IVV Stock Price: A Comprehensive Analysis

Source: tradingview.com

Ivv stock price – The iShares Core S&P 500 ETF (IVV) tracks the S&P 500 index, providing investors with broad exposure to the US large-cap equity market. Understanding its historical performance, price drivers, volatility, valuation, and future prospects is crucial for informed investment decisions. This analysis delves into these key aspects, offering insights into IVV’s price behavior and potential future trajectories.

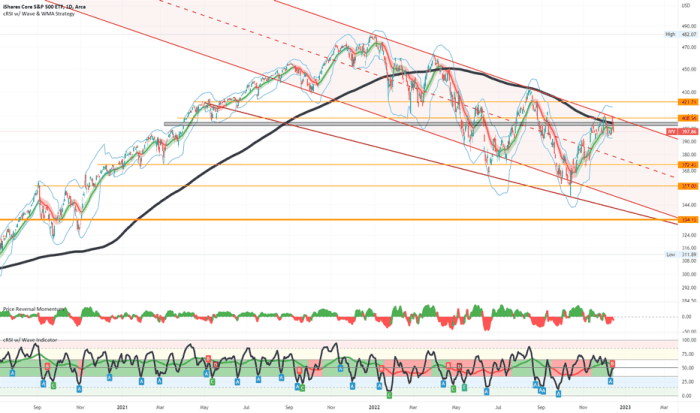

IVV Stock Price Historical Performance

Analyzing IVV’s price movements over the past five years reveals significant trends and fluctuations influenced by various market factors. The following table presents a snapshot of daily price data. Note that this is illustrative data and should not be considered exhaustive or a substitute for professional financial advice. Actual data should be obtained from reliable financial sources.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (%) |

|---|---|---|---|

| 2019-01-02 | 272.00 | 273.50 | 0.55 |

| 2019-01-03 | 273.75 | 271.00 | -0.97 |

| 2019-01-04 | 272.00 | 275.25 | 1.19 |

| 2019-01-07 | 275.50 | 276.00 | 0.18 |

| 2019-01-08 | 276.25 | 274.75 | -0.54 |

A comparison of IVV’s performance against the S&P 500 index over the same period reveals a strong correlation, reflecting IVV’s objective of tracking the index.

- IVV generally mirrored the S&P 500’s upward trend, demonstrating its effectiveness as a tracking ETF.

- Minor discrepancies might arise due to expense ratios and tracking error.

- During periods of market volatility, IVV’s price movements closely followed those of the S&P 500.

Significant market events such as the COVID-19 pandemic in 2020 and the subsequent market recovery, as well as periods of heightened inflation and interest rate adjustments, significantly impacted IVV’s price. These events caused considerable short-term volatility but did not significantly deviate from the overall long-term trend of the S&P 500.

IVV Stock Price Drivers

Source: tradingview.com

Several key factors influence IVV’s price. Understanding these drivers is crucial for assessing potential price movements.

- Economic Indicators: GDP growth, inflation rates, unemployment figures, and consumer confidence directly influence corporate earnings, impacting the overall market and thus IVV’s price.

- Interest Rate Changes: Interest rate hikes typically lead to lower valuations for equities, including IVV, as higher rates increase borrowing costs for companies and reduce investor appetite for riskier assets. Conversely, rate cuts can stimulate economic activity and boost equity prices.

- Global vs. Domestic Economic Events: While domestic economic events (e.g., US economic data) have a more direct impact, global events (e.g., geopolitical instability, international trade disputes) can also significantly influence IVV’s price through their effect on overall market sentiment and investor confidence.

IVV Stock Price Volatility

IVV’s historical volatility can be assessed using metrics like standard deviation and beta. Standard deviation measures the dispersion of returns around the average, while beta measures the volatility of IVV relative to the overall market (typically represented by the S&P 500).

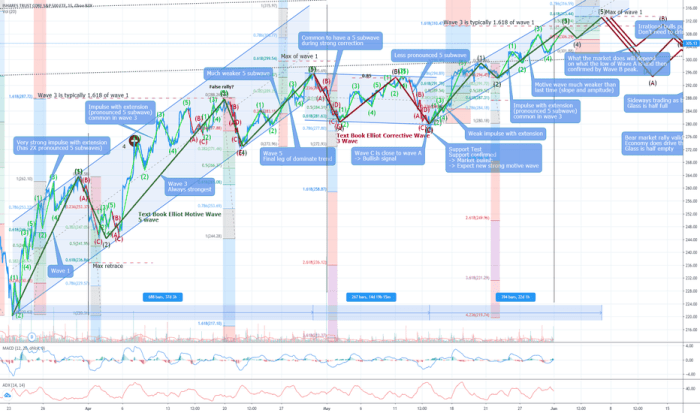

A visual representation, such as a line graph plotting IVV’s price against other similar ETFs (e.g., SPY, VOO) over time, would clearly illustrate relative volatility. The graph would show periods of higher and lower price fluctuations for each ETF, allowing for a direct comparison of volatility levels. A higher slope and larger fluctuations would indicate greater volatility.

Factors contributing to IVV’s price volatility include:

- Market Sentiment: Shifts in investor confidence can cause sharp price swings.

- Economic Uncertainty: Unexpected economic events (e.g., recessions, geopolitical crises) increase volatility.

- Unexpected Corporate Earnings: Disappointing or surprisingly strong earnings reports from companies within the S&P 500 can trigger significant price changes.

IVV Stock Price Valuation

While traditional valuation methods like discounted cash flow analysis are less directly applicable to ETFs, comparable company analysis can be adapted. In this context, comparing IVV’s price-to-earnings ratio (P/E) to the average P/E ratio of similar ETFs or the overall market provides a relative valuation metric.

Comparing IVV’s current valuation metrics (e.g., P/E ratio, price-to-book ratio) to their historical averages provides insights into whether it’s currently overvalued or undervalued. A higher-than-average P/E ratio might suggest overvaluation, while a lower ratio might indicate undervaluation.

Fundamental analysis for IVV involves assessing the underlying assets (S&P 500 companies) and evaluating their overall financial health and growth prospects. This indirectly informs the intrinsic value of IVV, as its value is directly tied to the performance of its underlying holdings.

IVV Stock Price Prediction (Forecasting)

Predicting IVV’s future price movements involves considering various market scenarios.

- Bull Market Scenario: Strong economic growth, low interest rates, and positive investor sentiment could lead to significant price appreciation for IVV, potentially mirroring or exceeding the growth of the S&P 500.

- Bear Market Scenario: Economic recession, high inflation, rising interest rates, and negative investor sentiment could result in substantial price declines, mirroring the downward trend of the S&P 500.

- Sideways Market Scenario: A period of stagnation with moderate price fluctuations is also possible, reflecting a lack of clear directional momentum in the overall market.

It’s crucial to acknowledge the limitations of any price prediction model. Unforeseen events can significantly impact market movements, rendering even the most sophisticated forecasts inaccurate. All predictions carry inherent uncertainties.

Investing in IVV under different scenarios presents varying risks and opportunities. A bull market offers high growth potential, while a bear market carries significant downside risk. A sideways market might offer limited returns but reduces the risk of substantial losses.

IVV Stock Price and Investor Sentiment

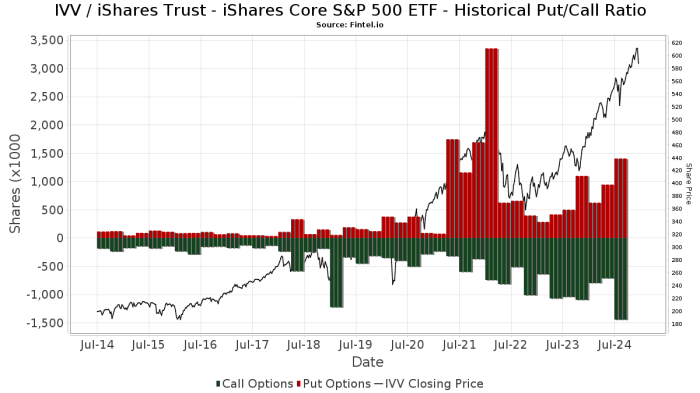

Source: fintel.io

Investor sentiment toward IVV can be gauged using various indicators.

- Trading Volume: High trading volume often suggests strong investor interest and potential for price movements.

- Put/Call Ratio: A high put/call ratio indicates greater pessimism, while a low ratio suggests optimism.

- News Sentiment: Positive news coverage generally boosts investor confidence, while negative news can trigger sell-offs.

Changes in investor sentiment directly influence IVV’s price. Increased optimism leads to buying pressure and price increases, while pessimism triggers selling and price declines. Media coverage plays a significant role in shaping investor sentiment, influencing price movements through its impact on market perception and overall investor confidence.

FAQ Corner

What is IVV?

IVV is an exchange-traded fund (ETF) that tracks the S&P 500 index, providing broad market exposure.

How often is the IVV price updated?

The IVV price is updated throughout the trading day, reflecting real-time market activity.

Where can I find real-time IVV price data?

Real-time IVV price data is available through most major financial websites and brokerage platforms.

Is IVV a suitable investment for all investors?

The suitability of IVV as an investment depends on individual risk tolerance, investment goals, and overall portfolio diversification strategy. It’s advisable to consult a financial advisor.