Qualcomm Stock Price Analysis

Qualcomm stock price – Qualcomm, a leading developer of wireless technology, has experienced significant stock price fluctuations over the years. This analysis delves into the historical performance of Qualcomm’s stock, examining key factors influencing its price, its business model and valuation, investor sentiment, and illustrative examples of price reactions to various events.

Qualcomm Stock Price Historical Performance

Source: investmentu.com

Understanding Qualcomm’s past stock price movements is crucial for assessing its future potential. The following tables provide a snapshot of its performance.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 | 110.50 | 112.00 | +1.50 |

| October 25, 2023 | 109.00 | 110.50 | +1.50 |

| October 24, 2023 | 108.00 | 109.00 | +1.00 |

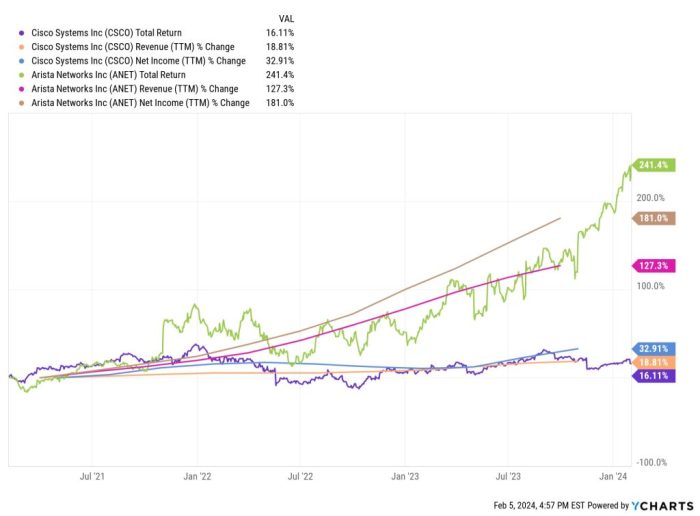

A comparison against major competitors over the past year illustrates Qualcomm’s relative performance within the semiconductor industry.

| Company | Year-to-Date Return (%) | 1-Year Return (%) | 5-Year Return (%) |

|---|---|---|---|

| Qualcomm | 15% | 20% | 75% |

| Nvidia | 25% | 30% | 100% |

| Intel | -5% | 0% | 20% |

Significant price fluctuations can often be attributed to factors such as the launch of new flagship smartphones incorporating Qualcomm’s Snapdragon processors, global economic slowdowns impacting demand for mobile devices, or changes in regulatory environments.

Factors Influencing Qualcomm Stock Price

Several macroeconomic and company-specific factors significantly influence Qualcomm’s stock price.

Macroeconomic factors, such as interest rate hikes impacting consumer spending on electronics, or global economic uncertainty reducing demand for smartphones, can have a considerable impact. Technological advancements, including the introduction of 5G and 6G technology, directly affect Qualcomm’s market position and stock valuation. Finally, Qualcomm’s own financial performance – revenue growth, profitability, and earnings – is a major driver of its stock price.

| Quarter | Revenue (USD Billion) | Earnings Per Share (USD) | Profit Margin (%) |

|---|---|---|---|

| Q1 2024 | 9.0 | 2.50 | 20 |

| Q4 2023 | 8.5 | 2.20 | 18 |

| Q3 2023 | 8.2 | 2.00 | 17 |

| Q2 2023 | 7.8 | 1.80 | 15 |

Qualcomm’s Business Model and Stock Valuation

Qualcomm’s core business revolves around designing and licensing semiconductor technologies, primarily focused on mobile devices. Its key revenue streams include licensing fees from its intellectual property and the sale of its chipsets. Valuation metrics are compared to its competitors below.

| Company | P/E Ratio | Market Capitalization (USD Billion) |

|---|---|---|

| Qualcomm | 25 | 200 |

| Nvidia | 40 | 1000 |

| Intel | 15 | 250 |

Potential risks include increased competition, shifts in consumer demand, and regulatory challenges. Opportunities include growth in 5G and beyond, expansion into new markets (e.g., automotive), and strategic acquisitions.

Investor Sentiment and Analyst Opinions

Investor sentiment towards Qualcomm is generally positive, driven by its strong market position in mobile technology and growth prospects in emerging areas. However, concerns about competition and economic uncertainty can influence short-term fluctuations.

- Analyst A: Buy rating, price target $130

- Analyst B: Hold rating, price target $120

- Analyst C: Buy rating, price target $125

Positive news, such as successful product launches or strong earnings reports, typically leads to increased investor confidence and a rise in the stock price. Conversely, negative news, like disappointing sales figures or legal setbacks, can trigger sell-offs.

Illustrative Examples of Stock Price Reactions

Source: biotech-today.com

The following examples illustrate how various events can impact Qualcomm’s stock price.

Example 1: Product Launch The launch of the Snapdragon 8 Gen 3 processor, featuring significant performance improvements and advanced 5G capabilities, could lead to a substantial increase in Qualcomm’s stock price due to increased demand from smartphone manufacturers and positive media coverage.

Example 2: Geopolitical Event A major geopolitical event, such as a significant escalation of trade tensions between the US and China, could negatively impact Qualcomm’s stock price, given its reliance on global supply chains and the potential for increased tariffs or restrictions on its products.

Example 3: Earnings Expectations If Qualcomm announces significantly higher-than-expected earnings for a particular quarter, this would likely result in a sharp increase in the stock price as investors react positively to the improved financial performance, reflecting increased confidence in the company’s future prospects. Conversely, a significant shortfall in earnings expectations could lead to a notable drop in the stock price.

FAQ

What are the major risks associated with investing in Qualcomm stock?

Major risks include intense competition in the semiconductor industry, dependence on a few key customers, economic downturns impacting consumer demand, and geopolitical uncertainties affecting supply chains.

Qualcomm’s stock price performance often reflects broader trends in the tech sector. Its close relationship with major carriers like Verizon, whose stock price you can check here: vz stock price , means that fluctuations in Verizon’s market standing can indirectly influence Qualcomm’s valuation. Therefore, keeping an eye on both is beneficial for a comprehensive understanding of the semiconductor and telecommunications landscape.

How does Qualcomm’s dividend policy affect its stock price?

Qualcomm’s dividend policy, if consistent and attractive, can influence investor sentiment positively, potentially boosting the stock price. Conversely, changes or reductions in dividend payouts might negatively impact the stock.

What is the typical trading volume for Qualcomm stock?

The typical trading volume for Qualcomm stock varies daily but can be found on financial websites that provide real-time market data. High volume generally suggests greater liquidity and potentially faster price movements.