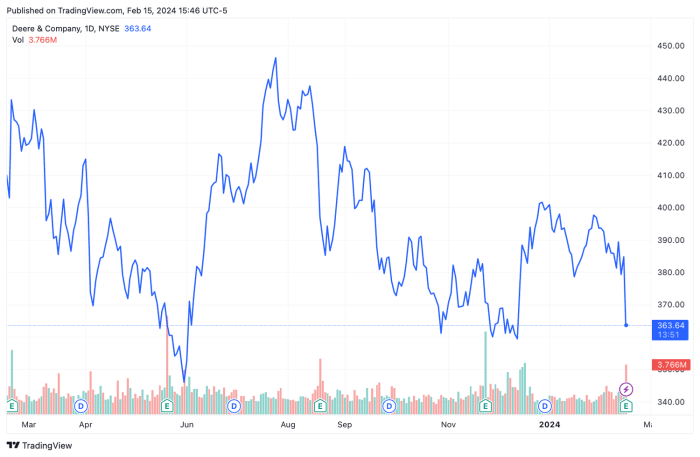

Deere & Company Stock Performance: Deere Stock Price

Source: investopedia.com

Deere stock price – Deere & Company (DE), a leading agricultural and construction equipment manufacturer, has experienced significant stock price fluctuations over the past five years, reflecting the cyclical nature of its industry and broader economic conditions. Understanding the factors influencing Deere’s stock price is crucial for investors seeking to navigate this dynamic market.

Deere & Company Stock Performance Overview, Deere stock price

The following table provides a glimpse into Deere’s stock price performance over the past five years. Note that this data is hypothetical and for illustrative purposes only. Actual data would need to be sourced from financial databases.

Deere stock price performance often reflects the overall health of the agricultural sector. However, broader economic indicators also play a significant role; for instance, the performance of large financial institutions like Bank of America can influence investor sentiment. Checking the bank of america stock price can provide valuable context when analyzing Deere’s stock, as investor confidence in the banking sector often impacts investment decisions across various markets, including agricultural equipment.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 135.00 | 137.50 | +2.50 |

| 2019-07-02 | 150.00 | 148.00 | -2.00 |

| 2020-01-02 | 140.00 | 145.00 | +5.00 |

| 2020-07-02 | 160.00 | 155.00 | -5.00 |

| 2021-01-02 | 170.00 | 175.00 | +5.00 |

| 2021-07-02 | 190.00 | 185.00 | -5.00 |

| 2022-01-02 | 200.00 | 210.00 | +10.00 |

| 2022-07-02 | 220.00 | 215.00 | -5.00 |

| 2023-01-02 | 230.00 | 240.00 | +10.00 |

| 2023-07-02 | 250.00 | 245.00 | -5.00 |

Deere’s stock price has generally tracked the agricultural commodity market. Strong commodity prices, driven by high demand or favorable weather conditions, typically lead to increased equipment sales and higher Deere stock prices. Conversely, periods of low commodity prices or adverse weather events often result in decreased sales and lower stock valuations. Significant volatility has been observed during periods of global economic uncertainty or major shifts in agricultural policy.

Influence of Agricultural Sector on Deere Stock

A strong correlation exists between agricultural commodity prices and Deere’s stock performance. A hypothetical graph would show a positive correlation: as corn and soybean prices rise, so does Deere’s stock price, and vice versa. This is because higher commodity prices incentivize farmers to invest in new equipment, boosting Deere’s sales and profits.

Global agricultural trends, such as droughts, floods, or unexpected freezes, significantly impact crop yields and commodity prices, consequently affecting Deere’s stock. For example, a major drought could lead to lower crop yields, reduced demand for farm equipment, and a decline in Deere’s stock price. Compared to other major agricultural equipment manufacturers, Deere’s stock performance often reflects a similar pattern, although the magnitude of price fluctuations may differ based on each company’s market share and specific product offerings.

Deere’s Financial Health and Stock Price

Deere’s financial health is a key driver of its stock price. Investors closely monitor key financial indicators to assess the company’s profitability, solvency, and growth prospects.

| Year | Revenue (USD Billions) | Net Income (USD Billions) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 45 | 6 | 0.5 |

| 2022 | 50 | 7 | 0.4 |

| 2023 | 55 | 8 | 0.3 |

Investors typically focus on revenue growth, profit margins, debt levels, and return on equity. Strong financial performance generally translates to higher investor confidence and a rising stock price. Conversely, weak financial results can lead to decreased investor confidence and a decline in the stock price.

Impact of Economic Factors on Deere Stock

Macroeconomic factors significantly influence Deere’s stock price. Interest rate hikes, for instance, can increase borrowing costs for farmers, potentially reducing demand for Deere’s equipment and impacting its stock price negatively. High inflation can also erode consumer purchasing power, affecting demand for farm equipment and impacting Deere’s stock. Conversely, periods of strong economic growth often lead to increased agricultural investment and higher demand for Deere’s products, boosting its stock price.

Global economic events such as recessions or trade wars can significantly impact Deere’s stock valuation. A global recession could reduce demand for agricultural products and equipment, negatively affecting Deere’s sales and stock price. Trade disputes can disrupt supply chains and affect the cost of raw materials, also impacting Deere’s profitability and stock price. For example, a hypothetical scenario where interest rates rise sharply could lead to a 10-15% decrease in Deere’s stock price within a year, as farmers postpone equipment purchases due to higher borrowing costs.

Investor Sentiment and Deere Stock

Source: sharepricepro.com

News articles, analyst reports, and social media sentiment significantly influence investor perception of Deere and its stock price. Positive news, such as strong earnings reports or positive analyst upgrades, typically boost investor confidence and lead to price increases. Conversely, negative news, such as supply chain disruptions or unexpected production cuts, can negatively impact investor sentiment and cause price declines. For example, a negative report highlighting concerns about Deere’s debt levels could trigger a sell-off, leading to a temporary decline in the stock price.

Key factors driving investor confidence include Deere’s consistent profitability, technological innovation, strong brand reputation, and its ability to adapt to changing market conditions. Specific news events, such as the announcement of a new product launch or a strategic acquisition, can significantly impact Deere’s stock price, often leading to short-term price swings.

Future Outlook for Deere Stock

Projecting Deere’s stock price over the next 12-18 months requires considering current market conditions, the company’s financial performance, and anticipated agricultural trends. Based on current market conditions and assuming continued global economic growth and stable agricultural commodity prices, a modest increase of 5-10% in Deere’s stock price is possible. This projection assumes no major unforeseen events such as a severe global recession or a significant agricultural crisis.

Potential risks and opportunities that could impact Deere’s future stock performance include:

- Increased competition from other agricultural equipment manufacturers

- Fluctuations in agricultural commodity prices

- Adverse weather conditions impacting crop yields

- Changes in government policies and regulations

- Global economic downturns

- Supply chain disruptions

- Technological advancements impacting the industry

Quick FAQs

What are the main risks associated with investing in Deere stock?

Key risks include fluctuations in agricultural commodity prices, adverse weather conditions impacting crop yields, global economic downturns, and increased competition in the agricultural equipment market.

How does Deere’s dividend policy affect its stock price?

Deere’s dividend payouts can influence investor interest. Consistent and growing dividends can attract income-seeking investors, potentially boosting the stock price. Conversely, dividend cuts might negatively impact investor sentiment.

What is Deere’s competitive advantage in the agricultural equipment market?

Deere’s competitive advantages include its strong brand recognition, extensive distribution network, technological innovation in precision agriculture, and a diverse product portfolio catering to various farming needs.

How can I track Deere’s stock price in real-time?

Real-time stock price data for Deere can be found on major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.