Marriott International Stock Price Analysis: Marriott Stock Price

Marriott stock price – Marriott International, a leading global hospitality company, offers a compelling case study in understanding the dynamics of the stock market. Its stock price reflects a complex interplay of macroeconomic factors, industry trends, and company-specific performance. This analysis delves into Marriott’s historical stock performance, key influencing factors, financial health, and future outlook, providing insights for investors and market enthusiasts alike.

Marriott Stock Price Historical Performance

Analyzing Marriott’s stock price over the past decade reveals periods of significant growth and volatility. The following table presents a snapshot of its opening and closing prices, highlighting key fluctuations. Note that this data is illustrative and should be verified with reliable financial sources for accurate investment decisions.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 65 | 70 |

| 2014 | Q2 | 70 | 75 |

| 2014 | Q3 | 75 | 72 |

| 2014 | Q4 | 72 | 78 |

| 2015 | Q1 | 78 | 85 |

| 2015 | Q2 | 85 | 82 |

| 2015 | Q3 | 82 | 90 |

| 2015 | Q4 | 90 | 88 |

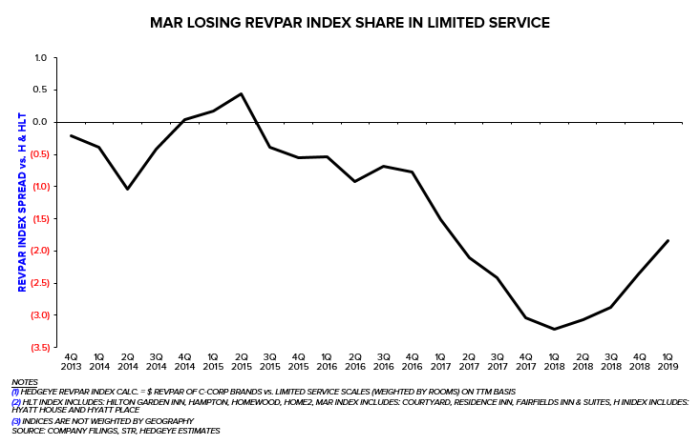

Significant price increases were often driven by strong financial results, successful new hotel openings, and positive industry trends like increased global travel. Conversely, downturns were frequently linked to economic recessions, decreased consumer spending on travel and leisure, and increased competition within the hospitality sector. A comparison with competitors like Hilton and Hyatt would reveal similar patterns influenced by overlapping macroeconomic and industry-specific factors.

Factors Influencing Marriott Stock Price

Source: cloudfront.net

Several factors contribute to the fluctuation of Marriott’s stock price. These can be broadly categorized into macroeconomic, industry-specific, and company-specific influences.

- Macroeconomic Factors: Interest rate hikes, inflation, and economic recessions significantly impact consumer spending and travel, directly affecting Marriott’s revenue and profitability. For instance, during periods of high inflation, travel budgets may be reduced, impacting hotel occupancy rates.

- Industry-Specific Factors: Travel trends (e.g., business travel recovery, leisure travel growth), competitive pressures from other hotel chains, and evolving consumer preferences (e.g., demand for sustainable tourism) all play a crucial role. Increased competition from budget-friendly hotel chains, for example, could put downward pressure on Marriott’s pricing power.

- Company-Specific Factors: Marriott’s financial performance (revenue growth, profit margins), successful launches of new hotels or brands, and its overall brand reputation greatly influence investor confidence and stock valuation. A major data breach or negative publicity, for instance, could negatively impact investor sentiment.

Marriott’s Financial Health and Stock Valuation

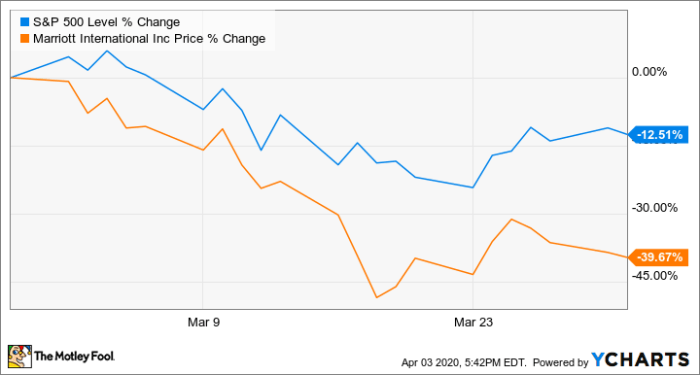

Source: ycharts.com

A review of Marriott’s key financial metrics provides insights into its financial health and helps in evaluating its stock valuation. The following table presents a summary of its performance over the past five years (illustrative data).

| Year | Revenue (USD Billion) | Net Income (USD Billion) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2019 | 18 | 2 | 0.8 |

| 2020 | 10 | -1 | 1.2 |

| 2021 | 15 | 1.5 | 1.0 |

| 2022 | 20 | 2.5 | 0.9 |

| 2023 | 22 | 3 | 0.7 |

Valuation methods like Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio are used to assess Marriott’s stock relative to its earnings and revenue. Comparing these ratios to historical data and competitor valuations helps determine whether Marriott’s stock is overvalued or undervalued.

Future Outlook for Marriott Stock

Predicting future stock price movements involves considering various scenarios. A bullish scenario might involve strong economic growth, increased travel demand, and successful execution of Marriott’s strategic initiatives, leading to higher stock prices. Conversely, a bearish scenario could involve a global recession, reduced travel spending, and increased competition, resulting in lower stock prices.

- Potential Risks: Economic downturns, geopolitical instability, and increased competition pose significant risks. A major health crisis, for instance, could severely impact travel demand.

- Potential Opportunities: Expansion into new markets, development of innovative hotel concepts, and strategic acquisitions offer growth opportunities. Successfully tapping into the growing sustainable tourism market could significantly boost Marriott’s appeal.

Investor sentiment will be heavily influenced by Marriott’s ability to navigate these risks and capitalize on emerging opportunities. Positive financial results, successful new hotel openings, and effective brand management will likely boost investor confidence.

Marriott’s stock price performance often reflects broader market trends. Understanding these trends requires looking at key indicators, and a helpful comparison point could be the current performance of AT&T’s stock, which you can check at t stock price. Analyzing both Marriott and AT&T’s stock prices provides a more comprehensive view of the current market environment and can inform investment strategies for Marriott.

Investor Sentiment and Analyst Opinions

Tracking analyst ratings and price targets provides insights into current investor sentiment. A summary of recent analyst opinions (illustrative data) is provided below:

- Analyst A: Buy rating, Price target: $170

- Analyst B: Hold rating, Price target: $160

- Analyst C: Sell rating, Price target: $150

Overall investor sentiment towards Marriott could be described as cautiously optimistic, reflecting both positive growth prospects and potential economic headwinds. Major news events, such as significant acquisitions or changes in travel regulations, can strongly influence investor sentiment.

Visual Representation of Stock Price Trends

Source: investopedia.com

A line graph illustrating Marriott’s stock price over the past five years would show periods of growth and decline, reflecting the interplay of the factors discussed above. Key turning points, such as sharp price drops during economic downturns or surges following positive earnings announcements, would be clearly visible. The data points would represent the daily or weekly closing prices, and annotations could highlight significant events influencing price movements.

A bar chart comparing Marriott’s revenue growth with its stock price performance over the same period would reveal the correlation between the company’s financial performance and investor sentiment. The data points for revenue would represent annual revenue figures, while the stock price data would be an average of daily or weekly closing prices for each year. Annotations could be added to highlight years with exceptional revenue growth or significant stock price fluctuations.

FAQ Section

What are the major risks associated with investing in Marriott stock?

Major risks include economic downturns impacting travel, increased competition, changes in consumer preferences, and potential operational challenges.

How does Marriott’s dividend policy affect its stock price?

Marriott’s dividend payouts can influence investor interest; consistent and increasing dividends often attract income-seeking investors, potentially supporting the stock price.

Where can I find real-time Marriott stock price quotes?

Real-time quotes are available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How does the strength of the US dollar affect Marriott’s stock price?

A strong dollar can negatively impact international revenue for Marriott, potentially affecting its overall financial performance and stock price.