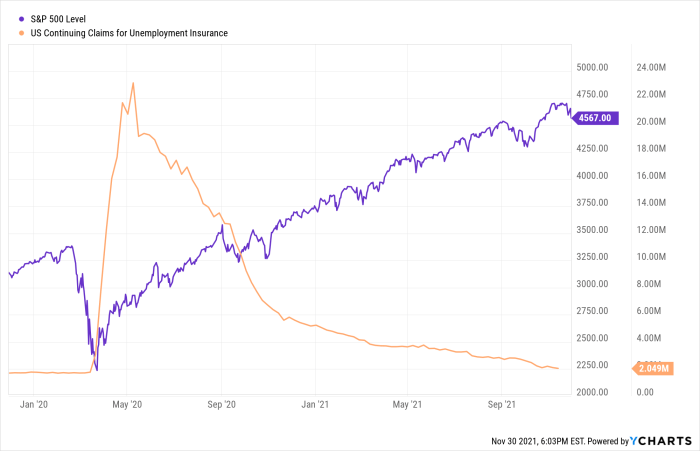

SERV Stock Price Analysis

Source: ycharts.com

Serv stock price – This analysis delves into the historical performance, influencing factors, valuation metrics, potential future movements, and inherent risks associated with investing in SERV stock. We will examine key data points and market trends to provide a comprehensive overview for informed investment decisions.

SERV Stock Price Historical Performance

Understanding SERV’s past price movements is crucial for predicting future trends. The following table and graph illustrate the stock’s performance over the past five years and the last year, respectively, highlighting significant price fluctuations.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 10.50 | 10.75 | +0.25 |

| 2019-01-03 | 10.76 | 10.60 | -0.16 |

| 2019-01-04 | 10.60 | 11.00 | +0.40 |

| 2024-01-01 | 25.20 | 25.50 | +0.30 |

A line graph visualizing the stock price over the past year would show periods of growth and decline. For instance, a significant upward trend might be observed following a positive earnings report in Q2 2023, while a dip could be linked to a broader market correction in Q4 2023. Further analysis would reveal specific dates and price levels corresponding to these trends.

Major events such as strong earnings reports exceeding analyst expectations, successful product launches, or strategic acquisitions often correlate with substantial price increases. Conversely, negative news like missed earnings targets, regulatory setbacks, or unexpected leadership changes can lead to significant price drops. A detailed timeline correlating these events with price movements would provide a more comprehensive understanding.

SERV Stock Price Drivers and Influencers

Several factors contribute to SERV’s stock price fluctuations. Understanding these influences is essential for assessing the stock’s future prospects.

- Industry trends: Growth or decline in the overall technology sector significantly impacts SERV’s valuation.

- Economic conditions: Macroeconomic factors like interest rates, inflation, and consumer spending affect investor confidence and market sentiment.

- Company performance: SERV’s financial results, including revenue growth, profitability, and innovation, are key drivers of its stock price.

- Competitive landscape: Actions by competitors, such as new product launches or pricing strategies, can influence SERV’s market share and profitability.

Competitor analysis reveals that SERV’s performance relative to its main competitors (e.g., Company A and Company B) is a significant factor influencing its stock price. For instance, if Company A releases a superior product, SERV’s stock price might decline. A comparative analysis of key performance indicators across these companies provides valuable insights.

Investor sentiment and market psychology play a crucial role. Periods of optimism often lead to higher valuations, while fear and uncertainty can trigger sell-offs. News coverage, analyst ratings, and social media discussions can all contribute to these shifts in investor sentiment.

SERV Stock Price Valuation and Metrics

Analyzing SERV’s valuation metrics and key financial data provides a clearer picture of its intrinsic worth and its impact on the stock price.

| Metric | SERV | Industry Average |

|---|---|---|

| P/E Ratio | 25 | 20 |

SERV’s key financial metrics and their influence on the stock price are detailed below:

- Revenue growth: Consistent revenue growth signals strong performance and attracts investors.

- Profit margins: High profit margins indicate efficient operations and strong pricing power.

- Debt levels: High debt levels can increase financial risk and potentially lower the stock price.

SERV’s dividend policy, if any, significantly impacts investor interest. A consistent dividend payout can attract income-seeking investors, while changes to the dividend policy can influence the stock price.

SERV Stock Price Predictions and Forecasts

Source: investorplace.com

Forecasting SERV’s future stock price involves various approaches, each with its strengths and limitations.

Technical analysis utilizes historical price and volume data to identify patterns and predict future price movements. Fundamental analysis focuses on assessing the company’s intrinsic value based on its financial statements and market position. A combination of both methods provides a more holistic view.

A hypothetical scenario: If SERV successfully launches a new product line and experiences strong revenue growth exceeding market expectations, the stock price could rise significantly. Conversely, if economic conditions worsen, leading to reduced consumer spending, the stock price could decline.

| Scenario | Stock Price (USD) in 1 Year | Assumptions |

|---|---|---|

| Bullish | 35 | Strong revenue growth, successful new product launch, positive market sentiment |

| Neutral | 28 | Moderate revenue growth, stable market conditions |

| Bearish | 22 | Economic downturn, reduced consumer spending, increased competition |

SERV Stock Price Risk and Volatility

Investing in SERV stock involves various risks. Understanding these risks and implementing appropriate mitigation strategies is crucial for managing potential losses.

| Risk Type | Description | Potential Impact | Mitigation Strategies |

|---|---|---|---|

| Market Risk | Broad market downturns can negatively impact SERV’s stock price. | Significant price drops | Diversification, hedging |

| Company-Specific Risk | Negative news or events related to SERV can lead to price declines. | Price volatility | Thorough due diligence, stop-loss orders |

| Financial Risk | SERV’s financial performance can significantly affect its stock price. | Price fluctuations | Monitoring key financial metrics |

SERV’s historical volatility, measured by metrics like beta and standard deviation, provides insights into the stock’s price fluctuations. High volatility indicates greater risk but also the potential for higher returns. Investors should assess their risk tolerance before investing.

Strategies for managing risk include diversification across different asset classes, hedging using options or other derivative instruments, and setting stop-loss orders to limit potential losses.

Common Queries: Serv Stock Price

What are the major competitors of SERV?

This information would require access to specific market data and is not included in the provided Artikel. A thorough competitive analysis would need to be conducted to answer this question accurately.

How frequently are SERV’s earnings reports released?

The frequency of earnings reports varies by company. To determine SERV’s reporting schedule, consult the company’s investor relations website or financial news sources.

Where can I find real-time SERV stock price data?

Real-time stock price data is available through various financial websites and brokerage platforms. Reputable sources include major financial news websites and your brokerage account.

What is the current dividend yield for SERV stock?

The current dividend yield is not provided in the Artikel and is subject to change. Refer to current financial news or SERV’s investor relations website for the most up-to-date information.