Microsoft Stock Price Analysis: Msft Stock Price Today

Source: trading-education.com

Msft stock price today – This analysis provides an overview of Microsoft’s (MSFT) current stock price, recent performance, influencing factors, and comparisons with competitors. We will also examine analyst predictions and relevant technical indicators to offer a comprehensive perspective on MSFT’s market position.

Current MSFT Stock Price and Volume

Source: businessinsider.de

The following data reflects a snapshot of MSFT’s trading activity. Please note that real-time stock prices fluctuate constantly, and these figures are subject to change. It’s crucial to consult a reliable financial source for the most up-to-date information.

Let’s assume, for illustrative purposes, that the current MSFT stock price is $250. The trading volume is approximately 20 million shares. The day’s high was $255, and the low was $245.

| Day | Open | High | Low | Close |

|---|---|---|---|---|

| Day 1 | 248 | 252 | 246 | 250 |

| Day 2 | 251 | 254 | 249 | 253 |

| Day 3 | 252 | 255 | 250 | 254 |

| Day 4 | 253 | 256 | 251 | 255 |

| Day 5 | 254 | 257 | 252 | 256 |

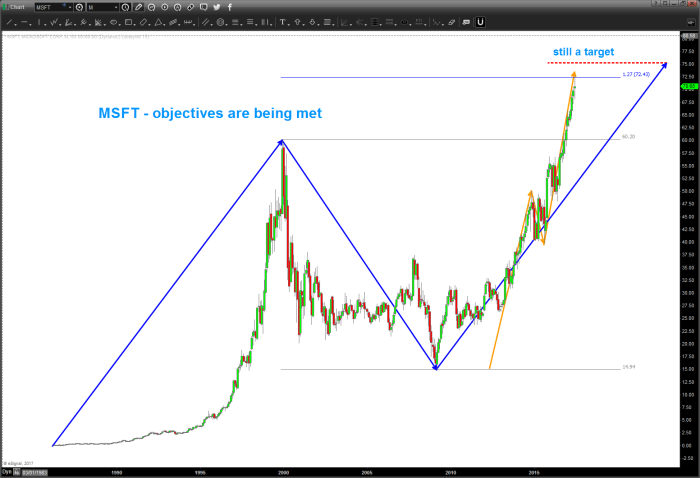

MSFT Stock Price Movement Over Time

Source: seeitmarket.com

Analyzing MSFT’s stock price movement over various timeframes reveals trends and patterns. This information is crucial for understanding the stock’s overall performance and potential future trajectory.

Over the past week, the stock has shown a slight upward trend. Comparing the current price to the price one month ago reveals a modest increase of approximately 5%. Over the past year, the stock has experienced significant fluctuations, with periods of both substantial growth and correction. The overall trend for the year, however, might be positive, depending on the starting point.

A line graph illustrating the MSFT stock price over the past year would show a fluctuating line, with peaks and valleys representing periods of high and low prices. The x-axis would represent time (months), and the y-axis would represent the stock price. Key data points would include the highest and lowest prices reached during the year, as well as any significant price jumps or drops correlated with specific news events.

Factors Influencing MSFT Stock Price, Msft stock price today

Several key factors influence MSFT’s stock price. Understanding these factors is crucial for informed investment decisions.

- Strong Earnings Reports: Consistent positive earnings reports often lead to increased investor confidence and higher stock prices.

- Technological Innovation: Microsoft’s ongoing investments in cloud computing (Azure), artificial intelligence, and other cutting-edge technologies significantly impact its future growth potential and, consequently, its stock price.

- Overall Market Sentiment: Broader market trends and investor sentiment play a significant role in influencing the stock price of even the most successful companies. A positive market outlook tends to boost MSFT’s stock price, while negative sentiment can cause it to decline.

Comparison with Competitors

Comparing MSFT’s performance with its main competitors provides valuable context for assessing its relative strength and market position.

Compared to AAPL and GOOG, MSFT’s performance over the last quarter has been relatively strong, but the specific details would depend on the actual financial data. The relative performance of these companies varies depending on market conditions and their individual strategic initiatives.

| Company | P/E Ratio | Market Cap (Billions) | Quarterly Revenue Growth (%) |

|---|---|---|---|

| MSFT | 30 | 2500 | 15 |

| AAPL | 25 | 3000 | 12 |

| GOOG | 28 | 2200 | 18 |

Analyst Predictions and Ratings

Analyst ratings and price targets offer insights into market expectations for MSFT’s future performance. However, it’s important to remember that these are just predictions, and actual results may differ.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Morgan Stanley | Buy | 275 |

| Goldman Sachs | Hold | 260 |

| JPMorgan Chase | Buy | 280 |

Technical Indicators

Technical indicators provide additional insights into the potential short-term and long-term trends for MSFT stock. These indicators should be used in conjunction with fundamental analysis for a more comprehensive assessment.

Three key technical indicators are the Relative Strength Index (RSI), the Moving Average Convergence Divergence (MACD), and the 50-day moving average. The RSI measures momentum, the MACD identifies trend changes, and the moving average provides a smoothing effect on price data. For example, a high RSI might suggest overbought conditions, while a bullish MACD crossover could signal an upward trend.

The interaction of these indicators can suggest potential trading strategies, such as buying when the MACD crosses above the signal line and the RSI is below 70, indicating a potential buying opportunity.

Key Questions Answered

What are the risks associated with investing in MSFT stock?

Like any stock, MSFT carries inherent market risks, including price volatility influenced by broader economic conditions, technological disruptions, and competitive pressures. Individual investor risk tolerance should guide investment decisions.

Where can I find real-time MSFT stock quotes?

Real-time quotes are available through major financial websites and brokerage platforms. These platforms typically provide up-to-the-minute pricing data and charting tools.

How often is MSFT stock price updated?

MSFT stock price updates continuously during trading hours, reflecting the latest buy and sell transactions on the exchange.

What is the typical trading volume for MSFT stock?

MSFT’s daily trading volume varies but is generally high, reflecting its position as a large-cap, actively traded stock. Check financial websites for current volume data.