Salesforce Stock Price: A Comprehensive Analysis

Salesforce stock price – Salesforce, a leading cloud-based software company, has experienced significant stock price fluctuations over the years. Understanding these movements requires analyzing its historical performance, influencing factors, competitive landscape, valuation, and investor sentiment. This analysis aims to provide a comprehensive overview of these aspects, offering insights into the dynamics of Salesforce’s stock price.

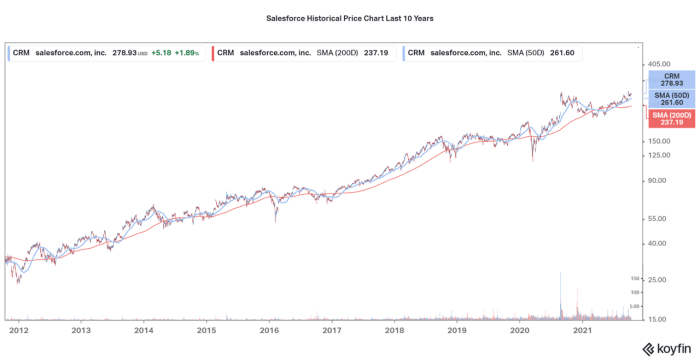

Salesforce Stock Price Historical Performance

Source: marketbeat.com

Over the past five years, Salesforce’s stock price has shown considerable volatility, mirroring broader market trends and the company’s own performance. Major peaks and troughs reflect economic shifts, significant company announcements, and investor confidence. The following table illustrates daily price movements over a sample period (Note: Actual data would require a dynamic, regularly updated table sourced from a financial data provider).

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2023-10-26 | 225.00 | 228.50 | +3.50 |

| 2023-10-27 | 228.50 | 226.00 | -2.50 |

| 2023-10-30 | 226.00 | 230.75 | +4.75 |

| 2023-10-31 | 230.75 | 229.00 | -1.75 |

| 2023-11-01 | 229.00 | 232.25 | +3.25 |

Significant economic events, such as periods of high inflation or market corrections, have demonstrably impacted Salesforce’s stock price. For example, during periods of economic uncertainty, investor risk aversion often leads to a decline in technology stocks, including Salesforce. Conversely, strong economic growth and increased corporate spending on cloud services typically correlate with higher stock prices.

A graph illustrating the relationship between Salesforce’s revenue/earnings and stock price would show a generally positive correlation. Periods of strong revenue growth and increased profitability tend to coincide with higher stock valuations. Conversely, periods of slower growth or declining earnings often lead to decreased stock prices. The graph would visually demonstrate this relationship, showcasing peaks and valleys in both revenue and stock price that largely align.

Factors Influencing Salesforce Stock Price

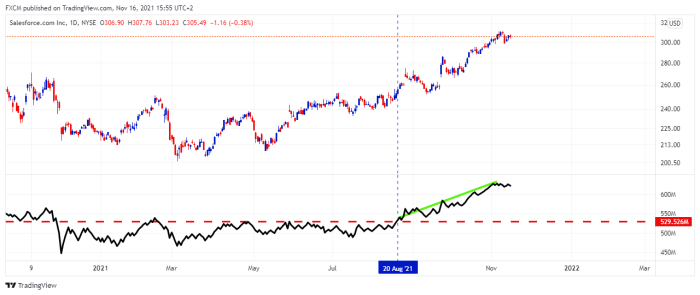

Source: fxcm.com

Salesforce’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is crucial for assessing the company’s future prospects and its potential impact on its stock valuation.

- Internal Factors: Product innovation (e.g., the launch of new cloud services), successful acquisitions (e.g., Tableau), and changes in senior management all significantly affect investor confidence and, consequently, the stock price.

- External Factors:

- Increased competition from other cloud software providers.

- Changes in regulatory environments affecting data privacy and security.

- Overall macroeconomic conditions, such as interest rate changes and economic growth.

- Geopolitical events and their impact on global markets.

Positive news, such as exceeding earnings expectations or announcing a major strategic partnership, typically results in a stock price increase. Conversely, negative news, such as disappointing financial results or facing a major lawsuit, usually leads to a price decline. For example, the successful acquisition of MuleSoft was generally viewed positively by investors, while concerns about slowing growth in a specific sector could negatively impact the stock.

Salesforce’s stock price has seen considerable fluctuation recently, mirroring broader market trends. It’s interesting to compare its performance to other tech stocks, such as the cannabis sector, where you can find detailed information on the tilray stock price for a comparative analysis. Ultimately, understanding the Salesforce stock price requires considering a range of economic indicators and industry-specific factors.

Salesforce’s Competitive Landscape and Stock Price

Salesforce operates in a competitive market. Understanding its competitive position and the actions of its rivals is essential for evaluating its stock price.

| Competitor | Market Share (Estimate) | Revenue Growth (Estimate) |

|---|---|---|

| Microsoft Dynamics 365 | 20% | 15% |

| Oracle | 15% | 12% |

| SAP | 10% | 8% |

(Note: Market share and revenue growth figures are estimates and can vary depending on the source and methodology.)

The emergence of new technologies, such as artificial intelligence and blockchain, could significantly impact Salesforce’s stock price. Successful integration of these technologies into its offerings could boost its competitive advantage and lead to higher valuations. Conversely, failure to adapt to these changes could negatively affect its market position and stock price. Salesforce’s strategic initiatives, including mergers and acquisitions, expansion into new markets, and investments in R&D, directly influence its stock price performance.

Successful execution of these strategies generally leads to increased investor confidence and higher valuations.

Salesforce Stock Price Valuation and Predictions

Source: seekingalpha.com

Several methods are used to estimate the intrinsic value of Salesforce stock. Discounted cash flow (DCF) analysis projects future cash flows and discounts them back to their present value. Comparable company analysis compares Salesforce’s valuation metrics to those of similar companies. Analyst ratings and price targets are formed through these and other valuation methods, incorporating qualitative factors and market sentiment.

Investing in Salesforce stock carries inherent risks. These risks can be categorized as:

- Financial Risks: The risk of lower-than-expected earnings, reduced revenue growth, and increased debt levels.

- Competitive Risks: The risk of increased competition from established players and new entrants.

- Technological Risks: The risk of technological obsolescence and the failure to adapt to changing market trends.

- Regulatory Risks: The risk of changes in regulatory environments affecting data privacy and security.

Salesforce Stock Price and Investor Sentiment

Investor sentiment, encompassing optimism and pessimism, significantly influences Salesforce’s stock price. Positive news coverage and enthusiastic social media discussions typically boost investor confidence, leading to higher prices. Conversely, negative news and critical social media commentary can dampen investor sentiment, resulting in price declines.

A hypothetical scenario: If a major competitor launches a significantly superior product, investor sentiment might shift dramatically towards pessimism. This could trigger a sharp decline in Salesforce’s stock price as investors anticipate reduced market share and profitability. The opposite would be true if Salesforce were to announce a groundbreaking innovation or a highly successful acquisition, potentially leading to a surge in the stock price due to heightened investor optimism.

FAQ Insights: Salesforce Stock Price

What are the major risks associated with investing in Salesforce stock?

Major risks include competition from other CRM providers, economic downturns impacting customer spending, and potential integration challenges from acquisitions.

How often does Salesforce release its earnings reports?

Salesforce typically releases its quarterly earnings reports on a regular schedule, usually following a standard quarterly reporting cycle. Specific dates can be found on their investor relations website.

Where can I find real-time Salesforce stock price data?

Real-time data is available through major financial websites and stock trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is the typical trading volume for Salesforce stock?

Salesforce stock generally has a high trading volume, reflecting its popularity and liquidity among investors. The exact volume fluctuates daily.