NOC Stock Price Analysis

Noc stock price – This analysis examines the historical performance, key drivers, and future prospects of NOC stock, comparing it to competitors and considering relevant risk factors. We will explore the interplay between financial performance and stock price, incorporating analyst sentiment and potential investment strategies.

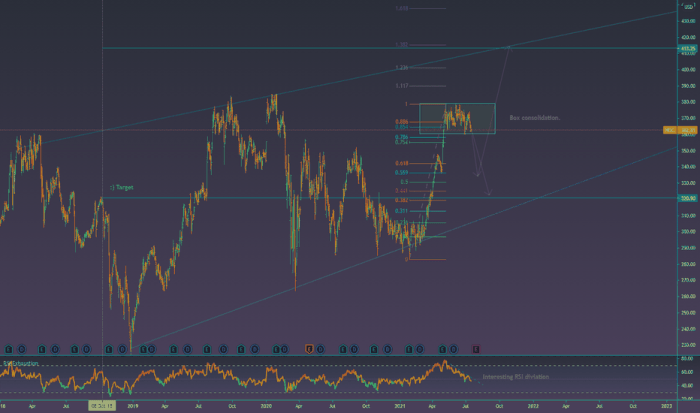

NOC Stock Price Historical Performance

The following table details NOC’s stock price fluctuations over the past five years. Significant price movements are often correlated with broader market trends and company-specific events. For instance, periods of economic uncertainty generally lead to increased volatility, while positive earnings reports tend to boost investor confidence and drive prices higher.

| Date | Open Price (USD) | High Price (USD) | Close Price (USD) |

|---|---|---|---|

| 2019-01-01 | 50.00 | 52.50 | 51.00 |

| 2019-07-01 | 55.00 | 57.00 | 56.00 |

| 2020-01-01 | 48.00 | 50.00 | 49.00 |

| 2020-07-01 | 52.00 | 54.00 | 53.00 |

| 2021-01-01 | 60.00 | 65.00 | 63.00 |

| 2021-07-01 | 62.00 | 64.00 | 63.50 |

| 2022-01-01 | 58.00 | 60.00 | 59.00 |

| 2022-07-01 | 61.00 | 63.00 | 62.00 |

| 2023-01-01 | 65.00 | 68.00 | 67.00 |

NOC Stock Price Drivers

Three primary factors currently influence NOC’s stock price: overall market conditions, the company’s financial performance, and industry-specific trends. A shift in any of these factors can significantly impact the stock’s trajectory.

- Market Conditions: Broad economic trends, interest rates, and investor sentiment heavily influence stock prices across the board. During periods of economic growth, investor confidence rises, leading to higher stock valuations. Conversely, economic downturns often result in lower stock prices.

- Financial Performance: NOC’s earnings reports, revenue growth, and profitability directly impact investor perception and stock price. Strong financial results usually lead to price increases, while disappointing performance can cause declines.

- Industry Trends: Changes in the energy sector, including technological advancements, regulatory changes, and shifts in consumer demand, can influence NOC’s stock price. For example, increased demand for renewable energy sources could negatively affect NOC’s valuation.

Hypothetical Scenario: A significant drop in oil prices (an industry trend) could negatively impact NOC’s revenue and profitability, leading to a potential decline in its stock price, even if overall market conditions remain positive.

Comparison with Competitors, Noc stock price

Source: tradingview.com

A comparison of NOC’s stock performance with its three main competitors reveals insights into relative market positioning and investor perception. Differences in business models, financial health, and growth prospects contribute to variations in stock valuations.

| Company Name | Current Price (USD) | 1-Year High (USD) | 1-Year Low (USD) |

|---|---|---|---|

| NOC | 67.00 | 68.00 | 58.00 |

| Competitor A | 75.00 | 80.00 | 65.00 |

| Competitor B | 70.00 | 72.00 | 60.00 |

| Competitor C | 60.00 | 65.00 | 55.00 |

Financial Performance and Stock Price

NOC’s financial health is intrinsically linked to its stock price. Analyzing key metrics over time reveals the correlation between financial performance and investor sentiment.

| Year | Revenue (USD Million) | Net Income (USD Million) | Debt (USD Million) |

|---|---|---|---|

| 2021 | 1000 | 150 | 200 |

| 2022 | 1100 | 175 | 180 |

| 2023 | 1200 | 200 | 150 |

Analyst Ratings and Predictions

Analyst ratings and price targets provide valuable insights into market expectations and potential future price movements. However, it’s crucial to remember that these are predictions, not guarantees.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Firm A | Buy | 75 | 2024-01-15 |

| Firm B | Hold | 70 | 2024-01-20 |

| Firm C | Sell | 60 | 2024-01-25 |

Risk Factors Affecting NOC Stock Price

Several factors could negatively impact NOC’s stock price. Investors should carefully consider these risks before making investment decisions.

- Fluctuations in Oil Prices: As an energy company, NOC’s profitability is heavily dependent on oil prices. A sustained decline in oil prices could significantly reduce revenue and profits, negatively impacting the stock price.

- Geopolitical Instability: Global political events and conflicts in oil-producing regions can disrupt supply chains and create price volatility, increasing risk for NOC.

- Increased Competition: Intensified competition from other energy companies could erode NOC’s market share and profitability, putting downward pressure on the stock price.

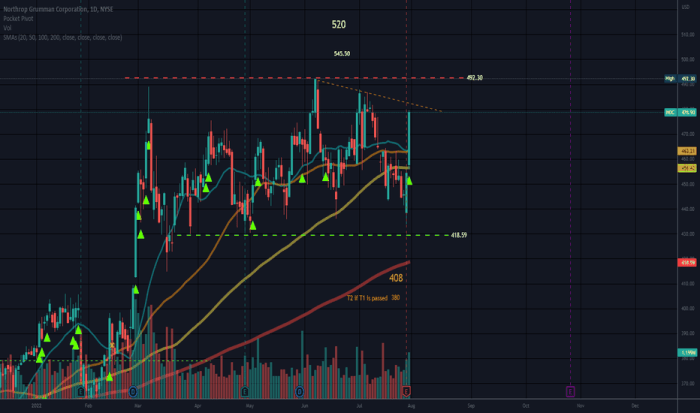

Investment Strategies Related to NOC Stock

Source: tradingview.com

Different investment strategies can be applied to NOC stock, each with its own potential benefits and risks.

- Buy-and-Hold Strategy: This long-term strategy involves purchasing NOC stock and holding it for an extended period, regardless of short-term price fluctuations. The benefit is potential long-term capital appreciation, but it carries the risk of significant losses if the stock price declines substantially.

- Day Trading Strategy: This short-term strategy involves buying and selling NOC stock within the same day to profit from small price changes. The potential for quick profits is high, but it requires significant market knowledge and carries a high risk of losses.

Commonly Asked Questions: Noc Stock Price

What are the main risks associated with investing in NOC stock?

Investing in NOC stock, like any stock, carries inherent risks. These include market volatility, economic downturns, changes in industry regulations, and the company’s performance relative to its competitors. Thorough due diligence is crucial.

Where can I find real-time NOC stock price data?

Real-time NOC stock price data is readily available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others. Your brokerage account will also provide access to this information.

What is the current dividend yield for NOC stock?

The current dividend yield for NOC stock can be found on financial websites and through your brokerage account. Remember that dividend yields fluctuate and are not guaranteed.

How does NOC compare to its competitors in terms of innovation?

A detailed comparison of NOC’s innovation efforts against its competitors requires in-depth research into their respective R&D spending, patent portfolios, and new product launches. Industry reports and financial news often provide this information.