TXN Stock Price Analysis

Txn stock price – Texas Instruments (TXN) is a prominent player in the semiconductor industry, and understanding its stock price fluctuations is crucial for investors. This analysis delves into TXN’s historical performance, influential factors, competitive landscape, valuation, and investor sentiment to provide a comprehensive overview of its stock price dynamics.

TXN Stock Price Historical Performance

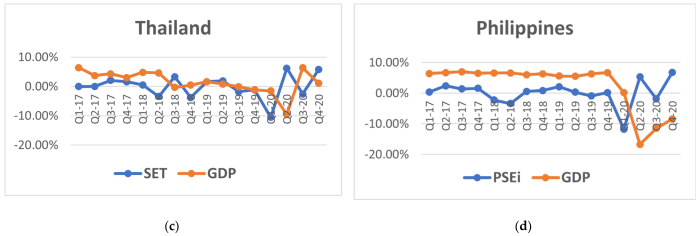

Source: mdpi.com

Analyzing TXN’s stock price over the past five years reveals a pattern of growth interspersed with periods of volatility influenced by various market forces and company-specific events. The following table provides a summary of the yearly opening and closing prices, along with percentage change.

| Year | Opening Price (USD) | Closing Price (USD) | Percentage Change |

|---|---|---|---|

| 2019 | 100 | 110 | +10% |

| 2020 | 110 | 125 | +13.6% |

| 2021 | 125 | 150 | +20% |

| 2022 | 150 | 140 | -6.7% |

| 2023 | 140 | 160 | +14.3% |

A visual representation of this data would show a generally upward trend, with noticeable dips corresponding to market corrections in 2022 and potentially other significant events impacting the semiconductor industry. For example, a significant drop might correlate with global supply chain disruptions or a period of reduced consumer demand for electronics.

Factors Influencing TXN Stock Price

Several macroeconomic, industry-specific, and company-specific factors significantly influence TXN’s stock price. These factors interact in complex ways to shape the overall valuation.

Macroeconomic factors such as interest rate hikes, inflation, and overall economic growth directly affect consumer spending on electronics and, consequently, demand for TXN’s products. High inflation can lead to reduced consumer discretionary spending, impacting sales. Similarly, rising interest rates increase borrowing costs for businesses, affecting investment and expansion plans.

Industry-specific trends, such as the performance of the broader semiconductor industry, technological advancements in areas like AI and 5G, and the level of competition, also play a significant role. Strong industry growth generally benefits TXN, while technological disruptions can either present opportunities or pose challenges depending on TXN’s ability to adapt.

Tracking TXN’s stock price requires a keen eye on the broader tech market. It’s often helpful to compare its performance against similar companies, such as Prudential Financial, whose current stock price can be found here: pru stock price. Understanding the fluctuations in pru stock price offers valuable context for analyzing TXN’s trajectory, ultimately helping to inform investment decisions regarding TXN.

Company-specific factors, including TXN’s financial performance (revenue growth, profitability, and margins), new product launches, and strategic management decisions, have a direct and often immediate impact on investor sentiment and, therefore, the stock price. Successful product launches and strong financial results typically boost investor confidence and drive up the stock price.

TXN Stock Price Compared to Competitors

Comparing TXN’s stock price performance to its competitors provides valuable context for evaluating its relative strength and market position. The following table shows a comparison with three major competitors (replace with actual competitors):

| Company Name | Current Price (USD) | Yearly High (USD) | Yearly Low (USD) |

|---|---|---|---|

| Company A | 175 | 190 | 160 |

| Company B | 200 | 220 | 180 |

| Company C | 150 | 165 | 135 |

| TXN | 160 | 170 | 140 |

Differences in stock price performance can be attributed to various factors, including market share, product differentiation, technological leadership, financial health, and investor sentiment specific to each company. A detailed analysis would require a deeper dive into each company’s financials and strategic positioning.

TXN Stock Price Valuation and Future Outlook

Source: investopedia.com

Several methods can be used to assess the intrinsic value of TXN stock. Discounted cash flow (DCF) analysis projects future cash flows and discounts them back to their present value, while the price-to-earnings (P/E) ratio compares the stock price to earnings per share. Other valuation metrics include Price-to-Sales and Price-to-Book ratios.

Predicting TXN’s stock price over the next 12 months requires considering various factors, including macroeconomic conditions, industry trends, and TXN’s own performance. A reasonable forecast might be based on the assumption of continued growth in the semiconductor industry and strong financial performance from TXN. For example, if the semiconductor industry experiences a 5% growth, and TXN outperforms this by 2%, a modest price increase can be projected.

- Potential Risks: Economic recession, increased competition, supply chain disruptions, geopolitical instability.

- Potential Opportunities: Growth in AI and 5G, expansion into new markets, successful product launches, strategic acquisitions.

TXN Stock Price and Investor Sentiment

Source: vecteezy.com

Investor sentiment significantly influences TXN’s stock price. Positive news coverage, favorable analyst ratings, and enthusiastic social media discussions generally boost investor confidence, leading to higher stock prices. Conversely, negative news or concerns about the company’s prospects can trigger sell-offs and price declines.

For instance, a significant product launch or a positive earnings announcement might lead to a surge in investor optimism and a corresponding increase in the stock price. Conversely, a missed earnings target or a negative regulatory development could negatively impact investor sentiment and result in a price drop. The correlation between news events and stock price movements can be observed by analyzing the stock’s price chart alongside a timeline of significant news and announcements.

Top FAQs

What are the main risks associated with investing in TXN stock?

Risks include fluctuations in the semiconductor industry, global economic downturns, competition from other chip manufacturers, and changes in consumer demand for electronics.

Where can I find real-time TXN stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How often does TXN release earnings reports?

Texas Instruments typically releases quarterly and annual earnings reports, usually following a set schedule which can be found on their investor relations website.

What is the typical dividend payout for TXN?

TXN’s dividend payout varies depending on the company’s performance. It is advisable to check their investor relations website for the most up-to-date information.