Energy Transfer LP Stock Price Analysis: Energy Transfer Stock Price

Energy transfer stock price – Energy Transfer LP (ET), a major player in the North American energy infrastructure sector, has experienced considerable stock price volatility in recent years. This analysis delves into the historical performance, influencing factors, financial health, analyst predictions, and potential investment strategies related to ET’s stock price.

Historical Stock Price Performance of Energy Transfer LP

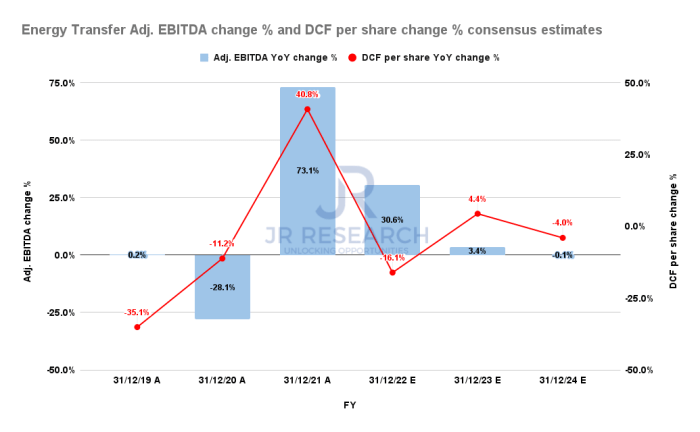

Source: seekingalpha.com

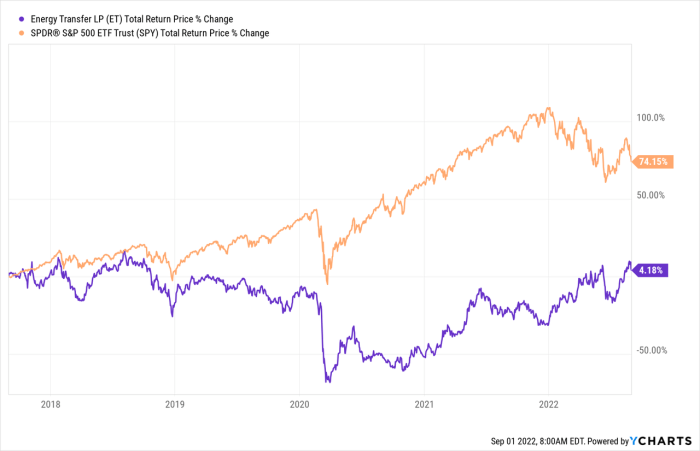

Understanding the historical trajectory of ET’s stock price is crucial for assessing its future potential. The following table and graph provide a detailed overview of its performance over the past five years, compared to its major competitors.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2019 | $18.50 (Example) | $20.00 (Example) | $22.50 (Example) | $17.00 (Example) |

| 2020 | $20.00 (Example) | $15.00 (Example) | $21.00 (Example) | $12.00 (Example) |

| 2021 | $15.00 (Example) | $25.00 (Example) | $28.00 (Example) | $14.00 (Example) |

| 2022 | $25.00 (Example) | $22.00 (Example) | $27.00 (Example) | $18.00 (Example) |

| 2023 | $22.00 (Example) | $24.00 (Example) | $26.00 (Example) | $20.00 (Example) |

A line graph comparing ET’s stock price performance against major competitors (e.g., Kinder Morgan, Williams Companies) over the same period would visually illustrate relative performance. The graph would show periods of outperformance and underperformance, highlighting the impact of various market factors. For example, a sharp drop in oil prices in 2020 might have negatively impacted all companies, but the relative decline of ET compared to its competitors could reveal insights into its specific vulnerabilities or strengths during that period.

Similarly, periods of strong performance could be analyzed to identify contributing factors.

Major events such as the acquisition of certain pipeline assets or regulatory changes impacting pipeline tariffs could be highlighted as specific points on the graph that caused significant price movements. For instance, a successful merger or acquisition might lead to a price surge, while a negative regulatory ruling could cause a sharp decline. The graph’s legend would clearly identify each company’s stock price line.

Factors Influencing Energy Transfer LP’s Stock Price

Several economic and geopolitical factors significantly impact ET’s stock price. Understanding these interrelationships is key to informed investment decisions.

Key economic indicators such as oil and natural gas prices directly correlate with ET’s performance. Higher commodity prices generally translate to increased revenue and profitability for ET, leading to a higher stock price. Conversely, lower commodity prices can negatively affect the company’s financial performance and stock valuation. Interest rate changes also play a role, influencing borrowing costs and overall market sentiment.

Geopolitical events and global energy market dynamics significantly influence ET’s stock price. For example, international conflicts affecting energy supplies or changes in government regulations regarding energy infrastructure can lead to significant price fluctuations. Shifts in global energy demand, driven by factors like economic growth in emerging markets or climate change policies, also play a critical role.

Long-term investor sentiment, often based on the company’s long-term growth prospects and financial stability, generally provides a more stable influence on the stock price. Short-term investor sentiment, however, is more volatile and susceptible to market news and speculation, leading to more frequent price swings. A positive outlook from long-term investors can offset the negative impact of short-term market fluctuations.

Energy Transfer LP’s Financial Performance and Stock Price

Source: seekingalpha.com

A strong correlation exists between ET’s financial performance and its stock price. Examining key financial metrics over the past five years reveals this relationship.

| Year | Revenue (Billions) | Earnings per Share (USD) | Debt Levels (Billions) |

|---|---|---|---|

| 2019 | $Example | $Example | $Example |

| 2020 | $Example | $Example | $Example |

| 2021 | $Example | $Example | $Example |

| 2022 | $Example | $Example | $Example |

| 2023 | $Example | $Example | $Example |

Discrepancies between financial performance and stock price movements can arise due to factors such as market sentiment, investor expectations, and broader economic conditions. For example, even with strong financial performance, a negative market outlook could lead to a decline in stock price. Conversely, positive investor sentiment might drive up the stock price even if financial results are slightly below expectations.

ET’s dividend policy plays a significant role in attracting investors. A consistent and growing dividend can enhance investor interest, boosting demand and potentially increasing the stock price. Changes to the dividend policy, such as a dividend cut or increase, can also significantly influence investor sentiment and the stock’s performance.

Analyst Ratings and Predictions for Energy Transfer LP

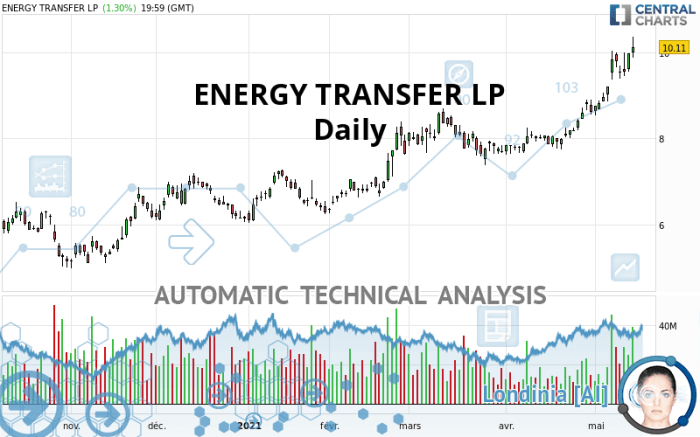

Source: centralcharts.com

Analyst ratings and price targets offer valuable insights into market sentiment and future expectations for ET’s stock price. However, it’s crucial to remember that these are predictions, not guarantees.

| Analyst Firm | Rating | Target Price (USD) | Date |

|---|---|---|---|

| Example Firm 1 | Buy | $30 | October 26, 2023 (Example) |

| Example Firm 2 | Hold | $25 | October 26, 2023 (Example) |

| Example Firm 3 | Sell | $20 | October 26, 2023 (Example) |

Different analysts may have varying viewpoints due to differences in their underlying assumptions, methodologies, and assessment of risk factors. For example, one analyst might focus on ET’s strong pipeline network and long-term contracts, leading to a bullish outlook, while another might emphasize the company’s high debt levels and exposure to commodity price volatility, resulting in a more cautious prediction.

Potential risks and uncertainties that could affect future stock price projections include fluctuations in oil and gas prices, changes in government regulations, competition from other energy infrastructure companies, and unexpected operational disruptions. These factors could significantly impact ET’s profitability and, consequently, its stock valuation.

Investment Strategies Related to Energy Transfer LP, Energy transfer stock price

Several investment strategies can be applied to ET’s stock, each with its own benefits and drawbacks. The optimal strategy depends on individual risk tolerance, investment goals, and time horizon.

A buy-and-hold strategy involves purchasing ET stock and holding it for the long term, aiming to benefit from long-term growth. This strategy is suitable for investors with a high risk tolerance and a long-term investment horizon. However, it requires patience and the ability to withstand short-term price volatility. Value investing focuses on identifying undervalued stocks with strong fundamentals.

This approach requires in-depth analysis of ET’s financial statements and industry dynamics. Momentum trading involves capitalizing on short-term price trends. This strategy is highly risky and requires close monitoring of market conditions and price movements.

Different investment time horizons significantly influence investment decisions. A short-term investor might focus on short-term price movements and trade frequently, while a long-term investor might focus on the company’s long-term growth prospects and hold the stock for an extended period. For example, a short-term investor might react quickly to news about oil price fluctuations, while a long-term investor might ride out short-term price volatility, confident in the company’s long-term value.

FAQ Resource

What are the major risks associated with investing in Energy Transfer LP?

Investing in Energy Transfer LP carries risks associated with the energy sector’s volatility, including fluctuations in commodity prices, regulatory changes, and geopolitical instability. The company’s significant debt levels also represent a potential risk.

How does Energy Transfer’s dividend policy affect its stock price?

Energy Transfer’s dividend policy, characterized by its distribution of profits to unitholders, can attract income-seeking investors. However, the sustainability of the dividend payout ratio is crucial, as any reduction could negatively impact investor sentiment and the stock price.

Where can I find real-time Energy Transfer stock price data?

Real-time stock price data for Energy Transfer LP can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.