Walmart Stock Price Today

Walmart stock price today – This report provides an overview of Walmart’s current stock price, recent performance trends, influencing factors, financial highlights, analyst predictions, and a comparison to its key competitors. Data presented reflects market conditions at a specific point in time and is subject to change.

Current Walmart Stock Price & Volume

Source: seeitmarket.com

The following table displays Walmart’s stock price and trading volume data as of [Insert Time of Data Retrieval, e.g., 10:30 AM EST, October 26, 2023]. Note that these figures are subject to constant fluctuation throughout the trading day.

| Time | Price | High | Low |

|---|---|---|---|

| [Insert Time of Data Retrieval] | $[Insert Current Price] | $[Insert Day’s High] | $[Insert Day’s Low] |

The percentage change compared to the previous closing price is [Insert Percentage Change, e.g., +1.5%].

Recent Price Trends

Walmart’s stock price has shown [Insert overall trend, e.g., a generally upward trend] over the past week. Over the past month, the stock has [Insert trend, e.g., experienced moderate volatility, with periods of both increase and decrease]. Compared to three months ago, the current price is [Insert comparison, e.g., approximately 5% higher].

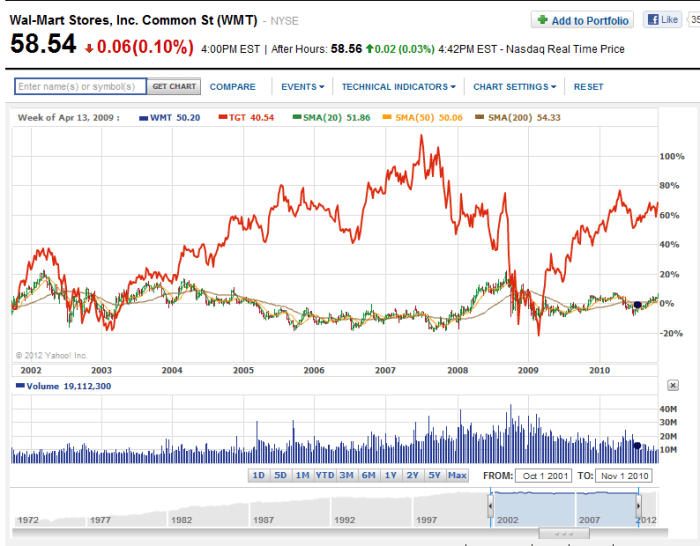

A line graph illustrating the stock price movement over the past year would show [Describe the graph’s overall shape, e.g., an initial period of decline followed by a gradual recovery and recent growth]. The x-axis would represent the date over the past year, and the y-axis would represent the stock price. Significant price changes would be visually apparent as sharp increases or decreases on the graph.

For example, a noticeable dip might correlate with a specific news event impacting the retail sector.

Factors Influencing Walmart’s Stock Price

Several economic factors significantly impact Walmart’s stock price. These include consumer spending habits, inflation rates, and competitive pressures.

Strong consumer spending generally boosts Walmart’s sales and, consequently, its stock price. Conversely, decreased consumer confidence can lead to lower sales and a decline in stock value. Inflationary pressures can impact both consumer spending and Walmart’s operating costs, potentially affecting profitability and share price. Competitor actions, such as aggressive pricing strategies or new product launches, can also influence Walmart’s market share and stock performance.

For instance, Amazon’s expansion into grocery delivery has put pressure on Walmart’s grocery business, affecting investor sentiment.

Walmart’s Financial Performance

Source: imgur.com

Walmart’s stock price today is showing moderate fluctuation, largely influenced by broader market trends. It’s interesting to compare this to the performance of other tech giants; for instance, you might want to check the current arm stock price for a contrasting perspective on the tech sector’s overall health. Ultimately, however, Walmart’s performance will depend on its own quarterly earnings and consumer spending habits.

Walmart’s most recent financial performance is crucial in understanding its stock valuation. The following summarizes key aspects from their latest quarterly report.

- Earnings Per Share (EPS): $[Insert EPS Figure]

- Revenue: $[Insert Revenue Figure]

- [Insert another key financial metric, e.g., Net Income: $X]

- [Insert another key financial metric, e.g., Same-store sales growth: X%]

- [Describe any significant changes in Walmart’s debt or cash flow, e.g., a reduction in debt due to strong cash flow.]

Recent announcements, such as [Insert example of a recent announcement and its impact on financials, e.g., a successful new supply chain initiative leading to cost savings], have also played a role in shaping investor perceptions of the company’s financial health.

Analyst Ratings and Predictions

Analyst opinions provide valuable insights into future stock performance. The following table summarizes the average analyst rating and price targets for Walmart stock.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| [Insert Analyst Firm 1, e.g., Goldman Sachs] | [Insert Rating, e.g., Buy] | $[Insert Price Target] |

| [Insert Analyst Firm 2, e.g., Morgan Stanley] | [Insert Rating, e.g., Hold] | $[Insert Price Target] |

| [Insert Analyst Firm 3, e.g., JP Morgan] | [Insert Rating, e.g., Buy] | $[Insert Price Target] |

Recent changes in analyst sentiment might reflect factors such as [Insert example, e.g., concerns about rising inflation or positive outlook on Walmart’s e-commerce growth].

Comparison to Competitors, Walmart stock price today

Comparing Walmart’s performance to its main competitors provides context for its stock price movement. Key competitors include Target and Amazon.

A bar chart comparing the year-to-date performance of Walmart’s stock price against Target and Amazon would visually illustrate the relative performance. Each bar would represent a company, and its height would correspond to the percentage change in its stock price year-to-date. For example, if Walmart’s stock increased by 10%, Target’s by 5%, and Amazon’s by 15%, the bars would reflect these differences.

The chart would highlight Walmart’s relative strength or weakness compared to its rivals. Differences in business models, such as Walmart’s focus on brick-and-mortar stores versus Amazon’s emphasis on e-commerce, could explain variations in stock performance.

FAQ Section

What are the major risks associated with investing in Walmart stock?

Like any stock, Walmart carries inherent risks, including market volatility, economic downturns impacting consumer spending, and increased competition from other retailers.

Where can I find real-time Walmart stock quotes?

Real-time quotes are available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How often does Walmart release its financial reports?

Walmart typically releases its quarterly and annual financial reports on a regular schedule, usually announced in advance.

What is the typical dividend payout for Walmart stock?

Walmart’s dividend payout history and current dividend yield can be found on financial websites and in the company’s investor relations materials.