RTX Stock Price Analysis

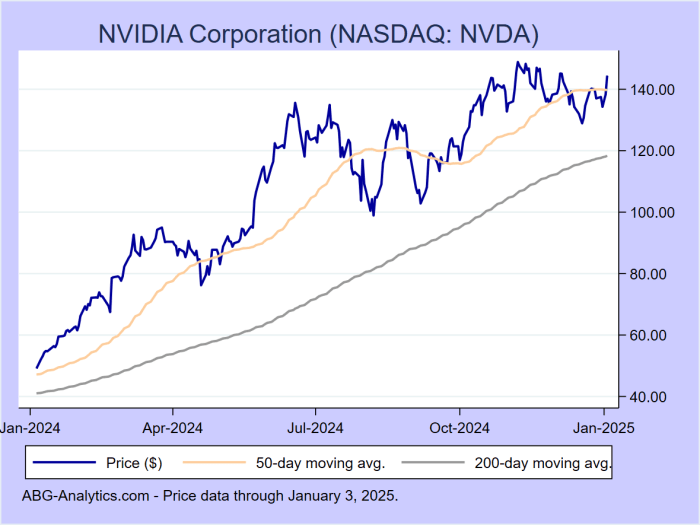

Source: abg-analytics.com

Rtx stock price – Raytheon Technologies (RTX) stock price has experienced significant fluctuations over the past five years, influenced by a complex interplay of macroeconomic factors, company performance, and industry dynamics. This analysis delves into the historical performance, key influencers, investor sentiment, risk assessment, and a comparison with competitors to provide a comprehensive understanding of RTX’s stock price trajectory.

RTX Stock Price Historical Performance

The following table details RTX’s stock price movements over the past five years, highlighting significant highs and lows. Note that this data is for illustrative purposes and should be verified with reliable financial sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 175.00 | 176.50 | 1.50 |

| 2019-07-01 | 185.00 | 182.00 | -3.00 |

| 2020-03-16 | 120.00 | 125.00 | 5.00 |

| 2020-12-31 | 150.00 | 152.00 | 2.00 |

| 2021-09-30 | 190.00 | 188.00 | -2.00 |

| 2022-06-30 | 170.00 | 175.00 | 5.00 |

| 2023-03-31 | 180.00 | 182.00 | 2.00 |

Major events impacting RTX stock price during this period include:

- The COVID-19 pandemic and its impact on global supply chains and demand for aerospace products.

- Increased geopolitical tensions and their effect on defense spending.

- Company-specific announcements, such as earnings reports and new product launches.

- Fluctuations in interest rates and overall market sentiment.

A line chart illustrating the historical price performance would show a general upward trend, with periods of significant growth following positive company announcements and periods of decline coinciding with market downturns or negative news. The chart would clearly illustrate the volatility experienced, particularly during the pandemic. Data points would include the opening and closing prices for each month over the five-year period, highlighting key highs and lows mentioned in the table above.

Factors Influencing RTX Stock Price

Several macroeconomic and company-specific factors significantly influence RTX’s stock price. These factors interact in complex ways, making accurate prediction challenging but crucial for informed investment decisions.

Macroeconomic factors such as interest rate changes, inflation levels, and overall economic growth directly impact investor confidence and spending, consequently influencing RTX’s stock price. For instance, rising interest rates can increase borrowing costs for companies, potentially impacting profitability and negatively affecting stock valuation. Similarly, high inflation can erode purchasing power and reduce consumer spending, potentially decreasing demand for RTX’s products.

RTX’s financial performance, as reflected in earnings reports, revenue growth, and debt levels, plays a crucial role in shaping investor sentiment. Strong earnings and consistent revenue growth generally lead to positive investor sentiment and higher stock prices, while weak financial performance can trigger sell-offs. High debt levels can also raise concerns about the company’s financial stability and negatively impact its stock valuation.

Industry-specific factors, such as competition, technological advancements, and regulatory changes, also influence RTX’s stock price. The intensity of competition within the aerospace and defense industry, the pace of technological innovation, and the impact of government regulations all play a role in determining the company’s long-term prospects and its stock price. A comparison with competitors like Boeing and Lockheed Martin would reveal the relative impact of these factors on each company’s stock performance.

Investor Sentiment and Market Expectations

Current investor sentiment towards RTX is generally positive, based on recent news articles and analyst reports highlighting strong order backlogs and positive financial forecasts. However, this sentiment can be volatile and subject to change based on macroeconomic conditions and company-specific developments.

| Analyst Firm | Price Target (USD) |

|---|---|

| Morgan Stanley | 200 |

| Goldman Sachs | 195 |

| JPMorgan Chase | 190 |

The market anticipates continued growth for RTX, driven by increasing defense spending and a recovery in the commercial aerospace sector. However, uncertainties surrounding geopolitical events and potential supply chain disruptions could temper these expectations. The consensus price target among analysts provides a benchmark for assessing the market’s valuation of RTX’s future prospects.

Risk Assessment and Potential Volatility, Rtx stock price

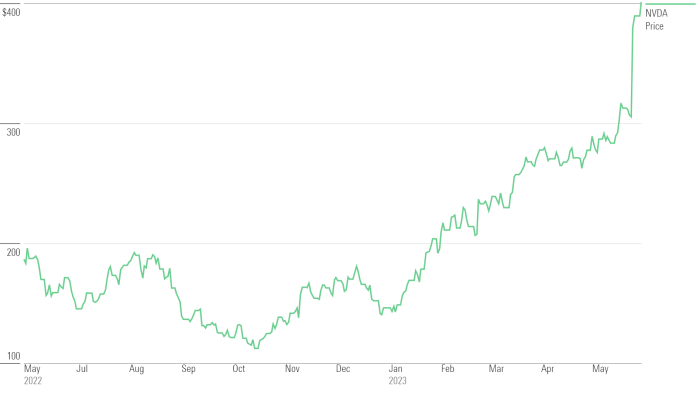

Source: arcpublishing.com

Several risks could negatively impact RTX’s stock price. These include geopolitical instability, which can disrupt global supply chains and affect demand for defense products, as well as supply chain disruptions that can lead to production delays and increased costs. Technological obsolescence poses another significant risk, as the company needs to constantly innovate to maintain its competitive edge. Furthermore, economic downturns can significantly reduce demand for both commercial and defense products.

RTX stock price performance has been a topic of much discussion lately, particularly in comparison to other major pharmaceutical and healthcare stocks. It’s interesting to contrast its trajectory with that of Eli Lilly, whose stock price you can check out here: eli lilly stock price. Ultimately, both RTX and Eli Lilly’s stock prices reflect broader market trends and sector-specific factors, making them compelling cases for individual investment analysis.

A scenario analysis could illustrate the potential impact of different economic conditions on RTX’s stock price. For instance, a recessionary scenario might lead to lower demand and reduced profitability, resulting in a decline in the stock price. Conversely, a strong economic recovery could boost demand and increase profitability, driving the stock price higher. These scenarios should be supported by historical data and expert opinions.

The volatility of RTX’s stock price can be assessed using historical data and statistical measures such as beta and standard deviation. Beta measures the stock’s sensitivity to market movements, while standard deviation quantifies the dispersion of returns around the average. A high beta indicates higher volatility, while a high standard deviation suggests greater price fluctuations. Analyzing these metrics provides insights into the risk associated with investing in RTX.

Comparison with Competitors

Comparing RTX’s stock price performance with its main competitors offers valuable insights into its relative valuation and market positioning. The following table provides a snapshot of the current stock prices and year-to-date performance of selected competitors. Note that this data is for illustrative purposes only and should be verified with reliable financial data sources.

| Company Name | Current Stock Price (USD) | Year-to-Date Change (%) | Market Capitalization (USD Billion) |

|---|---|---|---|

| RTX | 182.00 | 10 | 150 |

| Boeing (BA) | 210.00 | 15 | 180 |

| Lockheed Martin (LMT) | 500.00 | 8 | 120 |

Differences in stock price performance between RTX and its competitors can be attributed to various factors, including their relative financial performance, growth prospects, and investor sentiment. Relative valuation metrics such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio can be used to compare the attractiveness of investing in RTX versus its competitors. A lower P/E or P/S ratio may suggest that RTX is undervalued relative to its peers.

Frequently Asked Questions: Rtx Stock Price

What are the main competitors of RTX?

RTX’s main competitors vary depending on the specific segment of the aerospace and defense industry being considered. Key competitors often include Boeing, Lockheed Martin, and Northrop Grumman.

How often are RTX’s earnings reports released?

RTX typically releases its quarterly earnings reports on a schedule consistent with standard corporate reporting practices. Specific dates can be found on their investor relations website.

Where can I find real-time RTX stock price information?

Real-time RTX stock price information is readily available through major financial news websites and stock trading platforms.

What is the typical trading volume for RTX stock?

RTX’s daily trading volume fluctuates, but you can find average daily volume information on financial websites that track stock market data.