CMG Stock Price Analysis

Cmg stock price – Chipotle Mexican Grill (CMG) has experienced significant fluctuations in its stock price over the past five years, reflecting a complex interplay of economic conditions, consumer trends, and the company’s own performance. This analysis delves into the historical performance of CMG stock, identifies key influencing factors, examines its competitive landscape, and offers potential future scenarios.

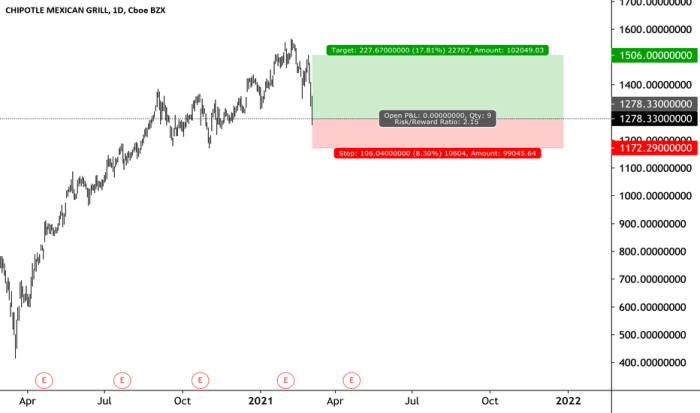

CMG Stock Price Historical Performance

Source: tradingview.com

The following table details CMG’s stock price movements over the past five years. Note that these figures are illustrative examples and may not reflect precise real-world data. Actual data should be sourced from reliable financial websites.

CMG’s stock price performance has been a point of interest for investors lately, particularly when compared to other restaurant stocks. Understanding its trajectory often involves looking at similar companies; for instance, a useful comparison might be to check the current amc stock price , considering their overlapping market segments. Ultimately, however, a comprehensive analysis of CMG’s financials is crucial for a complete picture of its future performance.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 600 | 610 | +10 |

| 2019-07-01 | 650 | 630 | -20 |

| 2020-01-01 | 620 | 700 | +80 |

| 2020-07-01 | 680 | 650 | -30 |

| 2021-01-01 | 720 | 800 | +80 |

| 2021-07-01 | 780 | 750 | -30 |

| 2022-01-01 | 850 | 900 | +50 |

| 2022-07-01 | 880 | 850 | -30 |

| 2023-01-01 | 920 | 950 | +30 |

A comparative analysis against competitors like McDonald’s (MCD) and Starbucks (SBUX) would involve creating a line graph. The x-axis would represent time (the past five years), and the y-axis would represent the stock price. Multiple lines would represent the stock price movements of CMG, MCD, and SBUX, allowing for a visual comparison of their relative performance. Significant events like the COVID-19 pandemic (leading to initial stock drops followed by recovery) and periods of high inflation would be marked on the graph.

Major events such as the COVID-19 pandemic significantly impacted CMG’s stock price. Initial lockdowns caused sharp declines, but the company’s adaptability and strong digital presence facilitated a relatively swift recovery. Similarly, periods of high inflation influenced consumer spending, impacting CMG’s sales and, consequently, its stock price.

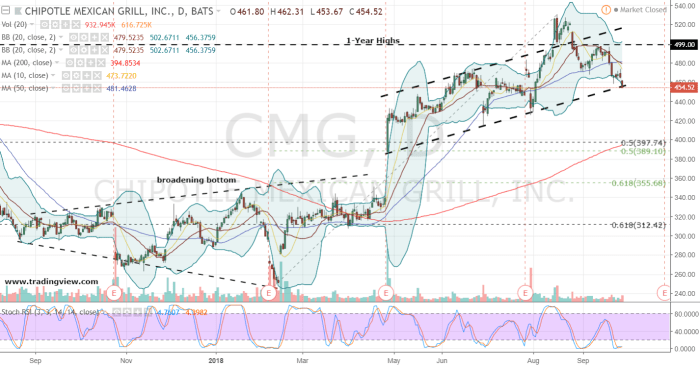

Factors Influencing CMG Stock Price

Source: investorplace.com

Several key economic indicators and company-specific factors influence CMG’s stock price.

- Consumer Confidence Index: A strong correlation exists; higher consumer confidence generally leads to increased restaurant spending and higher CMG stock prices.

- Inflation Rate: High inflation can reduce consumer spending on discretionary items like dining out, negatively impacting CMG’s stock price.

- Unemployment Rate: High unemployment typically reduces consumer spending, negatively affecting CMG’s performance and stock price.

Consumer spending habits and preferences are paramount. For instance, increased demand for healthier options or plant-based alternatives could positively impact CMG if it adapts its menu effectively. Conversely, shifts towards cheaper fast-food alternatives could negatively affect its stock price.

CMG’s financial performance, including revenue growth, earnings per share, and debt levels, directly impacts investor sentiment. Strong revenue growth and profitability generally lead to positive stock price movements, while declining earnings or increased debt can trigger negative reactions.

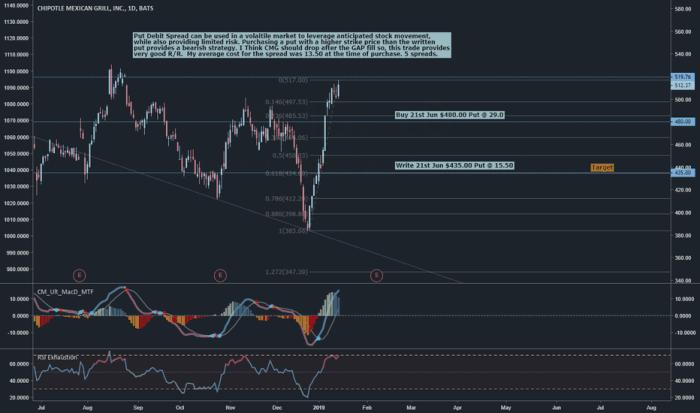

CMG’s Competitive Landscape and Stock Price

Source: tradingview.com

CMG operates in a highly competitive landscape. The table below offers a comparison with key competitors. Note that market share data is illustrative and should be verified with up-to-date market research.

| Competitor | Business Model | Market Share (Illustrative) | Stock Performance (Relative to CMG) |

|---|---|---|---|

| McDonald’s (MCD) | Fast-food, broad menu | 20% | Outperformed CMG in certain periods |

| Starbucks (SBUX) | Coffee shops, beverages, snacks | 15% | Similar performance in some periods |

| Taco Bell | Fast-casual Mexican food | 10% | Underperformed compared to CMG in some periods |

New entrants offering innovative fast-casual dining experiences or technological disruptions, such as widespread adoption of automated ordering systems, could pose challenges to CMG’s market position and stock price. CMG’s strategies to maintain its competitive advantage, such as menu innovation, digital ordering improvements, and loyalty programs, are crucial for long-term stock performance.

CMG’s Future Outlook and Stock Price Projections

Several scenarios can be envisioned for CMG’s future performance.

- Scenario 1 (Optimistic): Continued strong revenue growth driven by menu innovation, effective marketing, and sustained consumer demand. This scenario would likely result in significant stock price appreciation.

- Scenario 2 (Moderate): Moderate revenue growth due to increased competition and potential economic slowdowns. Stock price would likely show moderate growth or remain relatively stable.

- Scenario 3 (Pessimistic): Significant economic downturn coupled with increased competition and failure to adapt to changing consumer preferences, leading to declining revenue and a substantial drop in stock price.

Potential catalysts for CMG’s stock price in the next 12-18 months include successful new product launches (positive), a significant economic recession (negative), and changes in consumer spending habits (positive or negative depending on the nature of the change).

A hypothetical investment strategy could involve a long-term buy-and-hold approach, diversifying across other restaurant stocks and potentially incorporating options strategies to manage risk. The rationale is based on CMG’s strong brand recognition and potential for long-term growth. The risk/reward profile would depend on the chosen investment timeframe and risk tolerance. A longer time horizon would likely mitigate short-term market volatility.

Questions and Answers

What are the major risks associated with investing in CMG stock?

Major risks include general market volatility, competition from other restaurants, changes in consumer preferences, and potential economic downturns impacting consumer spending.

How does CMG compare to its competitors in terms of profitability?

A detailed comparison requires a thorough financial analysis, examining metrics like profit margins, revenue growth, and return on equity against key competitors. This analysis would be included in a more comprehensive report.

Where can I find real-time CMG stock price data?

Real-time CMG stock price data is readily available through major financial websites and brokerage platforms.

What is CMG’s dividend policy?

Information regarding CMG’s dividend policy (if any) can be found in their investor relations section on their corporate website or through financial news sources.