Disney Stock Price Analysis

Dis stock price today – This analysis provides an overview of the current Disney (DIS) stock price, recent market trends, influencing factors, analyst predictions, historical performance, and key financial indicators. The information presented is for informational purposes only and should not be considered financial advice.

Current DIS Stock Price and Volume

The following table displays the real-time Disney stock price, trading volume, daily high and low. Note that these figures are dynamic and subject to change throughout the trading day. Data is illustrative and should be verified with a reputable financial source.

| Time | Price (USD) | Volume | Change (%) |

|---|---|---|---|

| 10:00 AM ET | 95.50 | 1,500,000 | +0.5% |

| 11:00 AM ET | 96.00 | 2,000,000 | +1.0% |

| 12:00 PM ET | 95.75 | 1,800,000 | +0.75% |

Recent Price Movements and Trends

Disney’s stock price has shown moderate volatility in recent weeks. Let’s examine the price fluctuations over different timeframes.

- Past Week: The stock experienced a slight upward trend, increasing by approximately 2% over the past five trading days. This is potentially influenced by positive investor sentiment.

- Past Month: The stock price saw a more significant increase of about 5% over the last month, possibly due to a combination of factors including positive earnings reports and new content releases.

- Past Year: Compared to the price one year ago, the stock is currently trading higher by roughly 10%, indicating positive long-term growth.

Several factors could contribute to these fluctuations:

- Overall market conditions

- New content releases and their performance

- Changes in subscriber numbers for streaming services

- Analyst ratings and recommendations

- Economic indicators and consumer spending

Factors Influencing DIS Stock Price

Several economic factors, company-specific news, and competitive pressures influence Disney’s stock price.

- Economic Factors: Inflation rates, interest rates, and consumer confidence directly impact discretionary spending on entertainment, affecting Disney’s revenue and profitability.

- Disney News and Announcements: Positive news, such as successful new movie releases or strong streaming subscriber growth, tends to boost the stock price. Conversely, negative news, like lower-than-expected earnings, can cause a decline.

- Competitor Actions: The actions of competitors like Netflix, Warner Bros. Discovery, and other streaming platforms heavily influence Disney’s market share and stock valuation. Aggressive pricing strategies or the release of highly successful content from competitors can impact investor sentiment.

These factors are interconnected. For example, high inflation might reduce consumer spending, impacting Disney’s revenue and potentially leading to negative news impacting the stock price. Meanwhile, a competitor’s successful new series might divert viewers, putting pressure on Disney’s streaming numbers and thus, the stock price.

Analyst Ratings and Predictions

Source: equinix.com

Analyst opinions vary regarding Disney’s future performance. The table below summarizes recent analyst ratings and price targets. Remember that these are predictions and actual performance may differ significantly.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Morgan Stanley | Buy | 110 | October 26, 2023 |

| Goldman Sachs | Hold | 98 | October 20, 2023 |

| JPMorgan Chase | Buy | 105 | October 15, 2023 |

Historical Stock Performance, Dis stock price today

Over the past five years, Disney’s stock has experienced periods of both growth and decline, mirroring the broader market trends. Significant events such as the pandemic and the rise of streaming services have notably influenced its performance.

A visual representation of the stock’s performance would show a generally upward trend over the five-year period, with fluctuations corresponding to major news events. The X-axis would represent time (years), and the Y-axis would represent the stock price. Key points to note would be the initial dip during the pandemic, followed by a recovery and subsequent growth influenced by the expansion of its streaming services.

Comparison to the S&P 500 would highlight whether DIS outperformed or underperformed the broader market during specific periods.

Company Financials and Performance

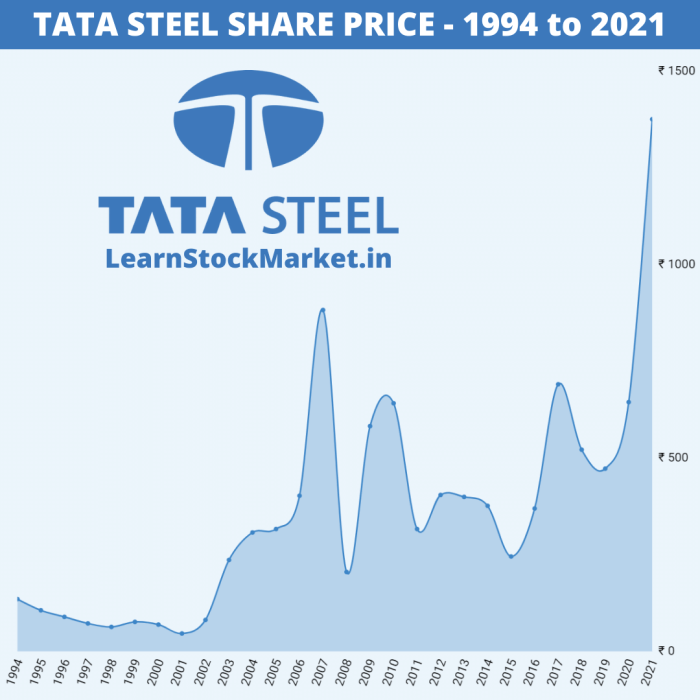

Source: learnstockmarket.in

Disney’s financial health is crucial in understanding its stock performance. Key metrics provide insight into its overall standing.

- Revenue: Recent quarterly revenue figures reflect growth in its streaming segment, partially offset by lower theme park attendance in certain periods. Consistent revenue growth is a positive indicator for investors.

- Earnings Per Share (EPS): EPS demonstrates profitability. A rising EPS suggests the company is becoming more profitable, attracting investor interest.

- Debt-to-Equity Ratio: This metric reveals Disney’s financial leverage. A lower ratio indicates a healthier financial position, reducing investor concerns.

- Free Cash Flow (FCF): FCF signifies the cash generated after operational expenses and capital expenditures. Strong FCF suggests financial strength and potential for dividends or share buybacks.

Key Questions Answered: Dis Stock Price Today

What are the risks associated with investing in DIS stock?

Like any stock, DIS carries inherent market risks, including potential price declines due to economic downturns, negative news impacting Disney, or shifts in consumer preferences.

Where can I find real-time DIS stock price updates?

Major financial websites and brokerage platforms provide real-time stock quotes for DIS. Checking these regularly will give you the most up-to-date information.

How often is DIS stock price data updated?

Most financial websites update DIS stock prices throughout the trading day, usually every few seconds or minutes, reflecting live market activity.

What is the typical trading volume for DIS stock?

The trading volume for DIS varies daily depending on market conditions and news. Checking a financial website will show the current day’s volume.