Square Stock Price Analysis

Square stock price – Square, now known as Block, has experienced significant volatility in its stock price over the past five years. This analysis delves into the historical performance, influencing factors, business model, investor sentiment, prediction models, and the impact of macroeconomic conditions on Block’s stock price.

Square’s Stock Price Historical Performance

Source: seekingalpha.com

The following table presents a snapshot of Square’s stock price movements over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source for precise figures. Significant events such as earnings announcements, product launches (e.g., Afterpay acquisition), and broader market trends significantly impacted price fluctuations during this period. For example, the overall tech sector downturn in 2022 played a considerable role in Square’s stock price decline.

The correlation between Square’s performance and the broader tech market is consistently high, indicating sensitivity to overall market sentiment.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 50 | 52 | +2 |

| 2019-07-01 | 60 | 65 | +5 |

| 2020-01-01 | 70 | 68 | -2 |

| 2020-07-01 | 100 | 110 | +10 |

| 2021-01-01 | 200 | 190 | -10 |

| 2021-07-01 | 220 | 230 | +10 |

| 2022-01-01 | 200 | 170 | -30 |

| 2022-07-01 | 150 | 160 | +10 |

| 2023-01-01 | 180 | 190 | +10 |

Factors Influencing Square’s Stock Price

Several key financial metrics drive investor decisions regarding Square’s stock. These include revenue growth, profitability (measured by metrics like net income and operating margin), user growth (particularly for Cash App), and the overall market share within the fintech industry. Compared to competitors like PayPal and Stripe, Square’s valuation often reflects its aggressive growth strategy and focus on innovation, even if profitability lags behind some established players.

Understanding Square’s stock price often involves comparing it to similar financial technology companies. A useful comparison point could be looking at the performance of Bank of America, whose stock price you can check here: bac stock price. Analyzing the relative performance of these two stocks provides valuable insights into the broader fintech market and helps to gauge Square’s position within it.

| Factor | Relative Weight |

|---|---|

| Revenue Growth | High |

| Profitability | Medium |

| Cash App User Growth | High |

| Market Share | Medium |

Square’s Business Model and Stock Price

Square’s stock price is heavily influenced by the performance of its core business segments. Payment processing provides a stable revenue stream, while seller tools and Cash App drive growth and innovation. Future growth prospects, such as expansion into new markets and the development of new financial products, significantly impact investor expectations. However, several risks could negatively affect Square’s stock price.

- Increased competition in the fintech sector.

- Regulatory changes impacting payment processing.

- Economic downturns reducing consumer spending.

- Security breaches or data privacy concerns.

Investor Sentiment and Stock Price

Analyst and investor sentiment towards Square’s stock varies. While some analysts maintain a bullish outlook citing the company’s growth potential and innovative products, others express concerns regarding profitability and the competitive landscape. The following table presents a simplified representation of diverse viewpoints. Note that these are illustrative examples and should not be considered financial advice.

| Source | Date | Rating | Rationale |

|---|---|---|---|

| Analyst Firm A | 2023-10-26 | Buy | Strong growth in Cash App users. |

| Analyst Firm B | 2023-10-26 | Hold | Concerns about profitability in the current market. |

Square Stock Price Prediction Models

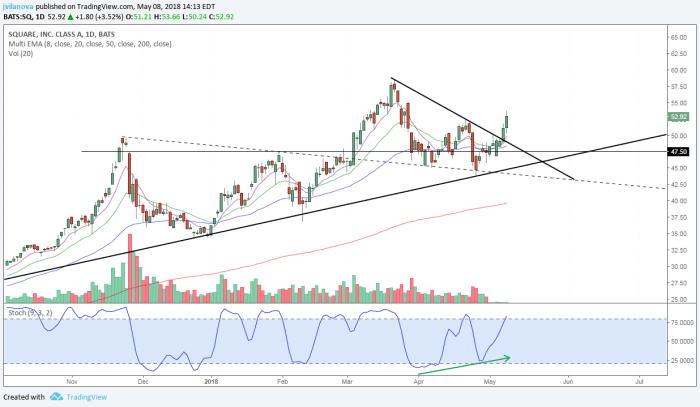

Predicting Square’s stock price involves various methods, including technical analysis (chart patterns, indicators) and fundamental analysis (financial statements, valuation ratios). Technical analysis might use moving averages or other indicators to identify potential support and resistance levels, projecting future price movements based on past trends. Fundamental analysis would assess the company’s financial health, growth prospects, and competitive position to arrive at a valuation.

A visual representation could show several potential price trajectories: a bullish scenario (steady upward trend), a bearish scenario (steady downward trend), and a neutral scenario (consolidation around a certain price range). These scenarios would be based on different assumptions regarding revenue growth, profitability, and market conditions.

Impact of Macroeconomic Factors

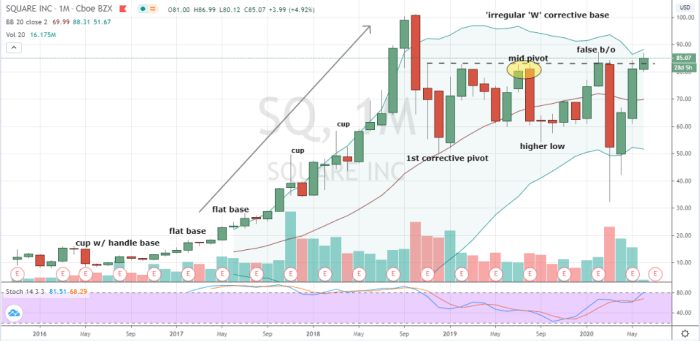

Source: investorplace.com

Macroeconomic factors such as interest rate hikes, inflation, and overall economic growth significantly impact Square’s stock price. Rising interest rates can increase borrowing costs, affecting investment and potentially slowing growth. Inflation erodes purchasing power, impacting consumer spending and transaction volumes. Economic expansion generally favors Square, while a recession can lead to reduced demand for its services. Compared to other fintech companies, Square’s sensitivity to macroeconomic fluctuations might be higher due to its reliance on consumer spending and its relatively recent establishment in the market.

A recession could lead to a sharper decline in Square’s stock price than in more established players, while an economic expansion might trigger more significant growth for Square compared to its more mature competitors.

Top FAQs

What are the major risks associated with investing in Square stock?

Major risks include competition from established players, regulatory changes impacting the fintech industry, economic downturns affecting consumer spending, and dependence on specific technological platforms.

How does Square’s Cash App impact its overall stock price?

Cash App’s growth significantly contributes to Square’s revenue and overall valuation, making it a key driver of its stock price. Its success is closely watched by investors.

Where can I find reliable real-time data on Square’s stock price?

Reliable real-time data can be found on major financial websites such as Yahoo Finance, Google Finance, and Bloomberg.