Plug Power Stock Price Analysis: Plug Stock Price

Source: fxstreet.com

Plug stock price – Plug Power, a leading player in the green hydrogen sector, has experienced significant price fluctuations in recent years. This analysis delves into the current market trends, key influencing factors, financial performance, analyst predictions, and inherent investment risks associated with Plug Power stock. Understanding these aspects is crucial for investors seeking to navigate the complexities of this dynamic market.

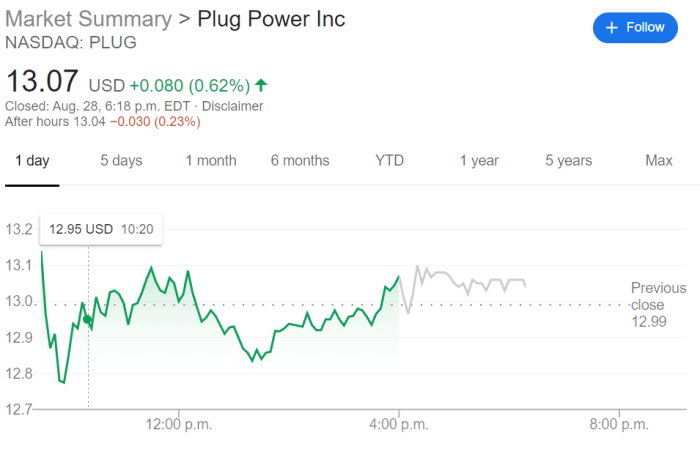

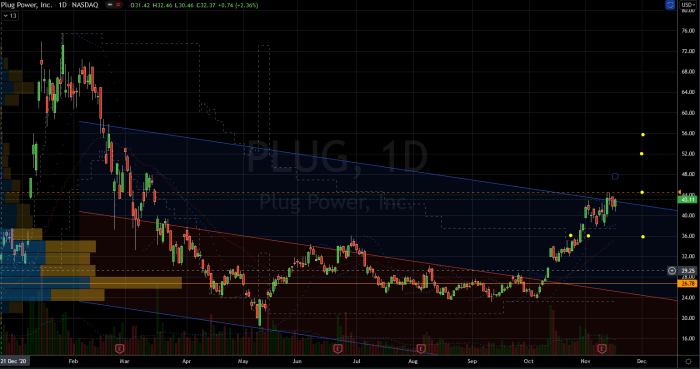

Current Plug Stock Price and Market Trends

Source: investorplace.com

The current Plug Power stock price (as of [Insert Current Date]) is [Insert Current Stock Price]. This price reflects a [Insert Percentage Change] change from the previous closing price. Over the past week, the stock has seen [Describe Week’s Performance], while the performance over the past month has been characterized by [Describe Month’s Performance]. Looking back at the past year, the stock’s performance has been [Describe Year’s Performance].

Significant market events, such as [Mention Specific Market Events and their Impact], have notably influenced the stock’s trajectory.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2018 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| 2019 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| 2020 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| 2021 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| 2022 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

Factors Influencing Plug Power’s Stock Price

Several key factors contribute to the volatility of Plug Power’s stock price. These include the company’s performance relative to its financial projections, the overall market sentiment towards green energy technologies, and significant news releases or announcements from Plug Power itself.

For instance, positive news regarding new contracts, technological breakthroughs, or expansion plans often leads to a rise in the stock price, while negative news such as missed earnings targets or production delays can trigger a decline. Compared to its competitors, such as [List Competitors], Plug Power’s performance is [Compare Performance, using specific metrics if possible].

Understanding Plug stock price fluctuations often requires considering broader market trends. For instance, observing the performance of similar companies, such as checking the current t stock price , can offer valuable context. This comparative analysis helps to gauge the relative strength of Plug’s position within the sector and predict potential future movements in its stock price.

- Macroeconomic Factors: Interest rate changes influence borrowing costs and investment decisions. Government regulations and subsidies related to green energy directly impact the industry’s growth and Plug Power’s profitability. Overall economic growth and consumer spending affect demand for Plug Power’s products and services. Geopolitical events and supply chain disruptions can also significantly impact the company’s operations and stock valuation.

Financial Performance and Valuation of Plug Power

Plug Power’s recent financial reports reveal [Summarize Key Financial Metrics such as Revenue, Earnings, and Debt]. The company’s valuation, based on metrics like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, currently stands at [Insert P/E and P/S ratios with context and comparison to industry averages]. A comparison of the company’s actual financial performance to its projected targets indicates [Compare Actual vs.

Projected Performance].

| Metric | 2021 | 2022 | Projection 2023 |

|---|---|---|---|

| Revenue (USD Million) | [Insert Data] | [Insert Data] | [Insert Data] |

| Net Income (USD Million) | [Insert Data] | [Insert Data] | [Insert Data] |

| Debt (USD Million) | [Insert Data] | [Insert Data] | [Insert Data] |

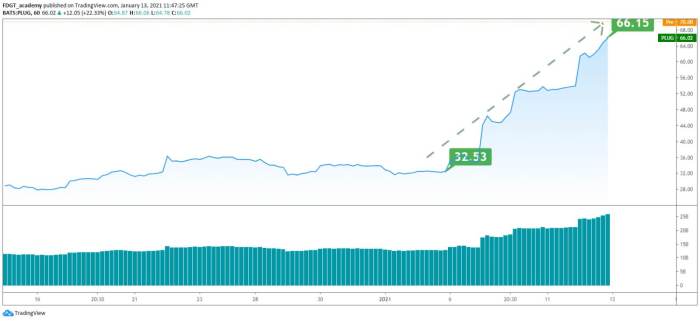

Analyst Ratings and Predictions for Plug Power Stock

Source: fdgtacademy.com

Analyst ratings for Plug Power stock vary, reflecting the inherent uncertainties in the green hydrogen market. Some analysts maintain a [Mention Dominant Rating Type] rating, citing [Reasons for Positive Outlook], while others express a more cautious outlook with [Mention Other Rating Types and Reasons]. The range of price targets set by analysts generally falls between [Mention Price Target Range].

| Analyst Firm | Rating | Target Price | Rationale |

|---|---|---|---|

| [Analyst Firm 1] | [Rating] | [Target Price] | [Rationale] |

| [Analyst Firm 2] | [Rating] | [Target Price] | [Rationale] |

| [Analyst Firm 3] | [Rating] | [Target Price] | [Rationale] |

Risk Assessment for Investing in Plug Power

Investing in Plug Power carries several inherent risks. The company operates in a rapidly evolving technological landscape, facing intense competition and the potential for disruptive innovations. Regulatory changes and government policies concerning green energy initiatives can significantly impact Plug Power’s profitability. Furthermore, macroeconomic factors and geopolitical instability could negatively affect the company’s growth and stock price.

- Potential Downside Scenarios: Failure to secure new contracts or meet production targets. Increased competition leading to lower market share. Significant regulatory hurdles or policy changes hindering expansion plans. Unexpected technological setbacks or delays. Adverse macroeconomic conditions impacting consumer demand.

Plug Power’s Business Model and Growth Strategy

Plug Power’s business model centers around the design, manufacture, and distribution of hydrogen fuel cell systems and related infrastructure. Key revenue streams include the sale of fuel cell systems, hydrogen fueling solutions, and long-term service contracts. The company’s growth strategy focuses on expanding its market share in various sectors, including material handling, transportation, and energy storage. Strategic initiatives such as [Mention Specific Initiatives] are expected to drive future growth and enhance the company’s long-term competitiveness.

A simplified representation of Plug Power’s business model could be visualized as a flowchart: The process begins with research and development leading to the production of fuel cell systems and hydrogen infrastructure. These products are then sold to customers across various sectors. The company also provides ongoing maintenance and service contracts, creating recurring revenue streams. This entire process is supported by strategic partnerships and investments in research and development to maintain a competitive edge in the industry.

Expansion into new markets and technological advancements further fuel growth and profitability.

Popular Questions

What are the main competitors of Plug Power?

Plug Power faces competition from several companies in the green hydrogen sector, including Ballard Power Systems, Bloom Energy, and FuelCell Energy, among others. The competitive landscape is dynamic and constantly evolving.

Is Plug Power profitable?

Plug Power’s profitability has fluctuated. Refer to their financial reports for the most up-to-date information on revenue, earnings, and profitability.

Where can I find real-time Plug Power stock quotes?

Real-time stock quotes for Plug Power are available through major financial websites and brokerage platforms.

What is the typical trading volume for Plug Power stock?

Trading volume varies daily and can be found on financial websites that track stock market data.