Understanding SPY Stock Price Fluctuations

Spy stock price – The SPDR S&P 500 ETF Trust (SPY) tracks the S&P 500 index, making its price a barometer of the overall US stock market. Understanding SPY price fluctuations is crucial for investors. Several interconnected factors contribute to its price movements, ranging from macroeconomic trends to individual company performance and investor sentiment.

Factors Influencing SPY Stock Price Movements

SPY’s price is influenced by a multitude of factors. These include broad economic conditions like interest rate changes, inflation, and GDP growth. Geopolitical events, such as international conflicts or trade wars, can also significantly impact market sentiment and, consequently, SPY’s price. Furthermore, the performance of individual companies within the S&P 500 directly affects the index’s overall value, influencing SPY’s price.

Finally, investor sentiment and trading activity play a pivotal role, with periods of high optimism leading to price increases and pessimism causing declines.

Historical Performance of SPY Stock Price (Past Five Years)

Over the past five years, SPY has exhibited periods of both significant growth and volatility. While specific numerical data requires referencing a financial data provider, a general observation would be a strong upward trend overall, punctuated by corrections and periods of consolidation. Analyzing historical data reveals patterns and potential future trends. Consider consulting financial charts and reports for detailed performance figures.

Comparison of SPY Stock Price with Other Major Indices

SPY’s performance is often compared to other major indices, such as the Dow Jones Industrial Average (DJIA) and the NASDAQ Composite. While these indices often move in tandem, their correlations are not always perfect. Differences in their composition and weighting schemes can lead to divergences in their performance. For instance, the technology-heavy NASDAQ might outperform SPY during periods of strong tech sector growth, while SPY might better reflect broader market trends.

Correlation Between SPY Stock Price and Economic Indicators

| Economic Indicator | Correlation with SPY Price (Example) | Strength of Correlation | Notes |

|---|---|---|---|

| Inflation Rate (CPI) | Negative | Moderate | High inflation generally negatively impacts stock prices. |

| Unemployment Rate | Negative | Moderate | High unemployment can signal economic weakness. |

| GDP Growth | Positive | Strong | Strong economic growth usually supports stock market performance. |

| Interest Rates | Negative | Moderate | Rising interest rates can increase borrowing costs for companies. |

SPY Stock Price and Market Sentiment

Market sentiment, the overall feeling of investors toward the market, significantly influences SPY’s price. News events, investor psychology, and social media trends all play a role in shaping this sentiment.

News Events Impacting SPY Stock Price

Major news events, such as unexpected economic data releases, significant geopolitical developments, or announcements from the Federal Reserve, can trigger sharp movements in SPY’s price. For example, unexpected interest rate hikes can lead to immediate sell-offs, while positive economic news often results in price increases. The COVID-19 pandemic serves as a prime example of a news event that dramatically impacted SPY, initially causing a sharp decline followed by a strong recovery.

Investor Sentiment and SPY Stock Price

Investor sentiment, ranging from extreme optimism to deep pessimism, directly impacts SPY’s price. Periods of widespread optimism often lead to “bull markets” characterized by rising prices, while pessimism can trigger “bear markets” with falling prices. These shifts in sentiment are often self-reinforcing, with rising prices attracting more buyers and falling prices prompting more selling.

Social Media’s Influence on SPY Stock Price

Social media platforms have become increasingly influential in shaping market sentiment and, consequently, SPY’s price. Rapid dissemination of information and opinions, sometimes lacking factual basis, can lead to short-term price volatility. The spread of misinformation or coordinated trading activity on platforms like Twitter or Reddit can create significant price swings, highlighting the need for critical evaluation of online information.

Timeline of Major SPY Price Shifts and Market Sentiment

A detailed timeline would require a visual representation, but generally, periods of economic expansion are associated with positive market sentiment and rising SPY prices, while recessions or economic uncertainty often correlate with negative sentiment and price declines. Major events like the 2008 financial crisis or the dot-com bubble provide clear examples of this correlation.

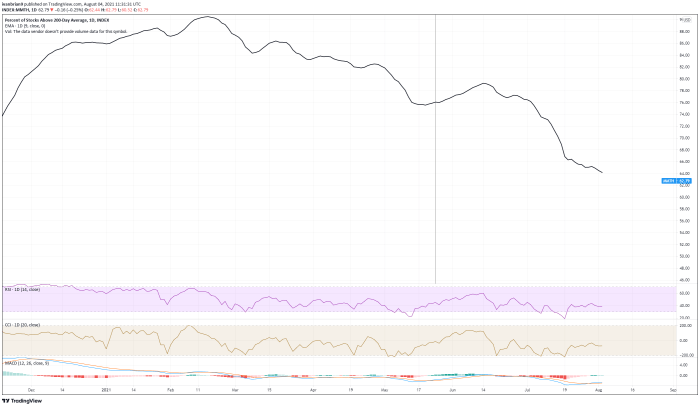

Analyzing SPY Stock Price Technical Indicators

Technical analysis uses historical price and volume data to predict future price movements. Several indicators help interpret SPY’s price trends and potential future direction.

Key Technical Indicators for SPY Stock Price Movements

Moving averages (simple moving average, exponential moving average), relative strength index (RSI), MACD (Moving Average Convergence Divergence), and Bollinger Bands are commonly used to analyze SPY’s price trends and identify potential buy or sell signals. These indicators provide insights into momentum, overbought/oversold conditions, and potential trend reversals.

Comparison of Technical Analysis Approaches for SPY

Different technical analysis approaches, such as candlestick charting, point and figure charting, and Elliott Wave theory, offer varying perspectives on SPY’s price movements. While some focus on price patterns, others emphasize volume or other market factors. The choice of approach often depends on an investor’s trading style and risk tolerance.

Interpreting SPY Price Trends Using Moving Averages

Moving averages smooth out price fluctuations, making it easier to identify underlying trends. A rising 50-day moving average, for example, could suggest an upward trend, while a falling 200-day moving average might indicate a bearish trend. Crossovers between different moving averages (e.g., a 50-day MA crossing above a 200-day MA) can be interpreted as buy or sell signals.

Commonly Used Technical Indicators and Their Applications to SPY

- Moving Averages: Identifying trends and potential trend reversals.

- Relative Strength Index (RSI): Determining overbought or oversold conditions.

- MACD: Identifying momentum changes and potential trend reversals.

- Bollinger Bands: Measuring volatility and identifying potential price breakouts.

SPY Stock Price and Fundamental Analysis

Fundamental analysis assesses the intrinsic value of SPY by examining the financial health and performance of the underlying companies within the S&P 500 index.

Key Financial Metrics Influencing SPY Stock Price

Key financial metrics, such as earnings per share (EPS), price-to-earnings ratio (P/E), revenue growth, and debt-to-equity ratio, collectively influence the overall valuation of the S&P 500 companies and thus, SPY’s price. Strong financial performance generally supports higher valuations and price increases.

Impact of Company Earnings on SPY Stock Price

Source: fxstreet.com

Company earnings reports significantly influence SPY’s price. Stronger-than-expected earnings often lead to price increases, while weaker-than-expected results can cause declines. The cumulative impact of earnings from multiple companies within the S&P 500 creates a ripple effect on SPY’s overall price.

Macroeconomic Factors Affecting SPY Stock Price (Fundamental Perspective)

Macroeconomic factors, such as interest rates, inflation, and economic growth, significantly impact the profitability and valuation of S&P 500 companies. For example, rising interest rates can increase borrowing costs, potentially reducing company profits and leading to lower SPY prices. Conversely, strong economic growth often boosts corporate profits, positively influencing SPY’s price.

Financial Performance of Companies Within the SPY ETF

| Company Sector | Average P/E Ratio (Example) | Average Revenue Growth (Example) | Average Debt-to-Equity Ratio (Example) |

|---|---|---|---|

| Technology | 30 | 15% | 0.5 |

| Financials | 15 | 8% | 1.0 |

| Healthcare | 25 | 10% | 0.7 |

| Consumer Staples | 20 | 5% | 0.6 |

Predicting Future SPY Stock Price Movements

Predicting future SPY price movements is inherently challenging, but various models and analyses can offer potential scenarios.

Models Used for Forecasting SPY Stock Price

Several models, including time series analysis, econometric models, and machine learning algorithms, are employed to forecast SPY’s price. These models often incorporate historical price data, economic indicators, and market sentiment to generate predictions. However, the accuracy of these predictions is limited by the inherent unpredictability of the market.

Limitations of Predicting SPY Stock Price Movements

Predicting stock prices is inherently uncertain. Unforeseen events, such as unexpected economic shocks or geopolitical crises, can significantly impact SPY’s price, rendering even sophisticated models inaccurate. Market sentiment, which is often irrational, can also lead to significant deviations from predicted price movements.

Potential Scenarios for SPY Stock Price in the Next Six Months

Predicting specific price points is impossible. However, based on current economic conditions and market sentiment (as of [Insert Date]), potential scenarios might include a moderate increase driven by continued economic growth, a period of consolidation with limited price changes, or a decline triggered by unforeseen negative events. These scenarios are highly speculative and should not be taken as investment advice.

Factors Leading to SPY Price Increase or Decrease

- Price Increase: Strong economic growth, positive corporate earnings, reduced inflation, positive investor sentiment.

- Price Decrease: Economic recession, negative corporate earnings, rising inflation, negative investor sentiment, geopolitical instability.

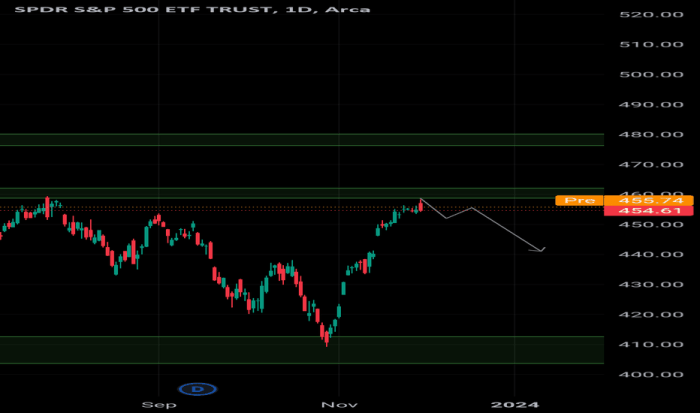

Visualizing SPY Stock Price Data

Visual representations of SPY’s price data, such as line charts, candlestick charts, and volume charts, offer valuable insights into price trends and market activity.

Typical SPY Stock Price Chart

A typical SPY stock price chart displays the price over time, often using a line graph to show the continuous price movement. Key features include the x-axis representing time and the y-axis representing price. Support and resistance levels, trendlines, and significant price highs and lows are typically highlighted.

Different Types of Charts for SPY Stock Price Data

Source: tradingview.com

Line charts show the continuous price movement, while candlestick charts provide additional information on opening, closing, high, and low prices for each period (e.g., daily, weekly). Volume charts display the trading volume at each price point, providing insights into market activity and potential momentum.

Candlestick Chart Showing High Volatility

A candlestick chart depicting high volatility would show long candles (both bullish and bearish) with significant gaps between consecutive candles, indicating large price swings within short periods. The chart would lack a clear trend, suggesting uncertainty and rapid shifts in market sentiment.

Volume Chart Illustrating Increased Trading Activity

A volume chart illustrating a significant increase in trading activity around a specific price point would show a dramatic spike in the volume bars at that price level. This suggests that a significant number of investors were actively buying or selling at that price, potentially indicating a strong reaction to a news event or a shift in market sentiment.

FAQ: Spy Stock Price

What is the SPY ETF?

The SPY ETF (Exchange-Traded Fund) tracks the S&P 500 index, providing investors with diversified exposure to 500 large-cap U.S. companies.

How often is the SPY stock price updated?

The SPY stock price is updated continuously throughout the trading day.

Where can I find real-time SPY stock price data?

Real-time SPY stock price data is available through various financial websites and brokerage platforms.

What are the risks associated with investing in SPY?

Like any investment, SPY carries market risk. Its price can fluctuate significantly based on overall market conditions.