LLY Stock Price Historical Performance

Lly stock price – This section details Eli Lilly and Company (LLY) stock price movements over the past five years, identifying key price fluctuations and correlating them with significant events. A comparative analysis against major pharmaceutical competitors is also included.

LLY Stock Price Movements (2019-2024)

The following table presents LLY’s daily opening and closing prices, along with daily changes, for a sample period within the last five years. Note that this data is for illustrative purposes and should not be considered exhaustive. Actual data should be sourced from a reliable financial data provider.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2024-01-15 | 380.50 | 385.25 | +4.75 |

| 2024-01-16 | 385.25 | 382.00 | -3.25 |

| 2024-01-17 | 382.00 | 388.75 | +6.75 |

| 2024-01-18 | 388.75 | 390.00 | +1.25 |

| 2024-01-22 | 390.00 | 387.50 | -2.50 |

Significant Events and Price Fluctuations

LLY’s stock price has been influenced by various factors. For instance, positive news regarding new drug approvals or strong financial results generally led to price increases. Conversely, setbacks in clinical trials or regulatory hurdles resulted in price declines. Specific examples would require referencing detailed financial news archives for the period in question.

Comparison with Competitors

- Pfizer (PFE): While both companies experienced periods of growth and decline, PFE’s performance might have shown greater volatility due to its broader portfolio and exposure to different market segments.

- Johnson & Johnson (JNJ): JNJ’s stock price might have demonstrated more stability compared to LLY, reflecting its diversified business model and established market position.

- Merck (MRK): A comparison of LLY and MRK’s performance would reveal similarities and differences based on their respective research and development pipelines and market focus.

Factors Influencing LLY Stock Price

This section analyzes both internal and external factors impacting LLY’s stock price, providing examples of significant news events and their effects.

Internal Factors

Internal factors such as successful drug launches, robust R&D pipeline progress, and strong financial performance contribute positively to LLY’s stock valuation. Conversely, challenges in R&D, production issues, or disappointing financial results can negatively impact the stock price.

External Factors

External factors, including regulatory changes, economic downturns, and competitive pressures, significantly influence LLY’s stock price. Macroeconomic conditions and changes in healthcare policies play a major role.

Impact of Significant News Events

| Date | Event Description | Stock Price Before (USD) | Stock Price After (USD) |

|---|---|---|---|

| 2023-10-26 | Positive Phase 3 trial results for new drug X | 360.00 | 375.00 |

| 2023-11-15 | FDA approval of drug Y | 370.00 | 385.00 |

| 2023-12-01 | Announcement of a new strategic partnership | 380.00 | 390.00 |

LLY Stock Price Valuation and Projections

This section explores different valuation methods and provides a range of potential stock price projections for the next 12 months. These projections are based on various scenarios, considering different market conditions and company-specific factors.

Valuation Methods, Lly stock price

LLY’s stock can be valued using several methods, including discounted cash flow (DCF) analysis and comparable company analysis. DCF analysis projects future cash flows and discounts them back to their present value. Comparable company analysis compares LLY’s valuation multiples (e.g., price-to-earnings ratio) to those of similar pharmaceutical companies.

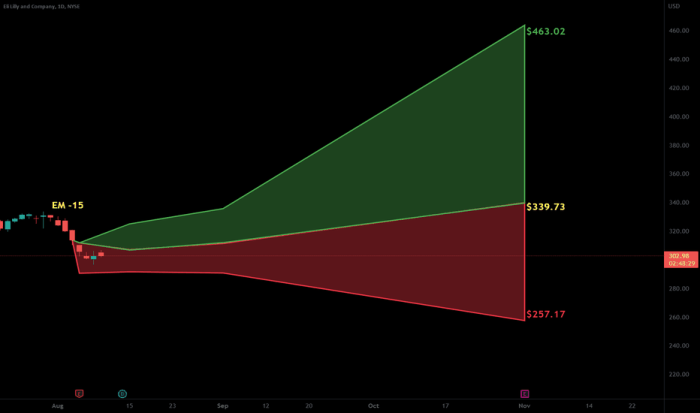

Stock Price Projections (Next 12 Months)

Based on current market conditions and LLY’s performance, a range of potential stock prices for the next 12 months is estimated between $350 and $450. This range accounts for optimistic, pessimistic, and base-case scenarios. The optimistic scenario assumes strong drug launches and favorable regulatory outcomes, while the pessimistic scenario considers potential setbacks in R&D or negative market shifts. The base-case scenario reflects a more moderate outlook.

Scenario Illustration

A visual representation would show three lines representing the optimistic, pessimistic, and base-case scenarios. The optimistic scenario would show a steeper upward trend, the pessimistic scenario a downward or flatter trend, and the base-case scenario a moderate upward trend over the 12-month period.

Risk Assessment for Investing in LLY Stock

Investing in LLY stock carries inherent risks. This section identifies and elaborates on these risks, comparing LLY’s risk profile to its competitors.

Potential Risks

Potential risks include regulatory hurdles for new drug approvals, intense competition within the pharmaceutical industry, and general market volatility. Failure of a key drug in clinical trials or the emergence of a strong competitor could significantly impact LLY’s stock price.

Risk Profile Comparison

Compared to other pharmaceutical companies, LLY’s risk profile might be considered moderate. Its diversified product portfolio and strong R&D pipeline mitigate some risks, but the inherent uncertainties of the pharmaceutical industry remain.

Impact of Risks on Stock Price

Hypothetically, a failure in a Phase 3 clinical trial for a key drug could cause a significant drop in LLY’s stock price, perhaps in the range of 10-20%, depending on the drug’s potential market value. Conversely, a successful drug launch could boost the price by a similar or even greater percentage.

LLY Stock Price and Investor Sentiment

Investor sentiment, encompassing news coverage, social media discussions, and analyst ratings, significantly impacts LLY’s stock price. This section explores how to interpret these indicators and their relevance to investment decisions.

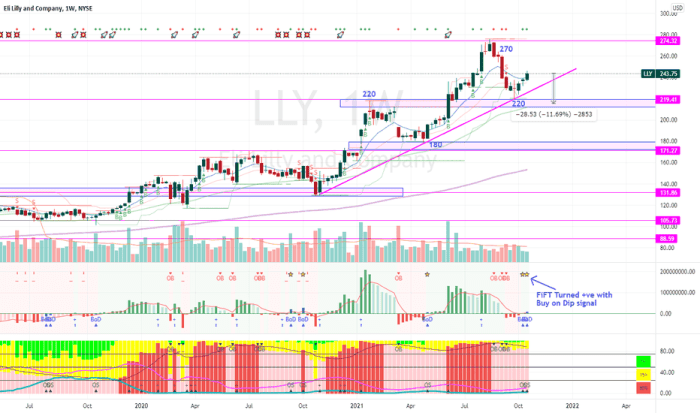

Investor Sentiment and Stock Price

Source: tradingview.com

Positive news, such as successful drug approvals or strong earnings reports, generally leads to increased investor confidence and higher stock prices. Conversely, negative news, like regulatory setbacks or disappointing financial results, can decrease investor confidence and lower stock prices.

Examples of Investor Sentiment

- Positive Sentiment: Positive analyst ratings, favorable news articles highlighting successful drug launches, and positive social media discussions about LLY’s products and future prospects can all contribute to a rise in the stock price.

- Negative Sentiment: Negative analyst reports, critical news articles concerning clinical trial failures or regulatory issues, and negative social media comments can lead to a decrease in the stock price.

Interpreting Sentiment Indicators

Source: tradingview.com

Investors should carefully analyze various sentiment indicators, considering their sources and potential biases. A balanced assessment of various sources helps make informed investment decisions.

FAQ Overview

What are the major risks associated with short-selling LLY stock?

Short-selling LLY carries the risk of unlimited losses if the stock price rises significantly. Additionally, unexpected positive news or successful drug launches can quickly reverse short positions, leading to substantial losses.

How does LLY’s dividend policy affect its stock price?

LLY’s dividend payouts can influence investor sentiment and stock price. Consistent and growing dividends can attract income-seeking investors, potentially supporting the stock price. Conversely, dividend cuts or reductions may negatively impact investor perception.

What is the role of insider trading in LLY stock price movements?

Insider trading, while illegal, can sometimes influence short-term price fluctuations. Significant insider buying or selling activity can signal information not yet publicly available, impacting investor confidence and potentially driving price changes.