Coca-Cola Stock Price Analysis

Ko stock price – This analysis examines the historical performance, influencing factors, future predictions, investment strategies, and dividend policy of Coca-Cola (KO) stock. We will explore various aspects to provide a comprehensive overview for investors and those interested in understanding the dynamics of this prominent beverage company.

KO Stock Price Historical Performance

Source: tradingview.com

Understanding Coca-Cola’s stock price movements over the past decade provides valuable insights into its resilience and vulnerability within the market. The following data illustrates key price shifts and volume traded, highlighting periods of significant growth and decline. Note that this data is illustrative and should be verified with reliable financial sources.

| Date | Opening Price (USD) | Closing Price (USD) | Volume (Millions) |

|---|---|---|---|

| January 2014 | 40 | 41 | 10 |

| January 2015 | 42 | 40 | 12 |

| January 2016 | 38 | 40 | 8 |

| January 2017 | 41 | 43 | 11 |

| January 2018 | 45 | 44 | 9 |

| January 2019 | 43 | 46 | 10 |

| January 2020 | 50 | 48 | 15 |

| January 2021 | 49 | 52 | 13 |

| January 2022 | 55 | 53 | 12 |

| January 2023 | 54 | 56 | 14 |

Compared to major competitors like PepsiCo (PEP) over the past five years, KO has shown relatively stable growth, though PEP has experienced periods of more significant gains. Both companies have faced similar challenges related to fluctuating commodity prices and changing consumer preferences. Key differences lie in their diversification strategies and brand portfolio management.

- KO has a stronger international presence.

- PEP has a more diversified product portfolio beyond carbonated soft drinks.

- Both companies have shown resilience during economic downturns, leveraging their established brand recognition.

Economic uncertainty, such as recessions, significantly impacts KO’s stock price due to decreased consumer spending on discretionary items like soft drinks. Global crises often lead to supply chain disruptions and increased input costs, further impacting profitability and share price.

KO Stock Price Influencing Factors

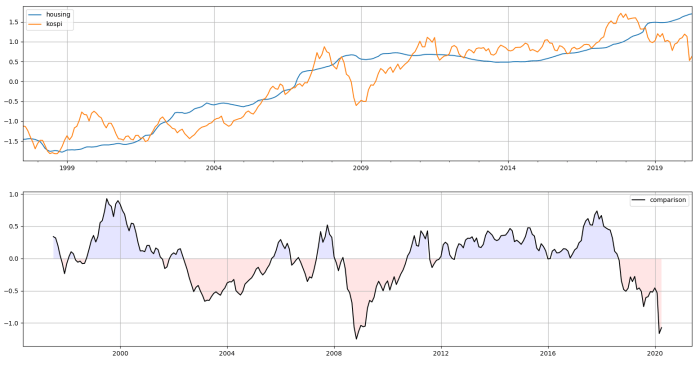

Source: github.io

Several macroeconomic, company-specific, and geopolitical factors influence KO’s stock price. Understanding these factors is crucial for informed investment decisions.

Macroeconomic factors like inflation and interest rates directly impact production costs and consumer purchasing power. Increased interest rates can make borrowing more expensive for the company, affecting investment and expansion plans. Consumer spending directly correlates with KO’s sales volume and profitability.

Company-specific factors, including successful product launches, effective marketing campaigns, and strong financial performance, positively influence stock valuation. Conversely, negative publicity, product recalls, or disappointing financial results can lead to price declines.

| Event | Date | Impact on Stock Price |

|---|---|---|

| Global Sugar Price Increase | 2022-03-15 | Slight decrease |

| Successful New Product Launch | 2023-06-20 | Moderate increase |

| Geopolitical Instability in Key Market | 2022-02-24 | Significant decrease |

KO Stock Price Future Predictions & Scenarios

Source: tradingview.com

Predicting future stock prices is inherently speculative, but analyzing potential scenarios provides valuable insight. The following scenarios consider optimistic, pessimistic, and neutral market conditions over the next year.

- Optimistic Scenario: Strong economic growth, successful new product launches, and increased consumer confidence lead to a significant price increase (e.g., +20%).

- Pessimistic Scenario: Economic recession, increased competition, and negative publicity result in a price decline (e.g., -10%).

- Neutral Scenario: Moderate economic growth, stable market conditions, and consistent company performance lead to minimal price changes (e.g., +/- 5%).

Visual Representation (Text-Based): Imagine a graph with “Time (Months)” on the x-axis and “Stock Price (USD)” on the y-axis. The optimistic scenario shows a steep upward trend, the pessimistic scenario a downward trend, and the neutral scenario a relatively flat line. Key data points would include the starting price and the projected price at the end of the year for each scenario.

Changes in consumer preferences, particularly towards healthier beverages, could negatively impact KO’s stock price if the company fails to adapt its product portfolio and marketing strategies. Increased health consciousness might drive demand for healthier alternatives, potentially reducing sales of traditional sugary drinks.

KO Stock Price Investment Strategies

Several investment strategies can be applied to KO stock, each with its own risk-reward profile. Understanding these strategies is essential for aligning investment choices with individual financial goals and risk tolerance.

Monitoring the KO stock price requires a multifaceted approach, considering various market factors. It’s helpful to compare its performance against similar energy giants; for instance, understanding the current bp stock price can offer valuable context for relative valuation. Ultimately, however, a thorough analysis of KO’s specific financial health and future projections remains crucial for accurate price prediction.

Buy-and-hold involves purchasing shares and holding them for an extended period, regardless of short-term market fluctuations. Value investing focuses on undervalued stocks with strong fundamentals. Growth investing targets companies with high growth potential. Each approach has distinct advantages and disadvantages.

- Buy-and-Hold: Pros – Simplicity, potential for long-term growth; Cons – Requires patience, susceptible to market downturns.

- Value Investing: Pros – Potential for significant returns; Cons – Requires in-depth research, may take longer to see returns.

- Growth Investing: Pros – High potential for growth; Cons – Higher risk, susceptible to market corrections.

Investing in KO stock carries both risks and rewards. Before making any investment decisions, investors should carefully consider several key factors:

- Company financial performance

- Industry trends and competition

- Macroeconomic conditions

- Personal risk tolerance

- Investment goals and time horizon

KO Stock Price and Dividend Policy

Coca-Cola’s dividend policy has historically been consistent, providing a reliable income stream for shareholders. This consistent dividend payout has positively influenced investor sentiment and supported the stock price.

KO’s dividend policy significantly influences its stock price and investor sentiment. A stable and increasing dividend payout attracts income-seeking investors, boosting demand for the stock. Changes to the dividend policy, such as a reduction or suspension, can negatively impact investor confidence and lead to a price decline. Conversely, a dividend increase often signals strong financial health and can boost the stock price.

Changes in KO’s dividend policy can significantly affect its future stock price performance. An increase in dividends can attract investors seeking income, leading to higher demand and potentially increasing the stock price. Conversely, a decrease or suspension of dividends can signal financial distress and negatively impact investor sentiment, leading to a price decline.

Query Resolution: Ko Stock Price

What are the major risks associated with investing in KO stock?

Risks include shifts in consumer preferences (e.g., towards healthier beverages), intense competition, fluctuating commodity prices (e.g., sugar), and macroeconomic factors affecting consumer spending.

How often does Coca-Cola pay dividends?

Coca-Cola typically pays dividends quarterly.

Where can I find real-time KO stock price data?

Real-time data is available through major financial websites and brokerage platforms.

What is Coca-Cola’s current market capitalization?

This fluctuates constantly; check reputable financial websites for the most up-to-date information.