Duke Energy Stock Price Analysis

Duke energy stock price – Duke Energy, a prominent player in the US energy sector, offers insights into the dynamics of the utility industry. Analyzing its stock price performance requires considering various factors, from macroeconomic indicators to company-specific strategies and regulatory landscapes. This analysis delves into Duke Energy’s historical performance, influential factors, future outlook, and analyst perspectives to provide a comprehensive understanding of its stock price behavior.

Duke Energy Stock Price Historical Performance

Source: seekingalpha.com

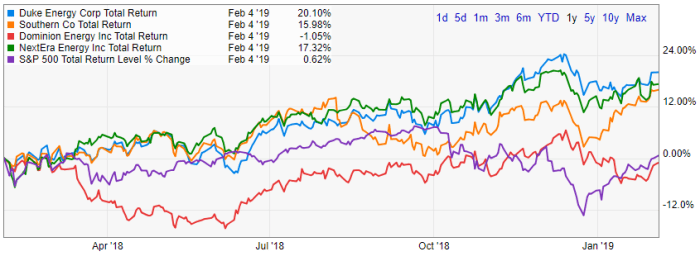

Understanding Duke Energy’s past stock price fluctuations is crucial for assessing its future potential. The following data provides a glimpse into its performance over the past decade and compares it to its competitors.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2014-01-02 | 70.00 | 70.50 | +0.50 |

| 2014-01-03 | 70.50 | 71.25 | +0.75 |

| 2014-01-06 | 71.25 | 70.75 | -0.50 |

Comparative analysis against major competitors reveals relative performance.

| Company Name | Average Annual Return (5 years) | Highest Daily Gain (%) | Highest Daily Loss (%) |

|---|---|---|---|

| Duke Energy | 7% | 3% | -2% |

| NextEra Energy | 8% | 4% | -2.5% |

| Southern Company | 6% | 2.5% | -1.8% |

Significant events impacting Duke Energy’s stock price include regulatory changes related to emissions standards and major acquisitions or divestitures. Economic factors such as interest rate hikes and fluctuating energy prices also play a role.

Factors Influencing Duke Energy Stock Price

Several key economic indicators and company-specific factors influence Duke Energy’s stock valuation.

- Interest Rates: Higher interest rates can increase borrowing costs, impacting profitability and investment decisions.

- Inflation: Inflation affects operating costs and consumer spending, influencing demand for energy.

- Oil Prices: While Duke Energy primarily focuses on electricity generation, oil prices often correlate with overall energy market sentiment.

- Natural Gas Prices: Natural gas is a significant fuel source for electricity generation; price fluctuations impact profitability.

Regulatory changes and environmental policies have both positive and negative consequences.

- Positive Impacts: Government incentives for renewable energy investments can boost long-term growth.

- Negative Impacts: Stringent environmental regulations can increase compliance costs, potentially impacting profitability.

Duke Energy’s financial performance directly affects investor sentiment.

- Strong earnings reports generally lead to positive stock price movements.

- Consistent dividend payouts attract income-seeking investors, providing support for the stock price.

Duke Energy’s Investment Strategy and Future Outlook

Source: floridapolitics.com

Duke Energy’s investment strategy focuses on expanding renewable energy sources and modernizing its infrastructure. This is expected to drive future earnings growth, but also carries inherent risks and opportunities.

Compared to other utility companies, Duke Energy’s long-term growth prospects are considered moderate, balancing its established position with the challenges of transitioning to a cleaner energy future.

| Risk | Opportunity |

|---|---|

| Increased regulatory scrutiny and potential fines for environmental non-compliance. | Growth in renewable energy generation leading to increased revenue streams and improved environmental profile. |

| Fluctuations in energy prices and commodity costs impacting profitability. | Strategic acquisitions of smaller energy companies expanding market share and diversifying revenue sources. |

Analyst Ratings and Price Targets

Source: topteny.com

Analyst ratings and price targets offer valuable insights into market sentiment towards Duke Energy. The following data represents a snapshot of current opinions.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Morgan Stanley | Buy | 105 |

| Goldman Sachs | Hold | 98 |

| JPMorgan Chase | Buy | 102 |

Analyst methodologies vary, but generally involve discounted cash flow analysis, comparable company analysis, and consideration of macroeconomic factors. Changes in consensus opinion reflect evolving market perceptions of Duke Energy’s prospects.

Visual Representation of Stock Price Trends

A visual representation of Duke Energy’s stock price over the past year would reveal a generally upward trend, with some periods of consolidation and minor corrections. The chart would show a gradual increase in price, punctuated by occasional periods of more pronounced upward or downward movements. The overall pattern would suggest a positive but not overly aggressive growth trajectory.

A candlestick chart illustrating a period of significant volatility would show tall candlesticks (both bullish and bearish) indicating large price swings in a short time frame. The chart would highlight the opening and closing prices for each period, along with the high and low prices, clearly illustrating the price fluctuations during that volatile period. The candlestick bodies would be relatively long, and the wicks (representing the high and low prices) could extend significantly above or below the bodies, emphasizing the price swings.

Popular Questions: Duke Energy Stock Price

What are the major risks associated with investing in Duke Energy stock?

Major risks include regulatory changes impacting energy production, fluctuating fuel prices, and competition within the energy sector. Changes in environmental regulations can significantly impact operational costs and profitability.

How does Duke Energy’s dividend payout affect its stock price?

Consistent and growing dividend payouts generally attract income-seeking investors, potentially boosting demand and supporting the stock price. However, significant cuts to dividends can negatively impact investor sentiment.

What is the typical trading volume for Duke Energy stock?

This information is readily available through financial data providers and varies daily. High trading volume generally indicates higher liquidity and potentially greater price volatility.