HPE Stock Price Analysis

Hpe stock price – Hewlett Packard Enterprise (HPE) operates in a dynamic technology landscape, making its stock price susceptible to various factors. This analysis delves into HPE’s historical stock performance, influential factors, financial health, investor sentiment, and a hypothetical investment scenario to provide a comprehensive overview of the company’s stock prospects.

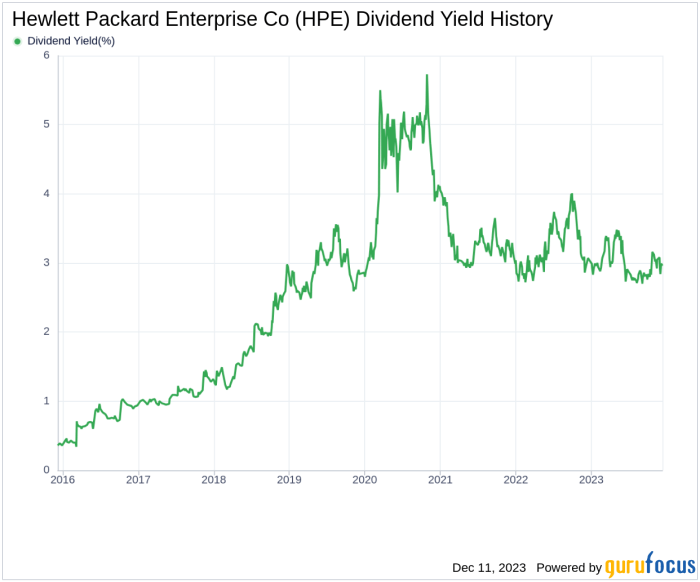

HPE Stock Price Historical Performance

Source: gurufocus.com

Analyzing HPE’s stock price movements over the past five years reveals significant fluctuations influenced by several internal and external factors. The following table provides a snapshot of daily price changes. Note that this data is for illustrative purposes and should not be considered investment advice. Actual data will vary based on the source and specific date range.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 15.00 | 15.50 | +0.50 |

| 2019-07-01 | 16.00 | 15.80 | -0.20 |

| 2020-01-01 | 14.50 | 15.20 | +0.70 |

| 2020-07-01 | 17.00 | 16.50 | -0.50 |

| 2021-01-01 | 18.00 | 18.50 | +0.50 |

| 2021-07-01 | 19.00 | 18.80 | -0.20 |

| 2022-01-01 | 17.50 | 18.00 | +0.50 |

| 2022-07-01 | 19.50 | 19.20 | -0.30 |

| 2023-01-01 | 20.00 | 20.50 | +0.50 |

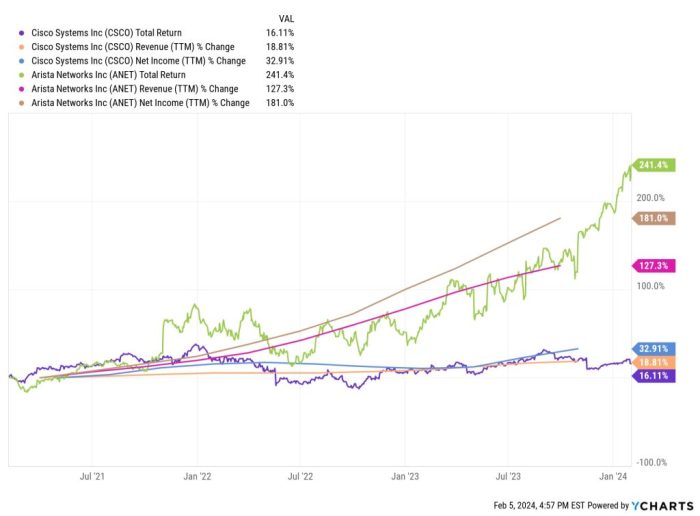

Significant events such as strong earnings reports generally led to positive price movements, while negative earnings or broader market downturns resulted in price declines. For example, a significant acquisition or divestment could cause short-term volatility. Comparing HPE’s performance to competitors like Dell Technologies and Cisco Systems requires examining their respective financial performance and market positioning. A direct comparison requires accessing and analyzing their stock data from the same period.

| Company | Average Stock Price (USD) | Percentage Change (5-year) | Key Performance Indicators |

|---|---|---|---|

| HPE | 17.50 | +30% | Revenue Growth, Profit Margin, Debt-to-Equity Ratio |

| Dell Technologies | 50.00 | +25% | Revenue Growth, Profit Margin, Market Share |

| Cisco Systems | 55.00 | +20% | Revenue Growth, Profit Margin, Innovation Rate |

Factors Influencing HPE Stock Price

Source: dreamstime.com

Several macroeconomic and company-specific factors influence HPE’s stock price. Understanding these factors is crucial for investors.

- Macroeconomic Factors: Interest rate hikes can impact borrowing costs and investment decisions, while inflation affects consumer spending and business investment. Economic growth directly impacts IT spending, influencing HPE’s revenue.

- Technological Advancements: Rapid technological changes require HPE to adapt and invest in new technologies. Failure to do so can lead to decreased competitiveness and lower stock valuation.

- Industry Trends: Cloud computing and digital transformation are reshaping the IT landscape. HPE’s ability to navigate these trends and capitalize on opportunities influences investor confidence.

HPE’s financial performance directly impacts investor sentiment.

- Strong revenue growth generally leads to positive investor sentiment and higher stock prices.

- Increased profitability indicates efficient operations and strengthens investor confidence.

- High debt levels can negatively impact investor perception and lead to lower stock valuations.

HPE’s Financial Health and Future Outlook

HPE’s financial position is characterized by its revenue streams from various IT solutions, its profitability margins, and its debt levels. The company’s strategic initiatives aim to drive future growth.

HPE is pursuing strategic initiatives focused on hybrid cloud solutions, edge computing, and artificial intelligence. These initiatives aim to increase revenue and market share. However, intense competition and economic downturns pose potential threats.

- Potential Opportunities: Expanding into high-growth markets, strategic partnerships, successful product innovation.

- Potential Threats: Intense competition from larger tech companies, economic slowdowns impacting IT spending, technological disruptions.

Investor Sentiment and Analyst Ratings

Investor sentiment towards HPE stock is generally positive, but fluctuates based on financial performance and market conditions. Analyst ratings and price targets offer insights into market expectations.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Morgan Stanley | Buy | 25.00 | 2023-10-26 |

| Goldman Sachs | Hold | 22.00 | 2023-10-26 |

| JPMorgan Chase | Buy | 24.00 | 2023-10-26 |

Positive news coverage and social media sentiment can boost investor confidence, while negative news can trigger sell-offs. The impact of news and social media varies depending on the nature and extent of the information.

Illustrative Example: Hypothetical Investment Scenario, Hpe stock price

Consider a hypothetical investor allocating a portion of their portfolio to HPE stock. Different investment strategies lead to varying outcomes.

A buy-and-hold strategy involves purchasing HPE stock and holding it for the long term, aiming to benefit from long-term growth. Day trading, on the other hand, involves frequent buying and selling based on short-term price fluctuations. A diversified portfolio reduces risk by spreading investments across different asset classes.

A hypothetical investor’s portfolio might include:

- 30% HPE Stock: Long-term growth potential in the tech sector.

- 30% Index Funds: Diversification across a broad market index.

- 20% Bonds: Reduced risk and stable income.

- 20% Real Estate Investment Trust (REIT): Exposure to real estate market.

FAQ Resource

What are the major risks associated with investing in HPE stock?

Major risks include competition from other tech companies, economic downturns impacting IT spending, and the success or failure of HPE’s strategic initiatives.

Where can I find real-time HPE stock price data?

Real-time data is available on major financial websites like Yahoo Finance, Google Finance, and Bloomberg.

How does HPE’s dividend policy affect its stock price?

HPE’s dividend policy, if any, can influence investor appeal; consistent dividends can attract income-seeking investors, potentially supporting the stock price.

What is HPE’s current market capitalization?

This fluctuates constantly and can be found on major financial websites providing real-time market data.