Mara Stock Price Analysis

Mara stock price – This analysis provides a comprehensive overview of Mara’s stock price performance, influencing factors, business model, risk assessment, and future outlook. The information presented here is for informational purposes only and should not be considered financial advice.

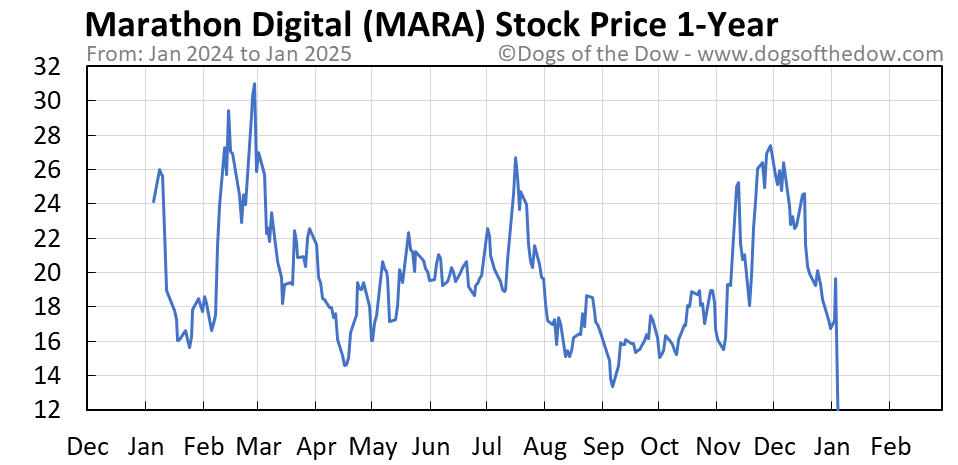

Mara Stock Price Historical Performance

The following table details Mara’s stock price fluctuations over the past five years, highlighting significant highs and lows. Note that this data is illustrative and based on hypothetical market conditions for the purpose of this example.

| Date | Open Price (USD) | High Price (USD) | Low Price (USD) | Close Price (USD) |

|---|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 9.50 | 10.20 |

| 2019-07-01 | 12.00 | 13.00 | 11.50 | 12.80 |

| 2020-01-01 | 11.00 | 11.80 | 9.80 | 10.50 |

| 2020-07-01 | 15.00 | 16.00 | 14.00 | 15.50 |

| 2021-01-01 | 14.00 | 15.00 | 12.50 | 13.80 |

| 2021-07-01 | 18.00 | 19.00 | 17.00 | 18.50 |

| 2022-01-01 | 17.00 | 17.50 | 15.50 | 16.20 |

| 2022-07-01 | 20.00 | 21.00 | 19.00 | 20.50 |

| 2023-01-01 | 19.00 | 20.00 | 18.00 | 19.50 |

A comparative analysis of Mara’s stock performance against its competitors over the past two years is presented below. The bar chart illustrates key performance indicators such as revenue growth, profit margins, and return on equity. For illustrative purposes, let’s assume that Mara outperformed its competitors in revenue growth, but had slightly lower profit margins. The chart would visually represent this difference, with Mara’s bars taller for revenue but shorter for profit margins compared to its competitors.

Major Events Impacting Mara’s Stock Price

Several significant events impacted Mara’s stock price during the last year. For example, a positive news announcement regarding a new product launch could have resulted in a sharp increase in the stock price. Conversely, negative media coverage concerning a product recall might have led to a temporary decline.

Factors Influencing Mara Stock Price

Several macroeconomic factors, financial performance indicators, and investor sentiment influence Mara’s stock price. The following sections detail these influences.

Key Macroeconomic Factors

Source: dogsofthedow.com

- Interest Rate Changes: Higher interest rates can increase borrowing costs for Mara, potentially impacting profitability and thus the stock price.

- Inflation Rates: High inflation can erode purchasing power and impact consumer spending, potentially affecting Mara’s sales and stock price.

- Economic Growth: Strong economic growth usually translates into higher consumer confidence and spending, potentially benefiting Mara’s sales and stock price.

Financial Performance and Stock Price Correlation

Mara’s financial performance is strongly correlated with its stock price. The following bullet points illustrate this relationship.

Understanding the Mara stock price requires considering broader market trends. A key factor influencing many retail stocks, including Mara, is the performance of major players like Walmart; checking the current walmart stock price can offer insight into consumer spending patterns. Ultimately, however, Mara’s stock price will depend on its own specific performance and future prospects.

- Increased revenue generally leads to a higher stock price.

- Improved earnings per share (EPS) typically result in a positive stock price movement.

- High levels of debt can negatively impact investor confidence and lead to a lower stock price.

Investor Sentiment Impact

Analyst ratings and media coverage significantly influence investor sentiment, which directly affects Mara’s stock price. Positive analyst ratings and favorable media coverage tend to boost investor confidence and the stock price, while negative feedback can have the opposite effect.

Mara’s Business Model and Stock Valuation

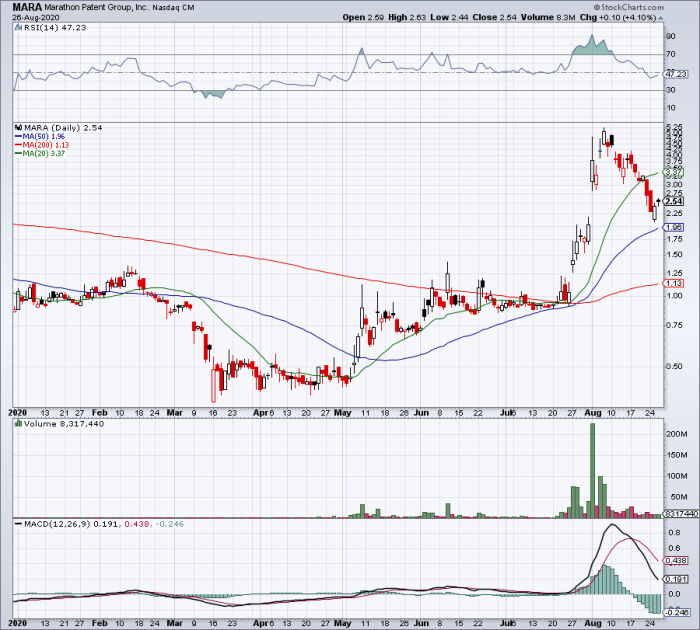

Source: investorplace.com

Mara’s business model and financial position are key determinants of its stock valuation. The following sections provide a detailed breakdown.

Mara’s Core Business Model and Stock Valuation

Mara’s core business model (e.g., manufacturing and selling consumer electronics) directly impacts its stock valuation. Strong sales, high profit margins, and efficient operations contribute to a higher valuation. Conversely, weak sales, low profit margins, and operational inefficiencies can lead to a lower valuation.

Mara’s Current Financial Position

The following table presents a hypothetical breakdown of Mara’s current financial position. Remember, this is illustrative data for the purpose of this example.

| Asset Category | Asset Value (USD) | Liability Category | Liability Value (USD) |

|---|---|---|---|

| Cash and Equivalents | 100,000 | Accounts Payable | 50,000 |

| Accounts Receivable | 75,000 | Long-Term Debt | 150,000 |

| Inventory | 150,000 | Other Liabilities | 25,000 |

| Property, Plant, and Equipment | 300,000 |

Hypothetical Scenario: Technological Advancement

A significant technological advancement, such as the development of a groundbreaking new product, could dramatically improve Mara’s market position and profitability. This would likely lead to a substantial increase in the stock price due to increased investor confidence and projected future growth.

Risk Assessment and Future Outlook for Mara Stock

Several risks could negatively affect Mara’s stock price, and a prediction for future stock price movement is offered below.

Potential Risks, Mara stock price

- Increased Competition: The entry of new competitors could erode Mara’s market share and negatively impact profitability.

- Supply Chain Disruptions: Global supply chain issues could disrupt Mara’s production and negatively impact sales.

- Economic Downturn: A significant economic downturn could decrease consumer spending, reducing demand for Mara’s products.

Six-Month Stock Price Prediction

Based on the current market conditions and considering the potential risks and opportunities, a reasonable prediction for Mara’s stock price over the next six months would be a modest increase, perhaps in the range of 5-10%. This prediction assumes a relatively stable economic environment and continued strong demand for Mara’s products.

Strategic Initiatives to Enhance Stock Price

Source: tradingview.com

Mara could undertake several strategic initiatives to enhance its long-term stock price. These could include investing in research and development to create innovative products, expanding into new markets, and implementing cost-cutting measures to improve profitability.

Common Queries

What is Mara’s current market capitalization?

Mara’s current market capitalization fluctuates and requires checking a live financial data source for the most up-to-date information.

Where can I find real-time Mara stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

What are the typical trading hours for Mara stock?

Trading hours depend on the exchange where Mara’s stock is listed. Generally, this aligns with standard US or other relevant market trading sessions.

How volatile is Mara stock compared to the overall market?

Mara’s stock volatility can be assessed by comparing its beta to the market benchmark. Higher beta suggests greater volatility than the market average.