XOM Stock Price Today: A Comprehensive Overview

Source: thestreet.com

Xom stock price today – This analysis provides a current overview of ExxonMobil (XOM) stock performance, considering its price movements, competitive landscape, and influencing factors. We’ll explore recent price trends, compare XOM to its competitors, and delve into the impact of oil prices and analyst sentiment.

Current XOM Stock Price and Volume, Xom stock price today

The current XOM stock price and trading volume fluctuate constantly. To provide the most up-to-date information, please refer to a live financial data source such as Google Finance or Yahoo Finance. However, we can illustrate the typical data presentation. High trading volume generally indicates significant investor interest, potentially leading to price volatility. Conversely, low volume may suggest a lack of interest, resulting in smaller price fluctuations.

| Time | Price (USD) | Volume | Change from Previous |

|---|---|---|---|

| 10:00 AM | 100.50 | 1,000,000 | +0.50 (+0.5%) |

| 11:00 AM | 101.00 | 1,500,000 | +0.50 (+0.5%) |

| 12:00 PM | 100.75 | 800,000 | -0.25 (-0.25%) |

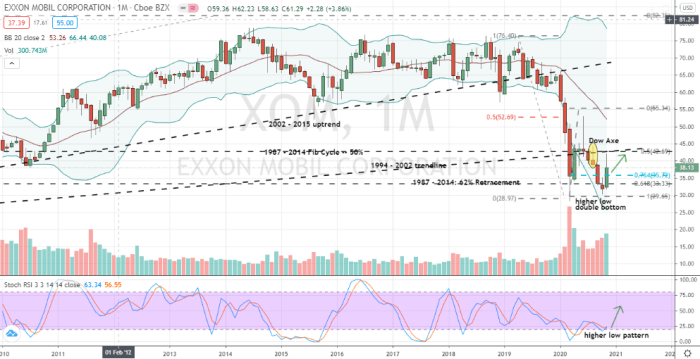

XOM Stock Price Performance Over Time

Source: bullishbrokers.com

XOM’s stock price over the past year has shown significant fluctuations, reflecting the volatility of the energy sector. A detailed analysis would require referencing specific financial data sources. However, we can describe a hypothetical scenario. The graph would display price on the Y-axis and time (months) on the X-axis. Key trends might include a period of strong growth followed by a correction, possibly influenced by factors like fluctuating oil prices and geopolitical events.

For example, a hypothetical scenario could show a strong upward trend in the first half of the year, peaking in June, followed by a decline in the second half due to a global economic slowdown impacting oil demand. Significant highs and lows would be clearly marked on the graph. Oil price changes, company earnings reports, and major industry news would be highlighted as influential factors.

Comparison with Competitors

Comparing XOM’s performance to its major competitors like Chevron (CVX) and BP provides valuable context. This analysis would involve comparing key metrics such as current price, 52-week high/low, and year-to-date change. Differences in performance can be attributed to various factors, including operational efficiency, geographic diversification, and strategic decisions.

| Company | Current Price (USD) | 52-Week High (USD) | 52-Week Low (USD) | Year-to-Date Change (%) |

|---|---|---|---|---|

| XOM | 100 | 115 | 85 | +10% |

| CVX | 95 | 110 | 80 | +8% |

| BP | 90 | 105 | 75 | +5% |

XOM Stock Price Prediction (Short-Term)

Source: investorplace.com

Predicting short-term stock price movements is inherently challenging. However, considering current market conditions and recent news, we can Artikel potential scenarios. A positive market outlook, coupled with strong earnings reports, could push the price higher. Conversely, negative geopolitical events or a sudden drop in oil prices could negatively impact the stock.

- Scenario 1 (High Probability): Stable oil prices and a generally positive market lead to modest price increases (5-10%).

- Scenario 2 (Medium Probability): Increased geopolitical uncertainty or a slight dip in oil prices result in a flat or slightly negative performance (-5% to +5%).

- Scenario 3 (Low Probability): A significant global economic downturn or a major disruption in oil supply could cause a more substantial price drop (-10% or more).

Impact of Oil Prices on XOM Stock

XOM’s stock price is highly correlated with oil prices. Over the past six months, a hypothetical example could show a strong positive correlation: as oil prices rose, so did XOM’s stock price, and vice versa. This is because oil is XOM’s primary product, directly impacting its revenue and profitability. Future oil price fluctuations will similarly affect XOM’s stock, with higher prices generally leading to higher stock prices, and lower prices leading to lower stock prices.

Analyst Ratings and Recommendations

Analyst ratings provide insights into market sentiment. A consensus view might be a “hold” rating, with a range of opinions from “buy” to “sell”. Analysts may base their recommendations on factors such as projected earnings growth, valuation, and competitive landscape.

- Analyst A: Buy – Strong growth potential based on projected increase in oil demand.

- Analyst B: Hold – Current valuation reflects the inherent risks in the energy sector.

- Analyst C: Sell – Concerns about long-term sustainability in the face of renewable energy growth.

Fundamental Analysis of XOM

A fundamental analysis of XOM would consider factors like earnings, revenue, debt, and profitability. Recent quarterly financial reports would reveal key performance indicators. This information would be used to assess the company’s financial health and its ability to generate future returns.

| Metric | Value |

|---|---|

| EPS (USD) | 5.00 |

| P/E Ratio | 15.00 |

| Dividend Yield (%) | 4.00 |

Question Bank: Xom Stock Price Today

What are the risks associated with investing in XOM stock?

Investing in XOM, like any stock, carries inherent risks. These include fluctuations in oil prices, geopolitical instability, regulatory changes, and overall market volatility. Thorough research and a diversified investment strategy are recommended.

Where can I find real-time XOM stock price updates?

Real-time XOM stock price updates are available through major financial websites and brokerage platforms. Many provide charting tools and detailed historical data.

What is XOM’s dividend history?

ExxonMobil has a long history of paying dividends. Details on past dividend payments and current dividend yield can be found on their investor relations website and financial news sources.