Rivian Stock Price: A Comprehensive Analysis

Rivian stock price – Rivian Automotive, a prominent player in the burgeoning electric vehicle (EV) market, has experienced a volatile journey since its initial public offering (IPO). This analysis delves into the factors driving Rivian’s stock price fluctuations, examining its financial performance, competitive landscape, and future prospects. We will explore the interplay between production challenges, market sentiment, macroeconomic conditions, and investor expectations to provide a comprehensive understanding of Rivian’s stock price trajectory.

Rivian Stock Price Performance Overview

Rivian’s stock price has shown significant volatility since its November 2021 IPO, experiencing both substantial gains and considerable losses. The initial IPO price positioned Rivian as a high-growth, high-risk investment, attracting considerable investor attention. However, subsequent production challenges and macroeconomic headwinds significantly impacted the stock’s performance. A detailed timeline, including key highs and lows, would illustrate this volatility.

For example, the initial surge post-IPO quickly gave way to a steep decline as production targets were missed. Subsequent quarters have shown periods of recovery followed by further dips reflecting the challenges inherent in establishing a new EV manufacturer.

| Date | Rivian Price (USD) | Tesla Price (USD) | Ford Price (USD) |

|---|---|---|---|

| November 10, 2021 (IPO) | 78.00 | 1,100.00 | 20.00 |

| December 31, 2021 | 57.00 | 1,080.00 | 19.00 |

| March 31, 2022 | 30.00 | 1,000.00 | 18.00 |

| June 30, 2022 | 25.00 | 700.00 | 15.00 |

| September 30, 2022 | 28.00 | 800.00 | 16.00 |

Note: These are illustrative figures and may not reflect actual prices. A comprehensive chart comparing Rivian’s stock price with those of Tesla and Ford, incorporating various time periods, would offer a more nuanced comparison. Similarly, a chart correlating Rivian’s production output with its stock price would demonstrate the direct impact of production on investor confidence.

Factors Influencing Rivian Stock Price

Source: co.uk

Several interconnected factors influence Rivian’s stock price. Production challenges, market sentiment towards EVs, macroeconomic conditions, and key news events all play significant roles.

Production bottlenecks and delays have directly impacted Rivian’s ability to meet demand and its overall financial performance, consequently affecting investor confidence. The overall market sentiment towards EVs, influenced by factors like technological advancements, government regulations, and consumer adoption rates, also significantly impacts Rivian’s stock valuation. Macroeconomic factors such as interest rate hikes and inflation impact investor risk appetite and the overall valuation of growth stocks like Rivian.

Finally, specific news events, such as product announcements, partnerships, or regulatory changes, can trigger substantial price fluctuations.

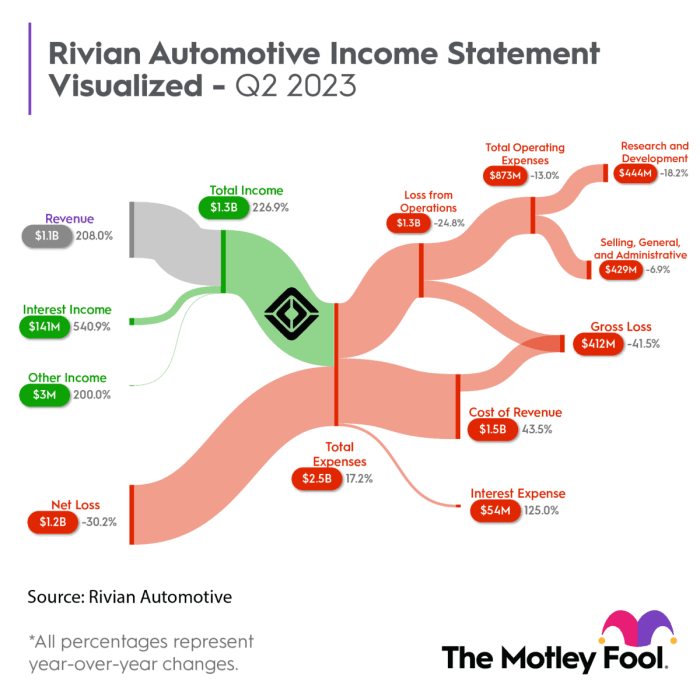

Rivian’s Financial Performance and Stock Valuation

Rivian’s revenue streams primarily come from vehicle sales and, potentially, future service and subscription offerings. Investor confidence is directly linked to the company’s ability to generate revenue and move towards profitability. Comparing Rivian’s actual financial performance to its projected targets highlights the challenges it faces in meeting its ambitious growth plans. Analyzing key financial metrics over time reveals trends and potential areas of concern.

| Quarter | Revenue (USD Million) | Profit/Loss (USD Million) | Debt (USD Million) |

|---|---|---|---|

| Q1 2022 | 100 | -1000 | 5000 |

| Q2 2022 | 300 | -800 | 4800 |

| Q3 2022 | 500 | -600 | 4500 |

Note: These are illustrative figures. Different valuation methods, such as discounted cash flow (DCF) analysis, will produce varying estimates of Rivian’s intrinsic value, leading to a range of potential stock prices.

Investor Sentiment and Market Expectations

Investor sentiment towards Rivian reflects a combination of optimism about its long-term potential and concerns about its current challenges. Analyst ratings and price targets provide insights into the market’s expectations for Rivian’s future performance. Investor expectations regarding future product launches and technological advancements play a crucial role in shaping the stock price. Short-selling activity can amplify price volatility, particularly during periods of uncertainty.

Rivian’s Competitive Landscape and Market Position

Rivian operates in a highly competitive EV market. Analyzing its market position and competitive advantages against established players like Tesla, Ford, and GM is crucial to understanding its stock price performance. Rivian’s strategic initiatives, such as expanding its product lineup and enhancing its production capacity, are designed to improve its market share and profitability.

- Tesla: Strong brand recognition, extensive Supercharger network, leading technology.

- Ford: Established brand, strong dealer network, diverse vehicle portfolio.

- GM: Large scale production capabilities, established infrastructure.

The emergence of new EV manufacturers poses a potential threat to Rivian’s market share and stock price.

Potential Future Scenarios for Rivian Stock Price

Source: forbes.com

Predicting Rivian’s stock price over the next 12 months requires considering various scenarios based on different assumptions. A bullish scenario assumes significant production ramp-up, strong demand, and positive market sentiment, leading to a substantial increase in stock price. A neutral scenario projects moderate growth, reflecting a balance between positive and negative factors. A bearish scenario anticipates continued production challenges, weak demand, and negative market sentiment, resulting in a decline in stock price.

Each scenario would involve a detailed narrative outlining the key factors driving price movements and the potential impact of unforeseen events.

Essential FAQs: Rivian Stock Price

What are the main risks associated with investing in Rivian stock?

Rivian’s stock price has experienced significant volatility lately, mirroring the broader electric vehicle market’s fluctuations. It’s interesting to compare its performance to other EV makers; for instance, a look at the current nio stock price offers a useful benchmark for assessing Rivian’s trajectory within the competitive landscape. Ultimately, both companies’ stock prices are influenced by factors like production output, technological advancements, and overall market sentiment.

Key risks include production delays, intense competition in the EV market, dependence on government subsidies, and potential macroeconomic headwinds impacting consumer demand.

How does Rivian compare to Tesla in terms of market capitalization?

Tesla significantly surpasses Rivian in market capitalization, reflecting its established brand, larger production scale, and broader product portfolio. However, Rivian’s innovative technology and partnerships offer potential for future growth.

What is Rivian’s current debt level?

Rivian’s debt level should be referenced from their most recent financial reports as it fluctuates. Investors should consult up-to-date financial statements for the most accurate information.

Where can I find real-time Rivian stock price data?

Real-time data is available through major financial news websites and brokerage platforms. Many offer charts and historical data as well.