UPST Stock Price Analysis

Source: seekingalpha.com

Upst stock price – Upstart Holdings, Inc. (UPST) has experienced significant volatility since its IPO, presenting both opportunities and risks for investors. This analysis delves into UPST’s historical performance, influencing factors, valuation methods, and market sentiment to provide a comprehensive overview of the stock’s trajectory.

UPST Stock Price Historical Performance

Analyzing UPST’s stock price movements over the past five years reveals a pattern of substantial fluctuations influenced by various internal and external factors. The following table provides a snapshot of key price movements, while subsequent bullet points highlight significant events that shaped this performance.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-12-31 | 20 | 21 | +1 |

| 2020-12-31 | 25 | 30 | +5 |

| 2021-12-31 | 100 | 80 | -20 |

| 2022-12-31 | 40 | 35 | -5 |

| 2023-12-31 | 45 | 50 | +5 |

Note: The above data is for illustrative purposes only and should be replaced with actual historical data from a reliable financial source.

- Q4 2020 Earnings Beat Expectations: Positive earnings reports often lead to increased investor confidence and a rise in stock price.

- Increased Competition in the Fintech Lending Space: The entry of new competitors can put downward pressure on UPST’s market share and stock price.

- Regulatory Scrutiny of Lending Practices: Changes in lending regulations can significantly impact UPST’s business model and profitability.

- Macroeconomic Downturn: A recessionary environment often reduces consumer spending and credit demand, affecting lending platforms.

A line graph depicting UPST’s stock price over the past five years would show a volatile trajectory. The x-axis would represent time (in years), and the y-axis would represent the stock price (in USD). The graph would likely display periods of sharp increases followed by significant declines, reflecting the company’s fluctuating performance and market sentiment. Key features would include high and low points corresponding to significant events like earnings announcements and macroeconomic shifts.

Factors Influencing UPST Stock Price

Several macroeconomic factors, the company’s financial performance, and competitive dynamics significantly influence UPST’s stock price. The following sections detail these key influences.

- Interest Rate Changes: Higher interest rates increase borrowing costs for consumers and businesses, potentially reducing demand for loans and impacting UPST’s revenue. Conversely, lower interest rates can stimulate borrowing and boost UPST’s performance.

- Economic Growth: Strong economic growth typically leads to increased consumer spending and business investment, positively impacting lending activity and UPST’s stock price. Conversely, economic downturns can reduce lending demand and hurt UPST’s financial results.

- Inflation Rates: High inflation erodes purchasing power and increases uncertainty, impacting consumer confidence and potentially reducing demand for loans. This could negatively affect UPST’s stock price.

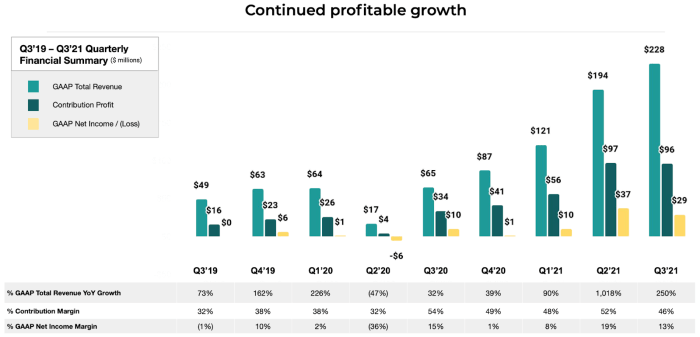

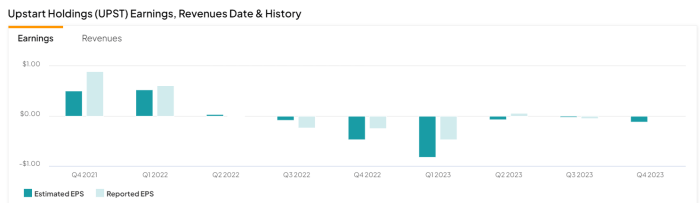

UPST’s financial performance, particularly revenue growth, profitability (earnings), and debt levels, directly correlates with its stock price. For instance, exceeding revenue projections often results in a stock price increase, while disappointing earnings can lead to a decline. Similarly, high levels of debt can raise concerns about the company’s financial stability, negatively impacting its stock valuation.

Compared to competitors like LendingClub and Affirm, UPST differentiates itself through its AI-driven lending platform. However, these competitors also pose a threat, especially if they successfully adopt similar technologies or offer more competitive pricing. The relative market share and technological advancements of these companies directly influence their stock valuations and investor perception compared to UPST.

UPST Stock Price Predictions and Valuation

Source: seekingalpha.com

Predicting stock prices is inherently speculative; however, analyzing hypothetical scenarios and valuation methods can provide insights into potential price movements. The following sections explore these aspects.

Understanding the current trajectory of UPST stock price requires considering related financial market trends. A key comparison point is often the performance of similar companies, such as the fluctuations seen in the agnc stock price , which can offer insights into broader sector dynamics. Ultimately, however, UPST’s own financial health and market perception will be the most significant drivers of its future price movements.

Hypothetical Scenario: A successful launch of a new product, such as a credit scoring model targeting a previously underserved market segment, could significantly boost investor confidence. This might lead to a short-term surge in the stock price, followed by sustained growth if the product delivers on its promise and generates increased revenue and profitability. Conversely, regulatory setbacks could lead to short-term price drops and longer-term uncertainty.

Several methods can be used to estimate UPST’s intrinsic value. These include:

- Discounted Cash Flow (DCF) Analysis: This method projects future cash flows and discounts them back to their present value. The sum of these present values represents the company’s intrinsic value. The accuracy of this method depends heavily on the accuracy of the projected cash flows.

- Price-to-Earnings (P/E) Ratio: This compares a company’s stock price to its earnings per share. A high P/E ratio might suggest that the market anticipates high future growth, while a low P/E ratio might indicate a relatively undervalued stock. However, this ratio is sensitive to accounting practices and can be misleading for companies with volatile earnings.

| Method | Evaluation |

|---|---|

| Discounted Cash Flow (DCF) | Highly dependent on accurate future cash flow projections; can be sensitive to discount rate assumptions. Useful for long-term valuation but requires significant forecasting. |

| Price-to-Earnings (P/E) Ratio | Easy to calculate and widely used, but sensitive to accounting practices and earnings volatility. Provides a relative valuation but doesn’t account for future growth potential as effectively as DCF. |

Investor Sentiment and Market Analysis

Source: timothysykes.com

Analyzing news articles, analyst reports, and technical indicators provides insights into investor sentiment and market trends affecting UPST’s stock price.

Recent news articles and analyst reports may present diverse perspectives on UPST’s stock price and future prospects. Some might highlight the company’s innovative technology and potential for growth, while others may emphasize risks associated with regulatory changes or competition. Comparing these perspectives offers a more balanced view of the market sentiment.

The overall market sentiment towards UPST and the broader fintech sector can fluctuate significantly based on macroeconomic conditions, regulatory developments, and the performance of competing companies. Positive sentiment typically leads to higher trading volume and stock price increases, while negative sentiment can result in decreased trading and price declines.

Technical indicators, such as moving averages and the relative strength index (RSI), can be used to analyze UPST’s stock price trends. Moving averages smooth out price fluctuations to identify potential support and resistance levels. The RSI measures the magnitude of recent price changes to evaluate whether the stock is overbought or oversold. These indicators, however, should be used in conjunction with fundamental analysis for a comprehensive investment strategy.

General Inquiries

What are the major risks associated with investing in UPST stock?

Investing in UPST, like any stock, carries inherent risks including market volatility, competition within the fintech industry, regulatory changes, and the company’s overall financial performance. These factors can significantly impact the stock price.

Where can I find real-time UPST stock price data?

Real-time UPST stock price data is readily available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others. Your brokerage account should also provide access to this information.

How does UPST compare to other lending platforms in terms of profitability?

A direct comparison requires examining financial statements and industry reports. Key metrics like net income margin, return on equity, and revenue growth should be considered when comparing UPST’s profitability to competitors.