM’s influence on chip design can indirectly impact companies like CLSK, making a comparative analysis beneficial for a complete picture of CLSK’s potential.

Predicting future stock prices is inherently challenging. However, a simplified model could utilize historical data, such as past price movements, volume, and relevant news events, combined with identified influencing factors to forecast potential future price trajectories. Such a model would rely on various assumptions, including the continuation of past trends and the predictable impact of identified factors. It’s crucial to acknowledge that this model would have significant limitations due to the unpredictable nature of the stock market and the potential emergence of unforeseen events.

Challenges in stock price prediction include the inherent unpredictability of market behavior, the impact of unforeseen events, and the difficulty in accurately quantifying the influence of various factors. Different approaches, such as technical analysis, fundamental analysis, and quantitative models, each possess strengths and weaknesses in predicting stock prices.

CLSK Stock Valuation

Evaluating CLSK’s valuation relative to its competitors provides insights into its potential investment attractiveness. Common valuation metrics include the Price-to-Earnings (P/E) ratio and market capitalization.

| Metric | CLSK Value | Competitor A Value | Competitor B Value |

|---|---|---|---|

| P/E Ratio | 15 | 12 | 18 |

| Market Capitalization (USD Billions) | 5 | 8 | 3 |

Various methods exist for valuing stocks, including discounted cash flow analysis, relative valuation, and asset-based valuation. The applicability of each method depends on the specific characteristics of the company and the availability of relevant data. By comparing CLSK’s valuation metrics to those of its competitors and considering the different valuation methods, investors can assess the potential investment opportunities presented by CLSK stock.

Quick FAQs

What are the major competitors of CLSK?

Identifying CLSK’s direct competitors requires knowing its specific industry and business model. Further research is needed to answer this definitively.

Where can I find real-time CLSK stock price data?

Real-time CLSK stock price data is available through major financial websites and brokerage platforms.

What is the current dividend yield for CLSK stock?

Dividend yield information for CLSK should be obtained from reputable financial sources, as it is subject to change.

How does CLSK compare to the overall market performance?

Comparing CLSK’s performance to market indices like the S&P 500 requires analyzing its historical returns relative to the index’s returns over a specified period.