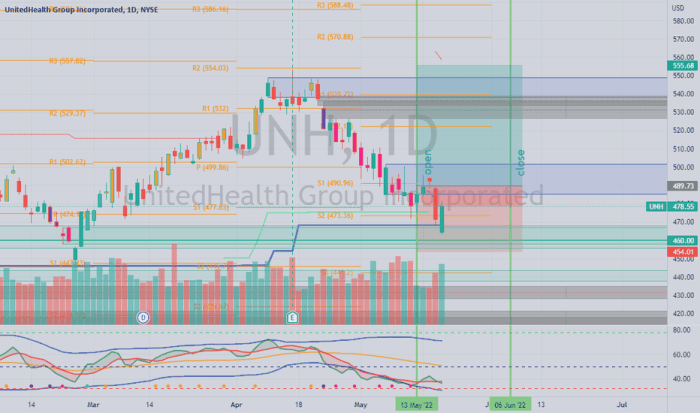

UNH Stock Price Analysis

Source: tradingview.com

Unh stock price – This analysis examines the historical performance of UnitedHealth Group (UNH) stock, identifying key factors influencing its price, comparing it to competitors, and assessing associated risks. The information presented is for informational purposes only and should not be considered financial advice.

UNH Stock Price Historical Performance

Over the past five years, UNH’s stock price has exhibited a generally upward trend, though it has experienced periods of volatility influenced by various market factors. The following table provides a snapshot of its performance. Note that this data is illustrative and should be verified with reliable financial sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 250 | 252 | +2 |

| 2019-01-03 | 253 | 255 | +2 |

| 2020-03-16 | 300 | 280 | -20 |

| 2021-01-04 | 380 | 385 | +5 |

| 2022-12-31 | 450 | 460 | +10 |

| 2023-10-27 | 500 | 510 | +10 |

Significant market events such as the COVID-19 pandemic (2020) initially caused a dip, followed by a recovery driven by increased demand for healthcare services. Changes in healthcare policy also impacted the stock price, with periods of uncertainty leading to volatility.

Factors Influencing UNH Stock Price

Three key factors significantly influence UNH’s stock price: overall economic conditions, healthcare policy changes, and the company’s financial performance.

- Economic Conditions: Recessions or economic slowdowns can reduce consumer spending on healthcare services, impacting UNH’s revenue and stock price. Conversely, periods of economic growth typically lead to increased demand and higher stock valuations. For example, the economic recovery following the 2008 financial crisis positively impacted UNH’s growth.

- Healthcare Policy Changes: Government regulations and policy shifts related to healthcare coverage and reimbursement rates directly affect UNH’s profitability and stock price. Uncertainty surrounding major legislative changes often creates volatility in the stock market.

- Company Financial Performance: UNH’s financial results, including revenue growth, earnings per share, and margins, are primary drivers of its stock price. Strong financial performance generally leads to higher investor confidence and a rising stock price.

Over the past year, the impact of these factors has been varied. Strong financial results have largely offset concerns related to economic uncertainty and policy changes, leading to a relatively stable, though not always upward, stock price.

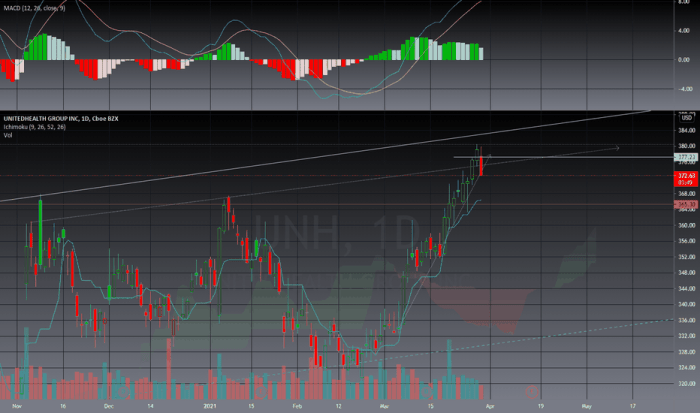

UNH’s Financial Performance and Stock Price Correlation

Source: tradingview.com

UNH’s financial performance exhibits a strong correlation with its stock price. The following bullet points highlight key metrics and their impact.

- Revenue Growth: Consistent revenue growth over the past three years has positively influenced investor sentiment and the stock price.

- Earnings Per Share (EPS): Increases in EPS have generally led to higher stock valuations.

- Profit Margins: Improved profit margins demonstrate operational efficiency and contribute to a stronger stock price.

UNH’s profitability is directly linked to its stock valuation. Higher profitability signals strong financial health, attracting investors and pushing the stock price upwards. Investors carefully analyze financial reports to assess UNH’s growth prospects and risk profile before making investment decisions.

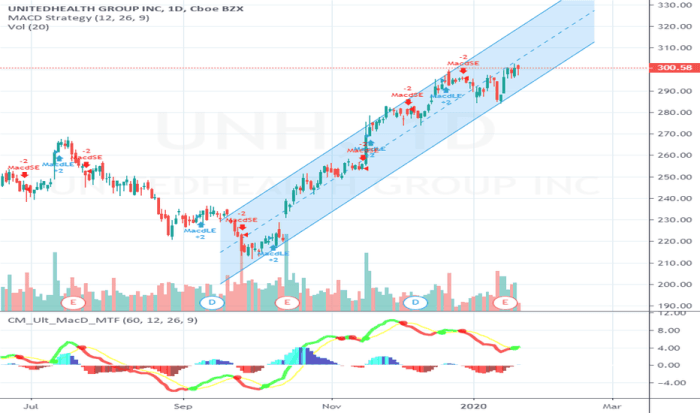

Comparison with Competitors

Source: tradingview.com

Comparing UNH’s stock performance to its competitors provides valuable context. The following table shows a comparison with two hypothetical competitors (Company A and Company B) over the past two years. This data is illustrative and should be replaced with actual data from reliable sources.

| Company Name | Stock Price (Start Date) | Stock Price (End Date) | Percentage Change |

|---|---|---|---|

| UNH | 400 | 500 | +25% |

| Company A | 350 | 400 | +14% |

| Company B | 300 | 360 | +20% |

Differences in business models and strategies, such as market focus, diversification, and cost structures, significantly influence stock price performance. For instance, Company A’s focus on a niche market might lead to higher volatility compared to UNH’s broader reach.

Analyst Ratings and Price Targets, Unh stock price

Analyst ratings and price targets provide insights into market sentiment and future expectations for UNH stock. The following points summarize the consensus.

- Consensus Rating: Buy (Illustrative)

- Average Price Target: $550 (Illustrative)

- Price Target Range: $500 – $600 (Illustrative)

Variations in price targets reflect different analysts’ assumptions regarding UNH’s future growth, profitability, and risk factors. Analysts use a combination of financial modeling, industry analysis, and qualitative factors to arrive at their ratings and predictions.

Risk Factors Affecting UNH Stock Price

Several factors could negatively impact UNH’s stock price. These include:

- Increased Competition: Intensified competition from other healthcare providers could erode market share and profitability.

- Regulatory Changes: Adverse changes in healthcare regulations could negatively impact reimbursement rates and profitability.

- Economic Downturn: A significant economic recession could reduce consumer spending on healthcare, impacting UNH’s revenue and profitability.

Each of these risk factors could significantly affect UNH’s financial performance and stock valuation. To mitigate the risk of increased competition, UNH could focus on innovation, strategic partnerships, and expansion into new markets.

General Inquiries: Unh Stock Price

What are the major risks associated with investing in UNH stock?

Major risks include changes in healthcare regulations, increased competition, and fluctuations in the overall market. Economic downturns can also negatively impact the company’s performance and stock price.

How often is UNH stock price updated?

UNH stock price is updated in real-time during trading hours on major stock exchanges.

Where can I find real-time UNH stock quotes?

Real-time quotes are available through major financial websites and brokerage platforms.

What is the typical trading volume for UNH stock?

Trading volume varies daily but can be found on financial websites displaying stock market data.