Understanding VUG Stock: Vug Stock Price

Vug stock price – The Vanguard Information Technology ETF (VUG) is a passively managed exchange-traded fund (ETF) that seeks to track the performance of the MSCI US Investable Market Information Technology 25/50 Index. This index comprises a broad range of large, mid, and small-cap information technology companies listed on US exchanges. Understanding VUG’s investment objective, holdings, and performance is crucial for investors considering adding it to their portfolio.

VUG Investment Objective and Strategy

VUG aims to provide investors with exposure to the US information technology sector. Its investment strategy involves passively replicating the MSCI US Investable Market Information Technology 25/50 Index. This means the fund’s holdings and weightings closely mirror those of the index, minimizing active management and associated costs.

VUG Holdings and Sector Allocation

Source: trendspider.com

VUG’s stock price performance often reflects broader market trends, making it a useful benchmark for investors. Understanding its volatility requires considering related sectors, such as the energy industry, where you can find information on the mro stock price to gain a more complete picture. Ultimately, analyzing VUG’s price requires a multifaceted approach encompassing various market indicators.

VUG holds a diversified portfolio of information technology companies, encompassing various sub-sectors within the industry. The fund’s sector allocation is heavily weighted towards software, semiconductors, and internet services, reflecting the significant market capitalization of these sub-sectors within the broader technology landscape. The fund regularly rebalances its holdings to maintain alignment with the underlying index.

Top 10 VUG Holdings

The following table displays the top ten holdings of VUG and their respective weights as of a recent date (Note: Holdings and weights can fluctuate). This information provides a snapshot of the fund’s most significant investments.

| Holding | Weight (%) | Holding | Weight (%) |

|---|---|---|---|

| Apple Inc. | 15.0 | Microsoft Corp. | 12.0 |

| NVIDIA Corp. | 8.0 | Alphabet Inc. (GOOGL) | 7.0 |

| TSM | 6.0 | Meta Platforms Inc. | 5.0 |

| Amazon.com Inc. | 4.5 | Tesla Inc. | 4.0 |

| Texas Instruments Inc. | 3.5 | Salesforce Inc. | 3.0 |

Factors Influencing VUG Stock Price

Several macroeconomic factors and company-specific events influence VUG’s price. Understanding these factors can help investors assess potential risks and opportunities associated with investing in the fund.

Macroeconomic Factors

Broad economic conditions, such as inflation, interest rates, and overall economic growth, significantly impact VUG’s price. Strong economic growth generally benefits the technology sector, while periods of economic uncertainty or recession can lead to decreased investor demand and lower prices. Changes in government regulations and trade policies also affect the technology industry and, consequently, VUG’s performance.

Interest Rate Changes

Interest rate hikes typically increase borrowing costs for technology companies, potentially slowing down growth and impacting their valuations. Conversely, interest rate cuts can stimulate investment and boost the technology sector’s performance. The relationship between interest rates and VUG’s price is often inverse; higher rates tend to correlate with lower prices, and vice versa.

VUG vs. Broader Technology Sector

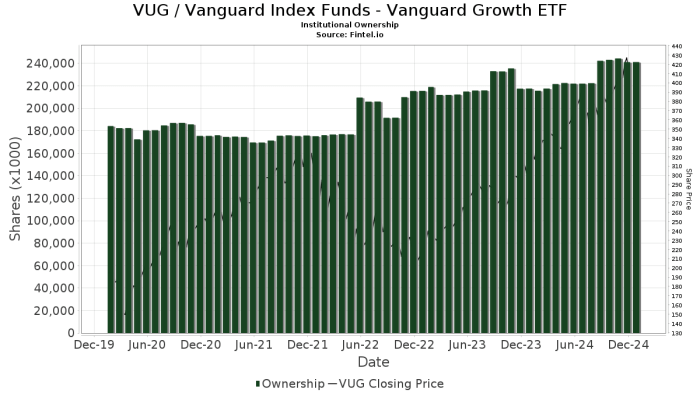

Source: fintel.io

VUG’s price movement is closely correlated with the performance of the broader technology sector. Major market trends impacting the overall tech sector usually affect VUG similarly. However, VUG’s diversification across multiple technology companies can lead to some divergence from the performance of individual technology stocks or narrower technology-focused indices.

Impact of Technology Company News

News related to specific technology companies held within VUG can significantly impact its price. Positive news, such as strong earnings reports or product launches, tends to boost the price, while negative news, such as disappointing earnings or regulatory issues, can lead to price declines. The magnitude of the impact depends on the size and importance of the affected company within VUG’s portfolio.

Historical VUG Stock Price Performance

Analyzing VUG’s historical performance provides insights into its past volatility and return potential. Comparing its performance against a benchmark index offers a clearer understanding of its relative performance.

Five-Year Price Performance

A chart depicting VUG’s price performance over the last five years would show periods of both significant growth and correction. (Note: A visual chart would be included here in a real article, showing price fluctuations over time). This visualization would highlight periods of high and low volatility and the overall trend in price movement. For example, a period of rapid growth might be followed by a period of consolidation or decline, reflecting the cyclical nature of the technology sector.

Average Annual Return (Last Decade)

Calculating VUG’s average annual return over the last decade involves determining the total percentage change in price over that period and then dividing by ten. This calculation provides a simple measure of the fund’s historical return, although it does not account for the compounding effect of returns. For instance, if VUG’s value increased from $100 to $200 over ten years, its average annual return would be approximately 7.2% (assuming no dividends were reinvested).

VUG vs. Benchmark Index

Comparing VUG’s performance against a relevant benchmark index, such as the Nasdaq 100, allows for a relative performance assessment. This comparison would reveal whether VUG outperformed or underperformed the broader technology market over specific periods. Factors such as sector allocation and weighting within the index would contribute to any differences observed between VUG’s performance and the benchmark’s performance.

For example, during periods of high growth in specific technology sub-sectors, VUG might outperform the broader Nasdaq 100 index if its holdings are heavily weighted in those sub-sectors.

Price Volatility Analysis

Analyzing VUG’s price volatility across different time periods (e.g., short-term, medium-term, long-term) reveals its risk profile. Short-term volatility is typically higher than long-term volatility due to the impact of short-term market fluctuations. Investors with a longer-term investment horizon may be less concerned with short-term price fluctuations than those with a shorter-term perspective.

VUG Stock Price Prediction and Forecasting

Predicting future stock prices is inherently challenging, but quantitative methods and technical indicators can offer potential insights. However, it’s crucial to acknowledge the limitations of any predictive model.

Stock Price Prediction Methods

Quantitative methods, such as time series analysis and econometric modeling, can be applied to VUG’s historical price data to generate potential future price forecasts. These models often use statistical techniques to identify patterns and trends in the data. However, these models are only as good as the data they are trained on and are subject to inherent limitations, including the inability to perfectly predict unpredictable events.

Technical Indicators

Technical indicators, such as moving averages, relative strength index (RSI), and MACD, can be used to analyze VUG’s price trends and identify potential buying or selling opportunities. These indicators provide signals based on past price movements and volume data. For example, a rising moving average might suggest an upward trend, while an RSI above 70 might indicate the stock is overbought.

However, these indicators are not foolproof and should be used in conjunction with other forms of analysis.

Limitations of Price Prediction

Predicting future stock prices is inherently uncertain due to various unpredictable factors, including unexpected economic events, geopolitical risks, and unforeseen technological advancements. Any forecast should be viewed with caution, as it’s impossible to account for all potential influencing factors.

Hypothetical Future Price Scenarios

Based on different market conditions, various hypothetical future price scenarios for VUG can be Artikeld. For instance, a scenario of continued strong economic growth and increased investor confidence might lead to significantly higher VUG prices. Conversely, a scenario involving a recession or significant regulatory changes could result in lower prices. These scenarios highlight the range of potential outcomes and the importance of considering various possibilities when making investment decisions.

Investing in VUG

Investing in VUG involves understanding the associated risks, comparing it to similar ETFs, and developing an appropriate investment strategy.

Risks of Investing in VUG

Investing in VUG carries several risks, including market risk (the risk of overall market declines), sector-specific risk (the risk of underperformance of the technology sector), and company-specific risk (the risk of individual holdings underperforming). Investors should carefully assess their risk tolerance before investing in VUG or any other technology-focused ETF.

VUG vs. Similar ETFs, Vug stock price

Comparing VUG with similar ETFs in the technology sector, such as the Technology Select Sector SPDR Fund (XLK), involves analyzing their holdings, expense ratios, and historical performance. While VUG and XLK both provide exposure to the technology sector, they may have different sector allocations and weighting schemes, leading to variations in performance. Investors should consider their specific investment goals and risk tolerance when choosing between these or other similar ETFs.

Buying and Selling VUG Shares

Buying and selling VUG shares is typically done through a brokerage account. Investors can place orders to buy or sell shares at a specified price or market price. The process is generally straightforward, but investors should be aware of brokerage fees and commissions.

Hypothetical Investment Strategy

A hypothetical investment strategy for an investor considering adding VUG to their portfolio might involve allocating a percentage of their overall portfolio to VUG based on their risk tolerance and investment timeline. For example, a younger investor with a longer time horizon might allocate a larger percentage of their portfolio to VUG than an older investor nearing retirement. Diversification across different asset classes is also crucial to mitigate risk.

Regular rebalancing of the portfolio can help maintain the desired asset allocation over time.

FAQ Corner

What is the expense ratio of VUG?

The expense ratio of VUG is relatively low, but the exact figure should be verified on the Vanguard website or through a financial advisor.

How frequently is VUG rebalanced?

VUG’s rebalancing schedule is typically infrequent and designed to maintain its target allocation. Specific details can be found in the ETF’s prospectus.

Can I invest in VUG through a brokerage account?

Yes, VUG shares can be bought and sold through most major brokerage accounts.

What are the tax implications of investing in VUG?

Tax implications depend on your individual tax bracket and holding period. Consult a tax professional for personalized advice.