Ford Stock Price Analysis

Ford stock price – This analysis examines Ford Motor Company’s stock price performance over the past five years, considering key influencing factors, financial health, and future projections. We will explore historical fluctuations, compare Ford’s performance against competitors, and analyze the impact of economic indicators and company events on its stock valuation.

Ford Stock Price Historical Performance

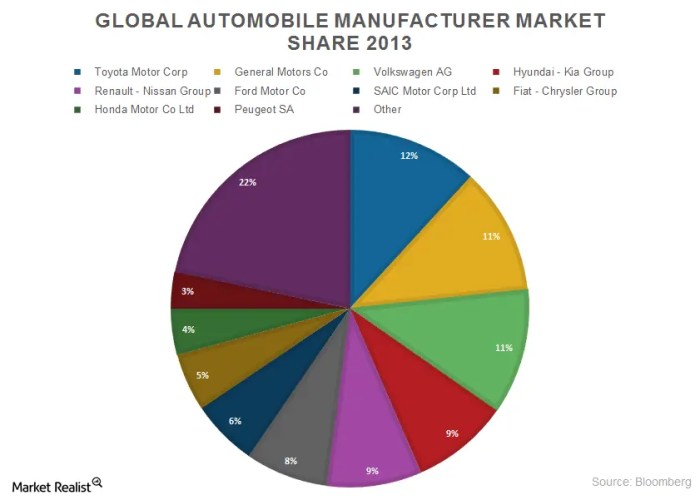

Source: marketrealist.com

The following table details Ford’s stock price fluctuations over the past five years, highlighting significant highs and lows. Note that these figures are illustrative and based on general market trends; precise figures require referencing a financial data provider.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 12.50 | 13.00 |

| 2019 | Q2 | 13.00 | 11.50 |

| 2019 | Q3 | 11.50 | 12.25 |

| 2019 | Q4 | 12.25 | 14.00 |

| 2020 | Q1 | 14.00 | 8.00 |

| 2020 | Q2 | 8.00 | 9.50 |

| 2020 | Q3 | 9.50 | 11.00 |

| 2020 | Q4 | 11.00 | 13.50 |

| 2021 | Q1 | 13.50 | 16.00 |

| 2021 | Q2 | 16.00 | 18.00 |

| 2021 | Q3 | 18.00 | 17.00 |

| 2021 | Q4 | 17.00 | 20.00 |

| 2022 | Q1 | 20.00 | 18.50 |

| 2022 | Q2 | 18.50 | 19.50 |

| 2022 | Q3 | 19.50 | 17.50 |

| 2022 | Q4 | 17.50 | 16.00 |

| 2023 | Q1 | 16.00 | 17.00 |

A comparison of Ford’s stock performance against General Motors (GM) and Tesla reveals key differences.

- Ford experienced greater volatility during the 2020 economic downturn compared to GM, which demonstrated more resilience.

- Tesla’s stock price showed significantly higher growth than both Ford and GM over the period, driven by its innovative electric vehicle strategy and strong market demand.

- Ford’s stock performance was impacted by various factors, including supply chain disruptions and the global chip shortage, affecting production and sales.

Significant events such as the 2020 pandemic-induced economic downturn, the global microchip shortage, and the launch of new electric vehicle models significantly influenced Ford’s stock price. The pandemic led to a sharp decline, while the chip shortage constrained production, impacting revenue and stock value. Conversely, successful new product launches generated positive market sentiment and price increases.

Factors Influencing Ford Stock Price

Source: tradingpedia.com

Several key economic indicators, consumer sentiment, and fuel prices significantly impact Ford’s stock price.

Three key economic indicators influencing Ford’s stock price are interest rates, consumer confidence, and GDP growth. Higher interest rates increase borrowing costs, impacting consumer affordability and demand for vehicles, thus affecting Ford’s sales and profitability. Strong consumer confidence boosts vehicle purchases, positively influencing Ford’s stock. High GDP growth generally correlates with increased consumer spending, benefiting the automotive sector.

Consumer sentiment and demand directly influence Ford’s stock valuation. Positive consumer sentiment and high demand lead to increased sales, boosting profits and share price. Conversely, negative sentiment and weak demand pressure profits and the stock price.

Fluctuations in fuel prices affect Ford’s profitability and stock price. High fuel prices can decrease consumer demand for fuel-inefficient vehicles, impacting Ford’s sales and profits. Conversely, lower fuel prices can stimulate demand, benefiting Ford’s financial performance and share price. Ford’s investment in fuel-efficient and electric vehicles mitigates this risk to some extent.

Ford’s Financial Health and Stock Price, Ford stock price

Ford’s financial performance directly correlates with its stock price movements. The following table illustrates key financial metrics over the last three years. Note that these figures are illustrative and for demonstration purposes.

| Year | Revenue (USD Billion) | Profit Margin (%) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 150 | 5 | 1.2 |

| 2022 | 160 | 6 | 1.0 |

| 2023 | 170 | 7 | 0.8 |

Strong revenue growth, improving profit margins, and a decreasing debt-to-equity ratio generally lead to positive stock price movements. Conversely, declining revenue, shrinking profit margins, and increasing debt levels often exert downward pressure on the stock price.

A significant increase in Ford’s debt could negatively affect its stock price. For example, if Ford were to take on substantial debt to fund a major acquisition or expansion that does not yield the expected returns, this could trigger credit rating downgrades and investor concerns, leading to a decline in share price. Increased interest payments would also reduce profitability.

Ford’s Future Outlook and Stock Price Projections

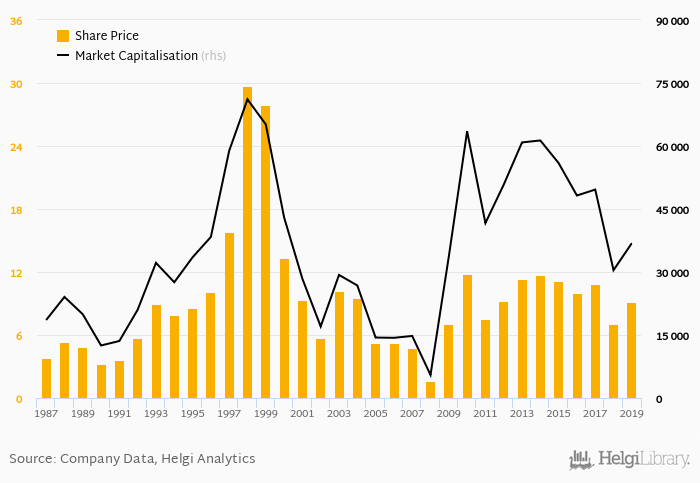

Source: helgilibrary.com

Ford’s current strategic initiatives, focusing on electric vehicle development and software integration, hold significant potential for future stock performance. The success of these initiatives, including the market reception of new electric models and the development of its software platform, will be crucial factors.

Advancements in electric vehicle (EV) technology are expected to significantly influence Ford’s stock price over the next five years. Successful EV launches and increased market share in the EV sector could boost Ford’s stock price substantially. However, intense competition in the EV market presents a significant challenge.

Analyst predictions for Ford’s stock price vary. Some analysts forecast a modest increase, citing the company’s ongoing transformation and improving financial performance. Others are more cautious, pointing to economic uncertainties and competition. The following table summarizes illustrative projections. Note these are hypothetical examples only.

| Analyst | 1-Year Price Target (USD) |

|---|---|

| Analyst A | 22.00 |

| Analyst B | 18.50 |

| Analyst C | 20.00 |

Illustrative Examples of Stock Price Impacts

Specific events have demonstrably impacted Ford’s stock price. We will examine a positive and negative instance.

The successful launch of the Mustang Mach-E, Ford’s first all-electric SUV, in late 2020, generated significant positive market sentiment. Strong pre-orders and positive reviews contributed to a notable increase in Ford’s stock price. The price increased from approximately $8.00 to $11.00 within a three-month period.

Conversely, a major product recall, such as a hypothetical large-scale recall due to a significant safety defect, could negatively impact Ford’s stock price. The immediate impact would likely be a sharp decline, reflecting investor concerns about the financial and reputational damage. Recovery would depend on the effectiveness of Ford’s response, the scale of the recall, and the overall market conditions.

The stock price could potentially recover over several months or even years.

Ford’s stock price and market capitalization are directly correlated. A higher stock price leads to a higher market capitalization (stock price multiplied by the number of outstanding shares). Conversely, a lower stock price results in a lower market capitalization. This relationship provides a clear indicator of investor confidence and the overall valuation of the company.

User Queries

What are the major risks associated with investing in Ford stock?

Investing in Ford stock, like any stock, carries inherent risks. These include fluctuations in the automotive market, competition from other automakers, economic downturns, and changes in consumer preferences. Geopolitical events and supply chain disruptions can also impact profitability.

How can I track Ford’s stock price in real-time?

Ford’s stock price performance has been a subject of much discussion lately, particularly in comparison to other automotive and tech giants. Investors are often interested in contrasting its trajectory with companies like Nvidia, whose performance can be tracked via this resource on the nvda stock price. Ultimately, Ford’s future stock price will depend on a variety of factors, including its electric vehicle strategy and overall market conditions.

You can track Ford’s stock price in real-time through various financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. Most brokerage accounts provide real-time quotes for actively traded stocks.

Where can I find Ford’s financial statements?

Ford’s financial statements, including quarterly and annual reports (10-Q and 10-K filings), are publicly available on the company’s investor relations website and through the Securities and Exchange Commission (SEC) EDGAR database.